December 11, 2023

Summary

A short squeeze to remember

Recession still on the table and what if it already started!

Markets tend to anticipate recessions but the brunt of the decline still occurs in the middle of them

A less strong job market than what it seems

Don’t exclude a deflation scare during the coming downturn. Longer-term this is another story

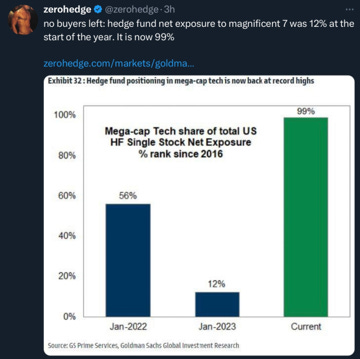

Investors positioning is now worrying

The quality factor might not offer the protection I has offered in previous downturn

Japan, what not to like about it

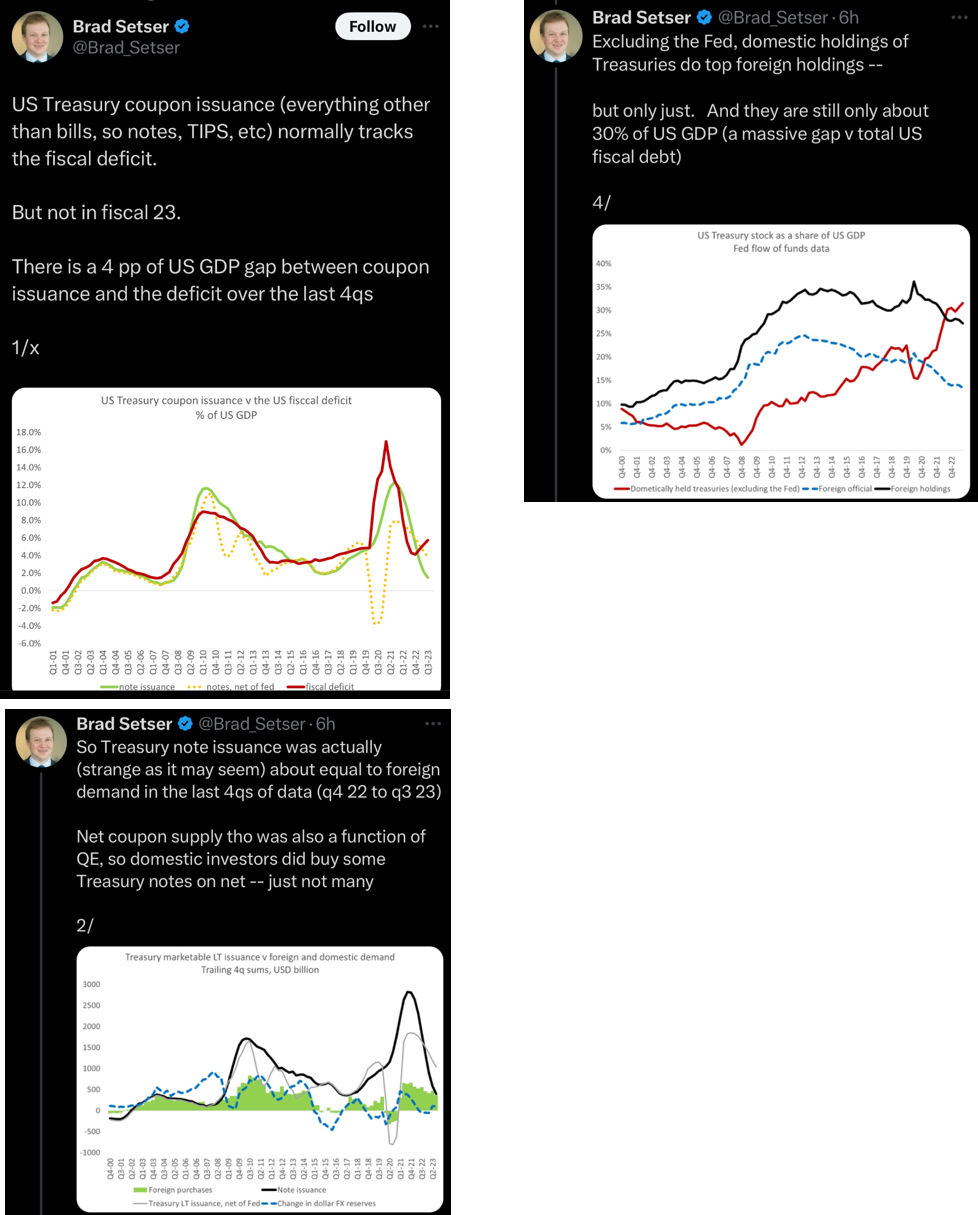

Don’t count on too many QRAs positive surprise going forward

Macro – What a Month!

What a difference a month can make! The markets needed an excuse to squeeze the extended short equities and treasuries positions and it found plenty. The marginally lower coupon issuance announced in the November 1st Treasury Quarterly Refunding Announcement, followed the same day by a perceived less hawkish J. Powell ignited the up moves. Disappointing macro data, a miserable less than 10 bps miss in the October core inflation number put gas on the fire.

The results:

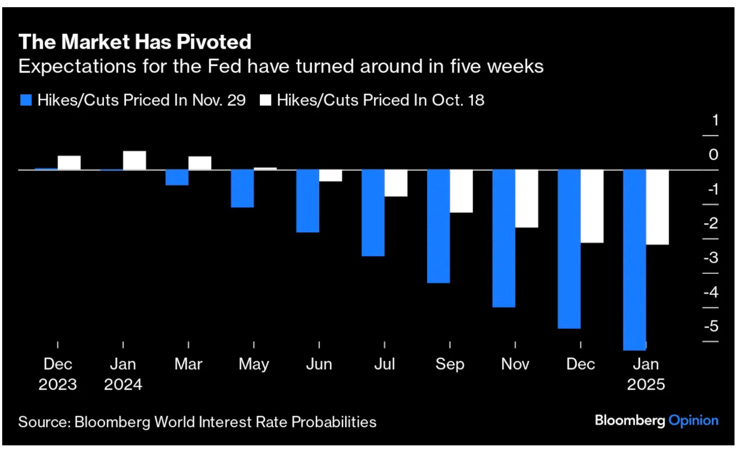

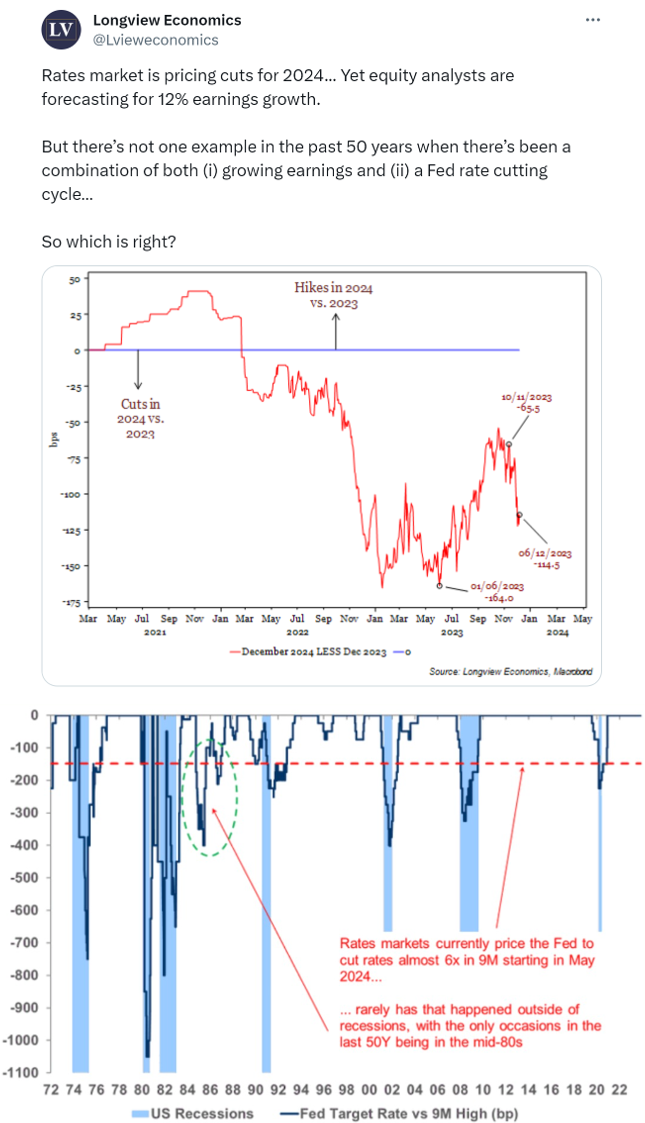

•From 2 rates cut priced in late October to more than 5 now, despite J. Powell attempt to sound rather hawkish (the market has priced cuts multiple times during the past 18 months despite the Fed hawkish guidance).

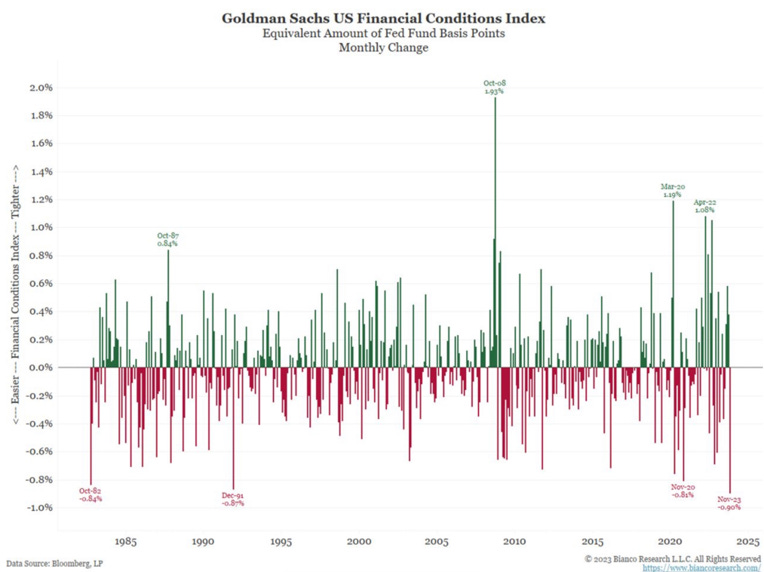

•The biggest monthly loosening of financial conditions since the early 80’s.

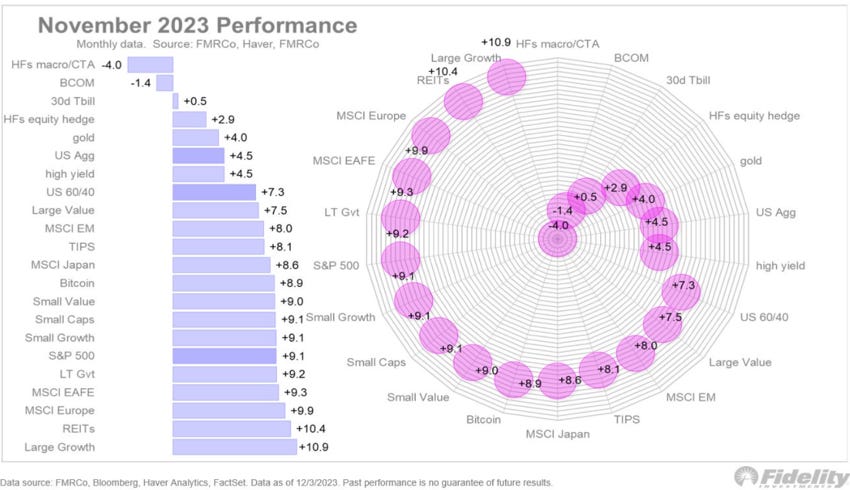

•Everything up and up a lot (if you were not a CTA or oil investor).

Macro – And Now…

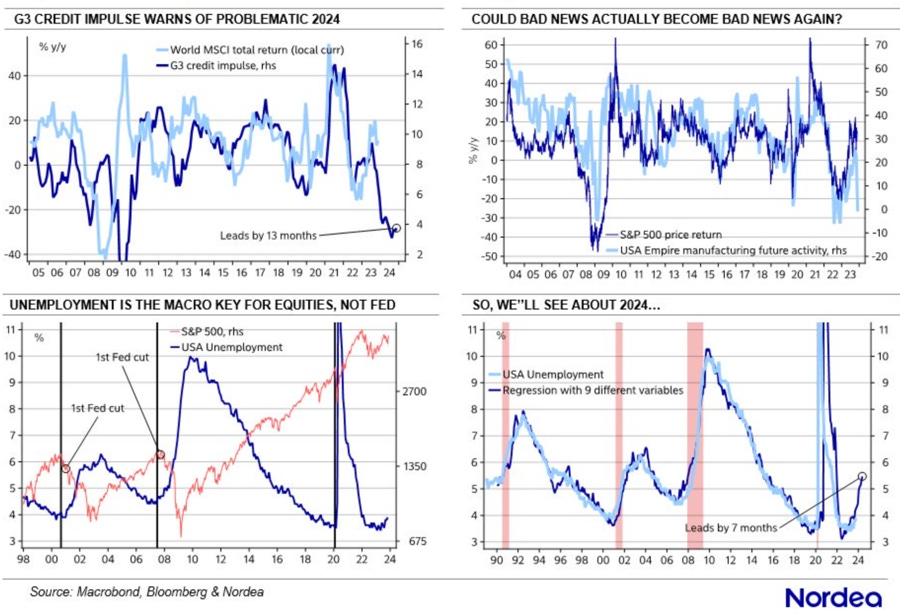

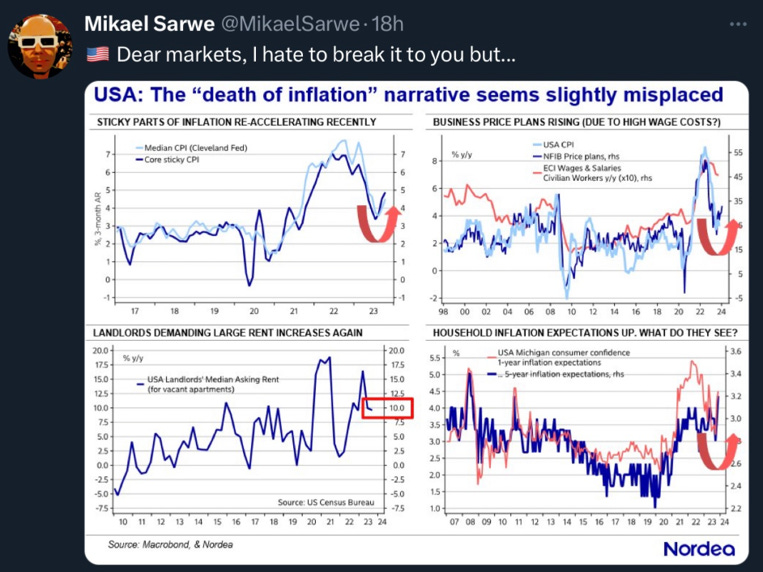

Mikael Sarwe thinks that markets could soon start to take bad news as bad news again…

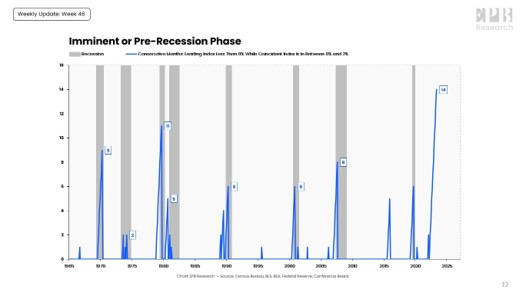

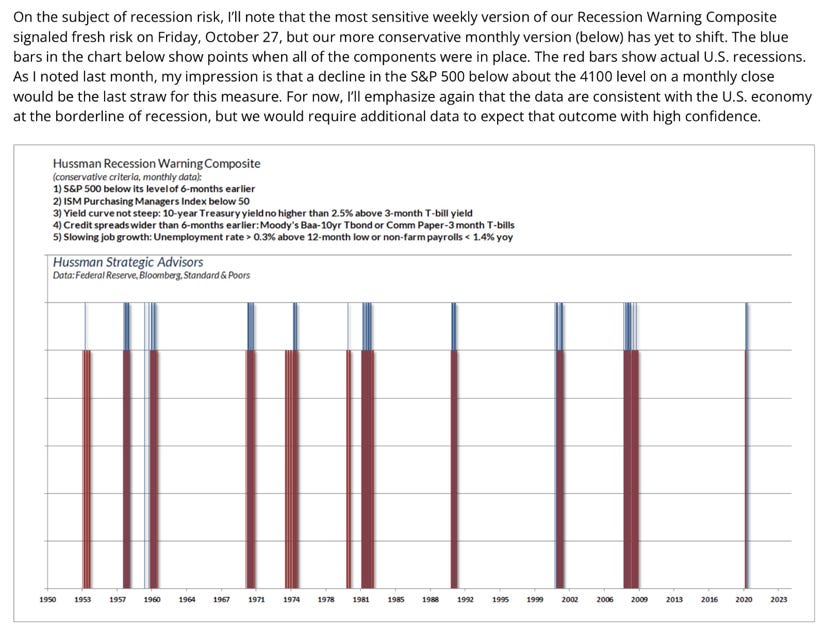

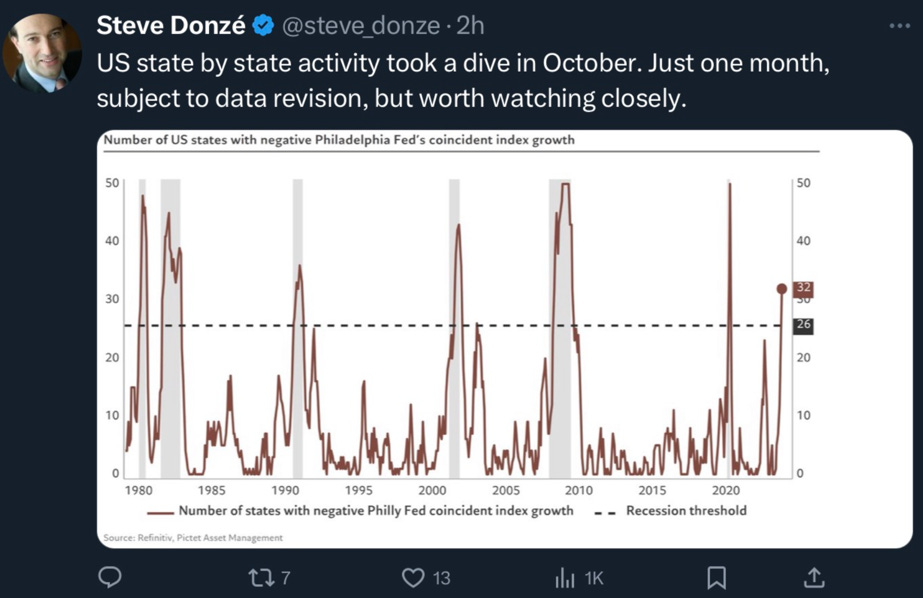

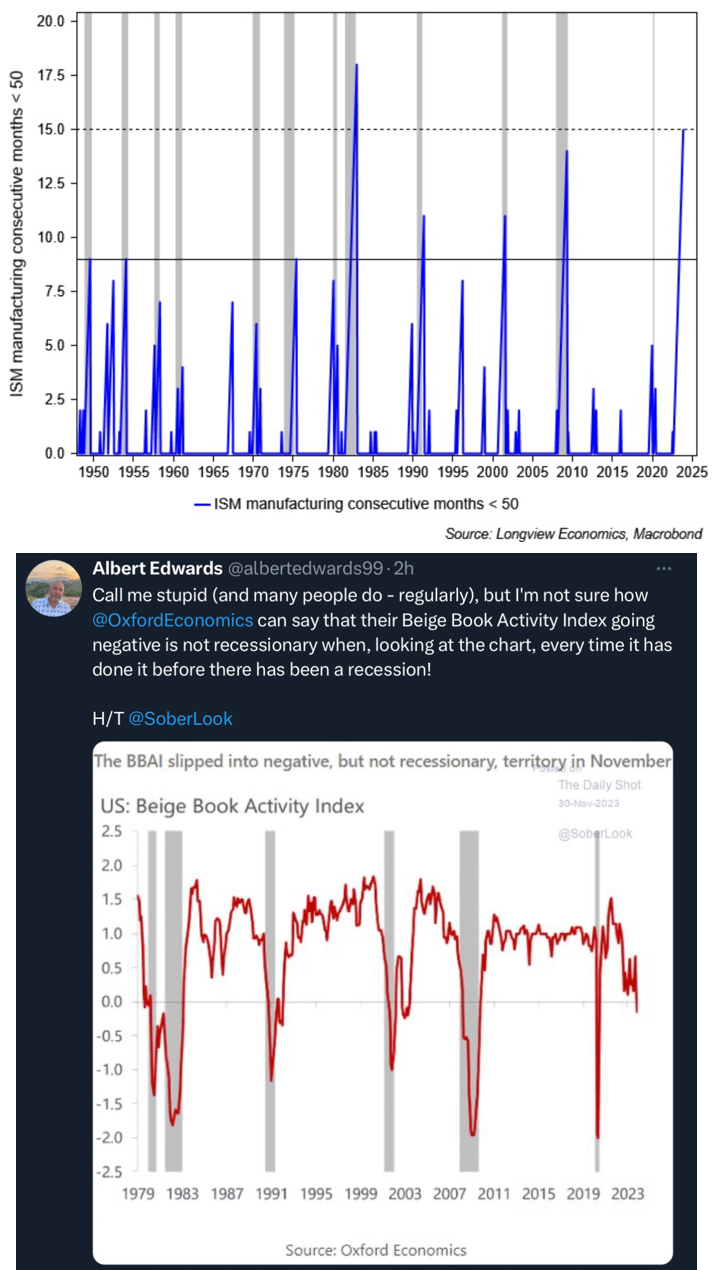

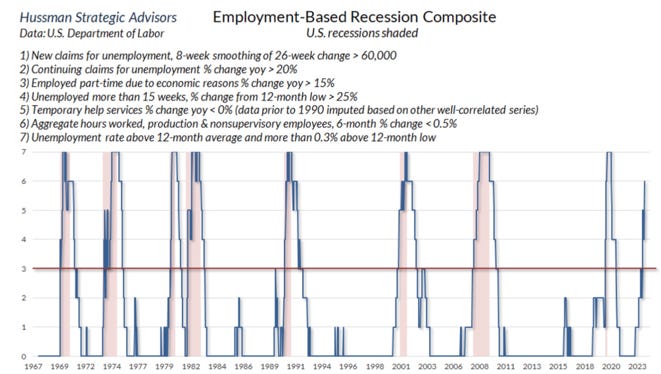

Let’s first start by inspecting some macro recession leading indicators before we tackle what we see as the key for 2024, the employment market.

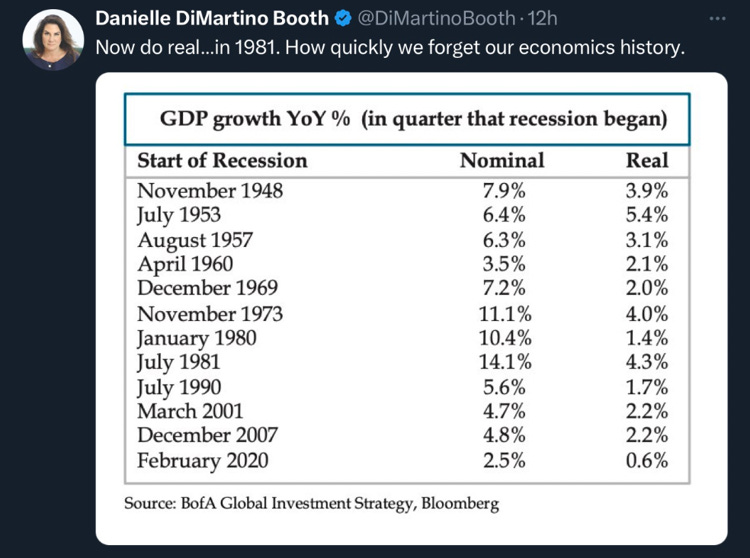

But how could we have (or already be in) a recession given the last GDP growth numbers? Well…

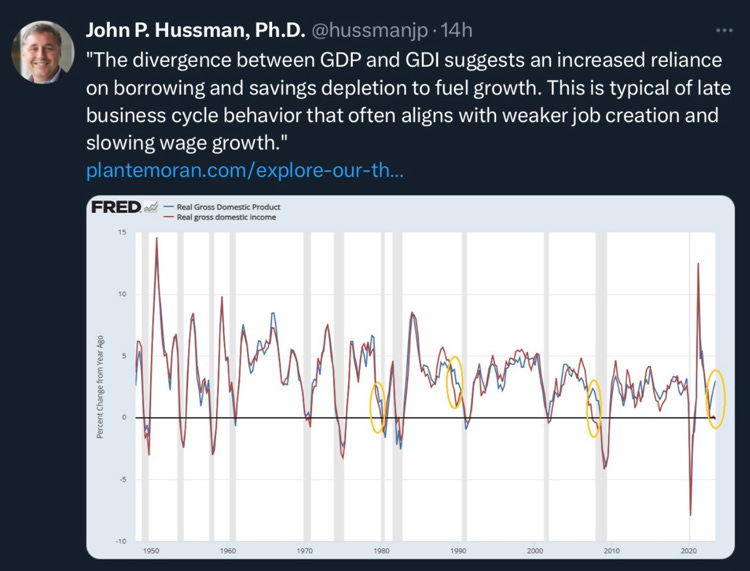

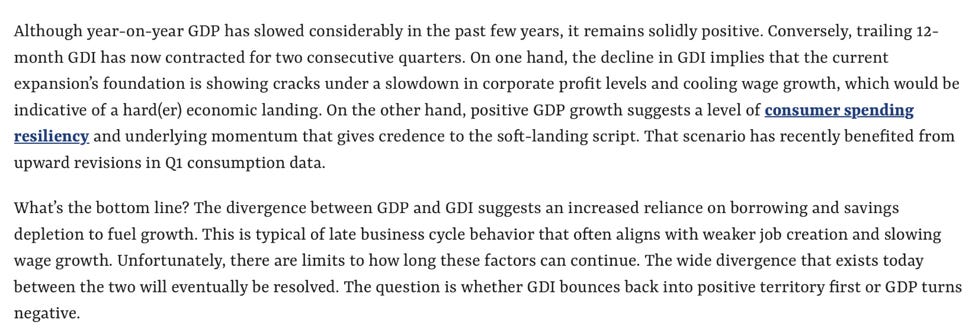

Furthermore, we have alluded to the large divergence between GDP and GDI in the past.

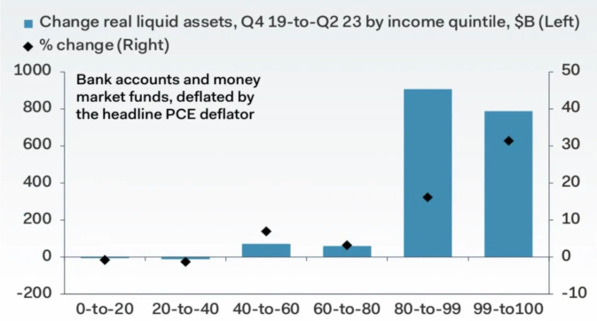

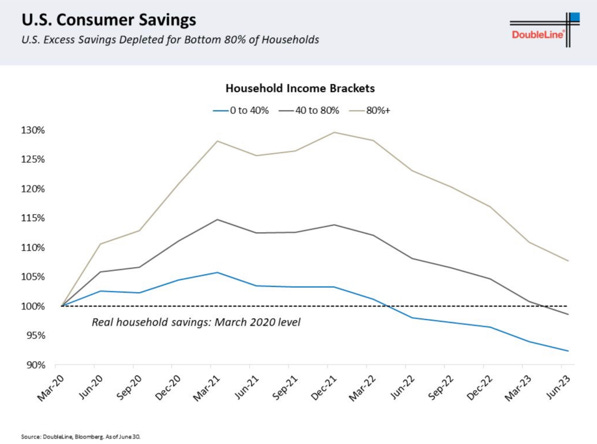

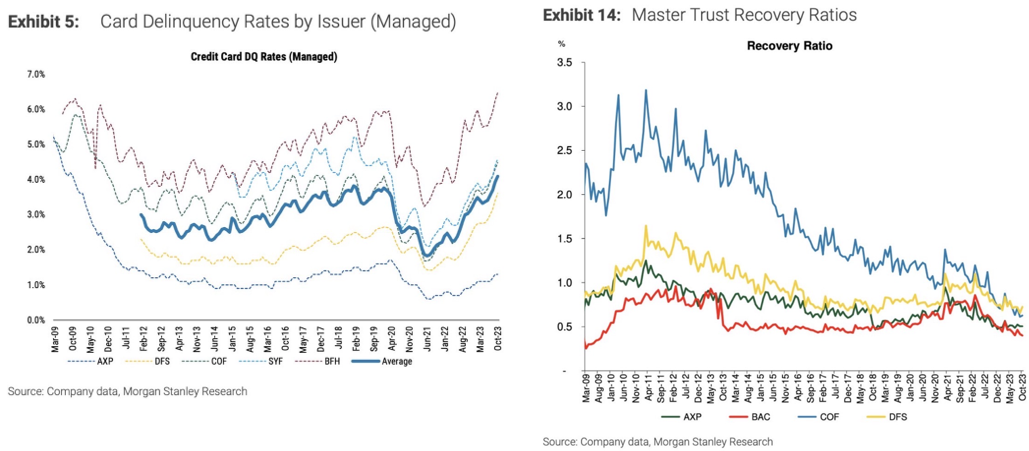

Excess savings are gone for a large cohort of the population (the one with the highest propensity to consume), while credit is harder to get by (except if you can borrow from the private credit fund mania).

Man interpretation of the disconnect between lending conditions and real GDP is similar…

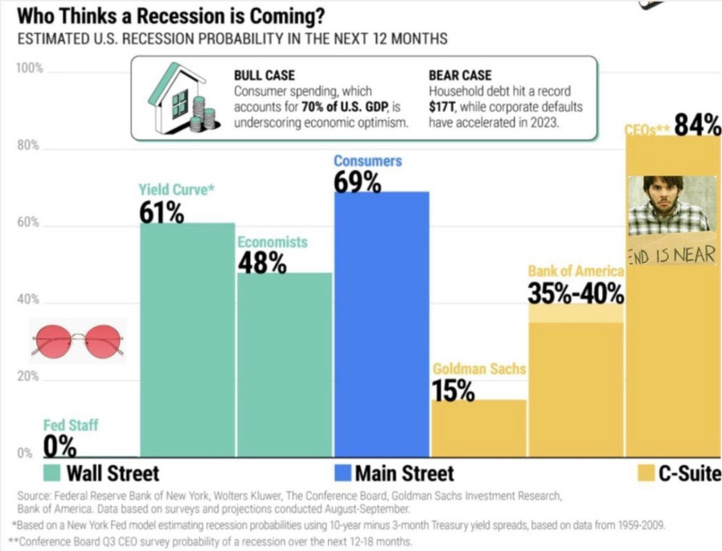

Looking at who is expecting a recession, it seems that there is a cliff between Main Street (where we would include CEO’s) and Wall Street.

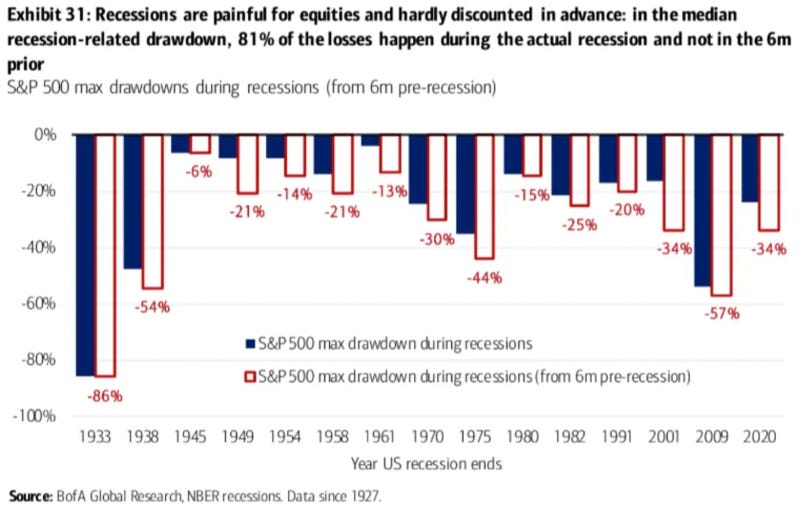

One thing to remember is that while the markets tend to anticipate recessions, a large part of the decline materializes during recessions…

… and the equity markets, contrarily to the rates market, are not expecting a recession (not totally true as small cap US stocks were anticipating one not so long ago ironically when rates were not anticipating one). It shows that the recent moves have more to do with flows than fundamentals.

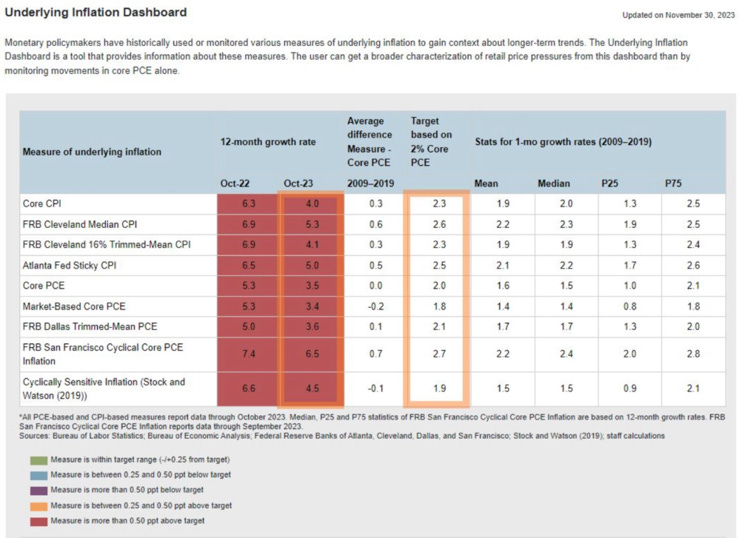

Macro – Inflation

We will now focus on inflation and the employment markets.

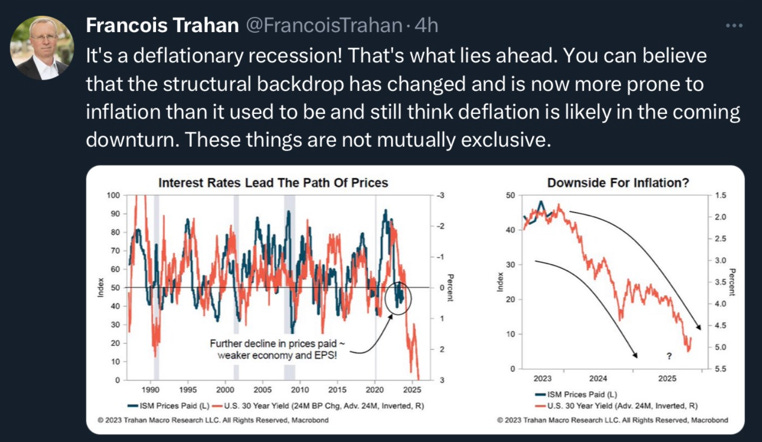

We remain in the same camp as F. Trahan that during the coming downturn, markets will be spooked by deflation rather than inflation (longer-term it might well be another story).

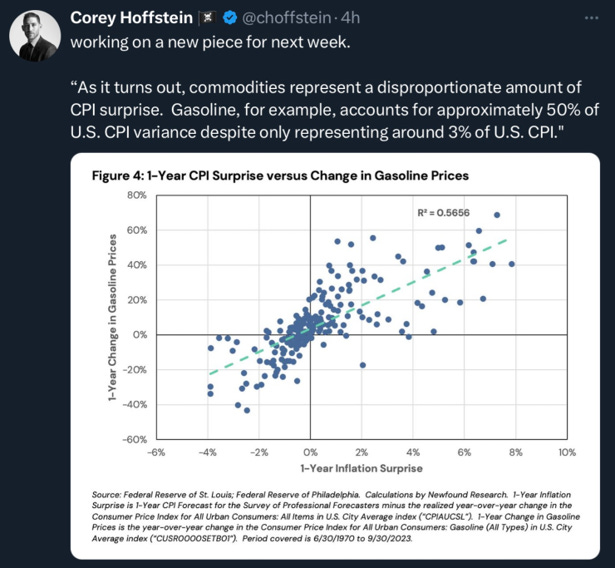

Some analysts are still expecting a short-term rebound in inflation which is possible but really depends on how quickly the employment market unravels and how commodities move (2024 being a Presidential one should be open to anything though!).

Regarding commodities influence on inflation and inflation expectations, don’t forget this…

And as much as inflation has cooled down, it remains too high for the Fed to aggressively lowering rates, especially given the lagging nature of employment cost.

Macro – Employment

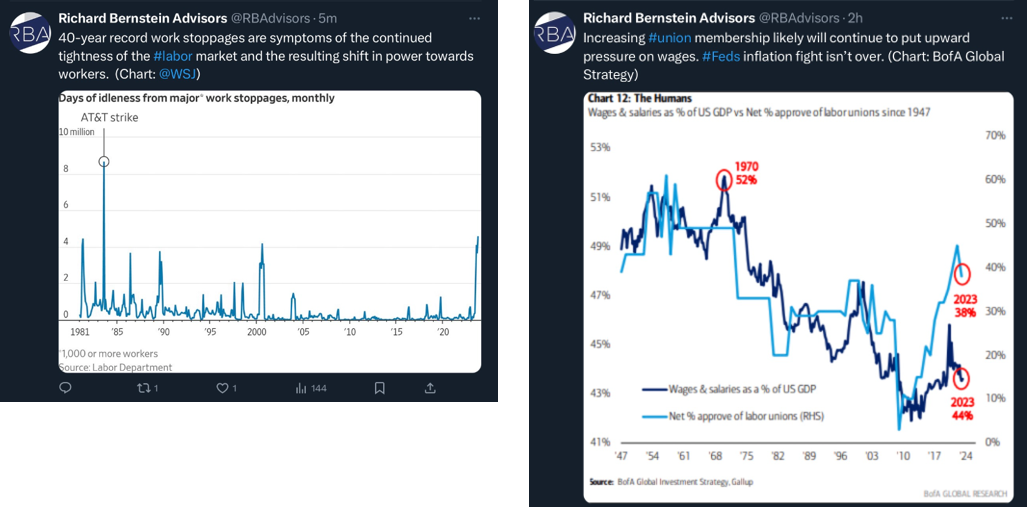

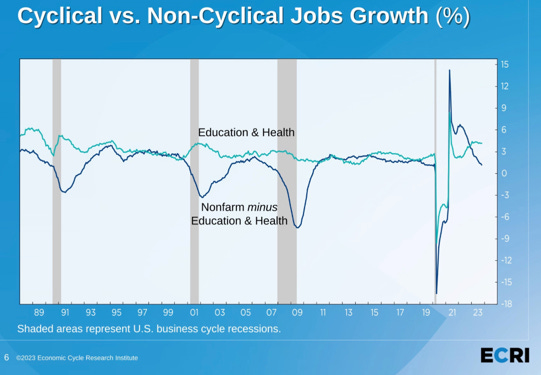

The employment market is weaker than it appears but the recent high inflation/high profit margin episode and the success of unions to get large salaries and benefits increase is likely to make employment cost stickier this time around (and it is likely to be very sticky for government workers in 24!)

Non growing US population should not help either and, down the road, this will contribute to push companies margins lower (and we are not even talking about higher interest costs, higher raw material and probably higher tax rates…).

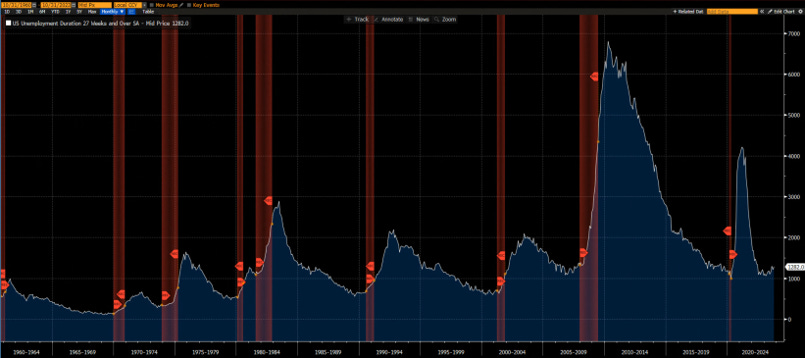

Here below are some datapoints showing that the employment market is weaker than what it seems (we showed this in previous MashUp’s editions).

Workers unemployed for more than 27 weeks.

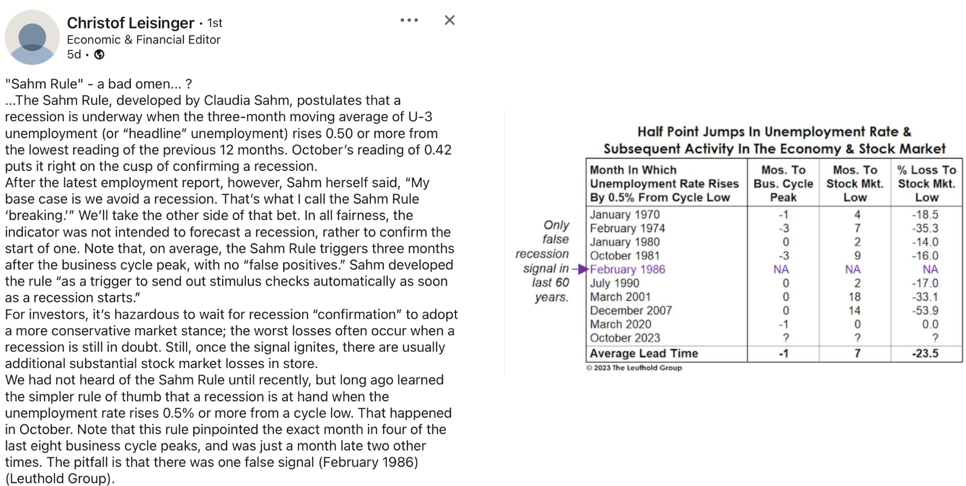

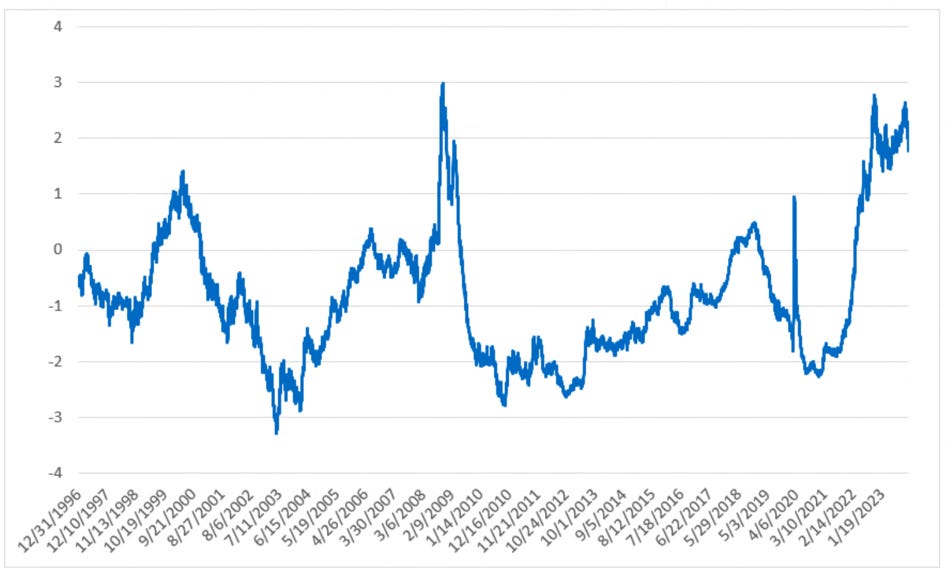

The “Sahm Rule” and its implication… Note that it has yet to trigger and that Claudia Sahm, the economists behind it, is on the record that she does not expect a recession if it triggers this time.

Macro – Housing

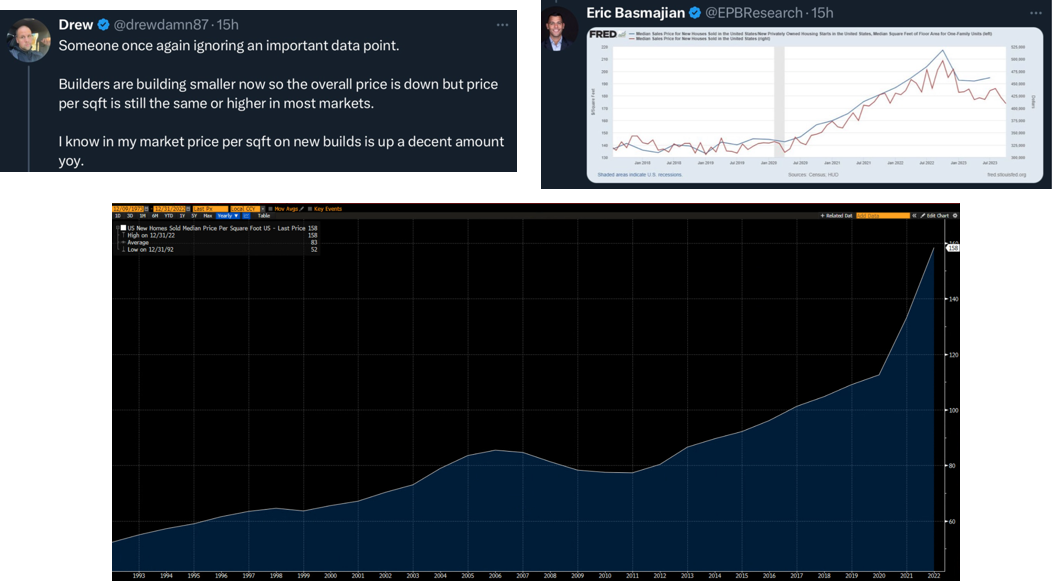

For those who think that shrinkflation only affects staples…

Market – Intermarkets

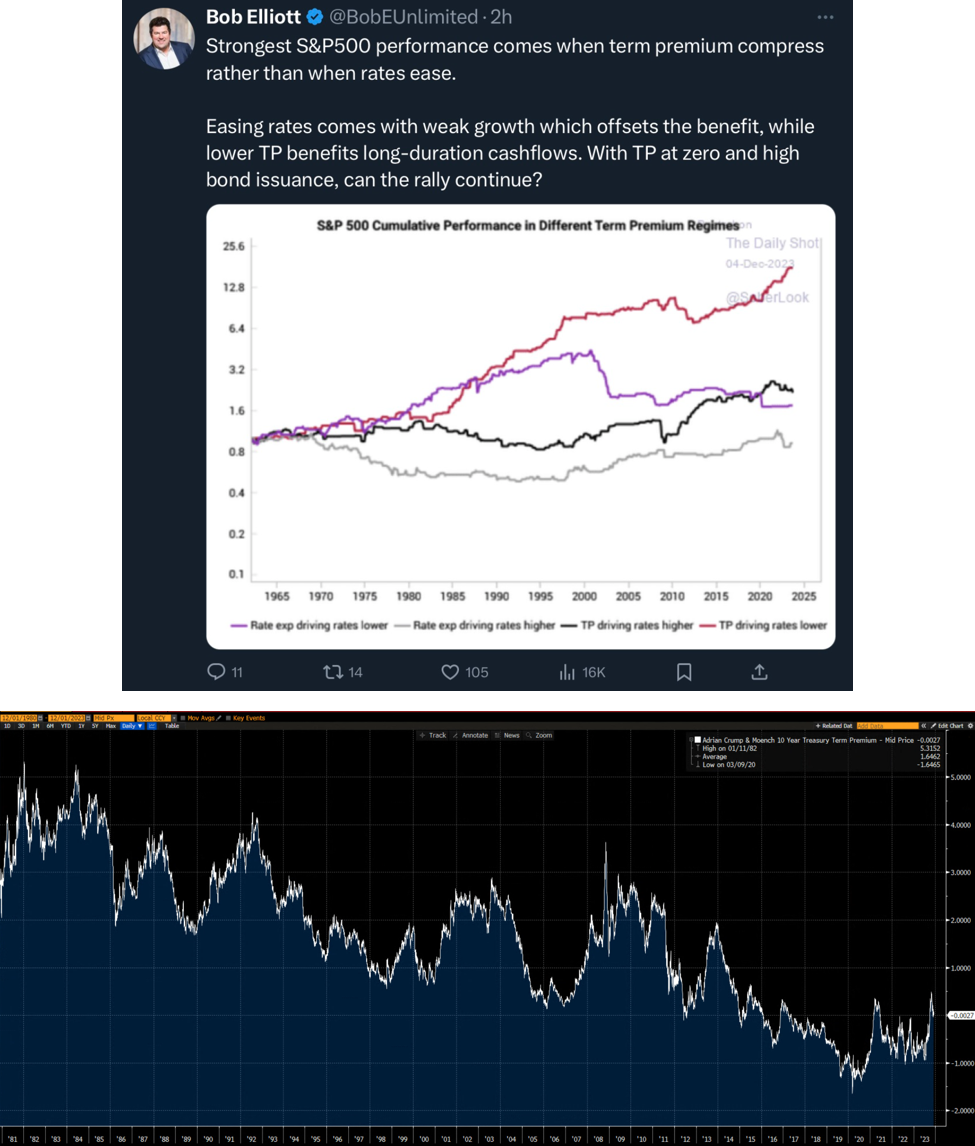

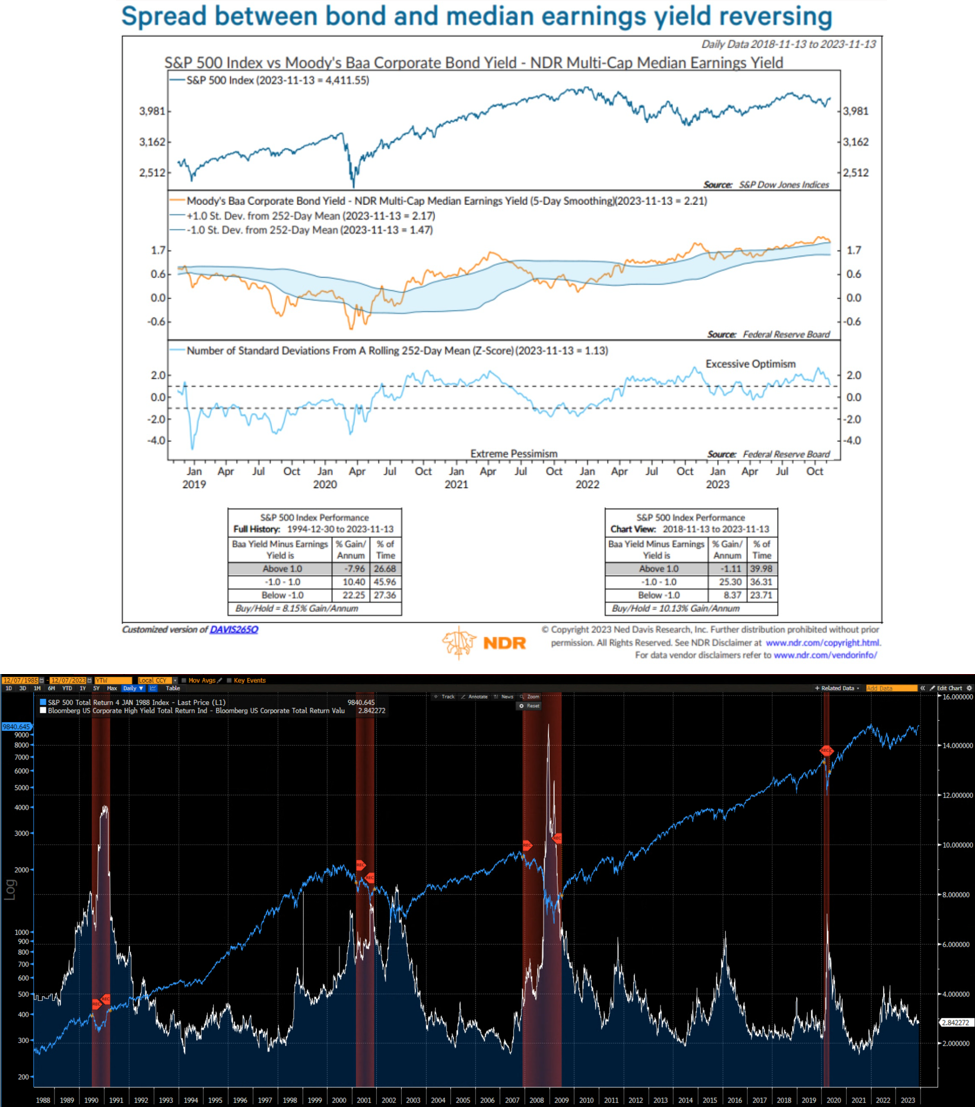

Falling bond yields are not all created equal…

Corporate bonds are offering a worthy alternative to equities for many today despite their low spreads to Treasuries. Spreads are not going to stay there if the macro picture deteriorates meaningfully.

Market – Factors

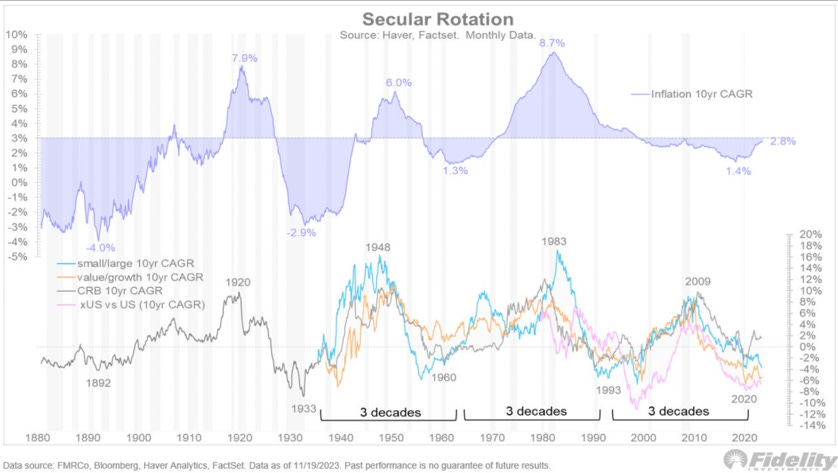

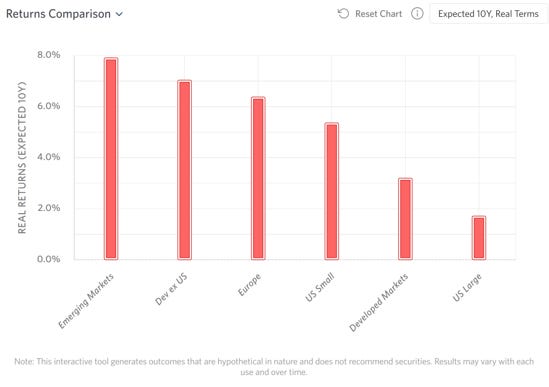

Another brilliant graph from J. Timmer. If you agree with us that inflation won’t be as benign and well behaved as is has in the past 40 years, you now know how to position yourself after the coming deflation scare… And guess what, this is exactly what serious relative valuation analysis suggest too…

Market – Liquidity

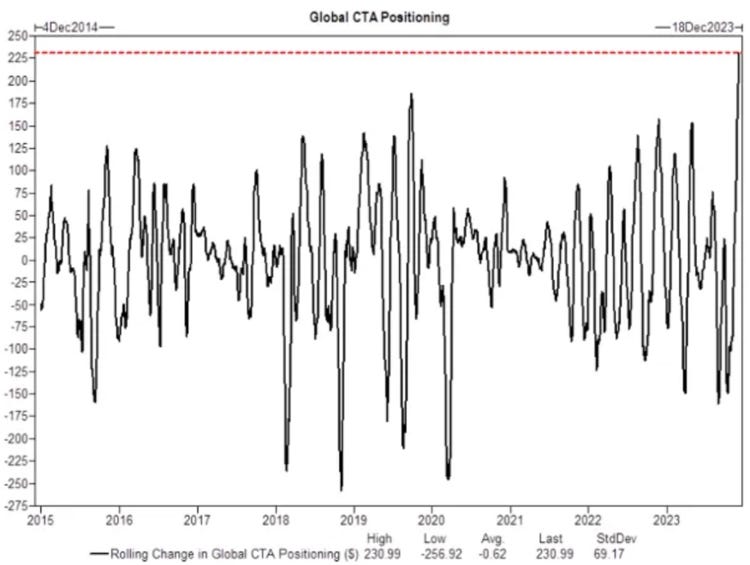

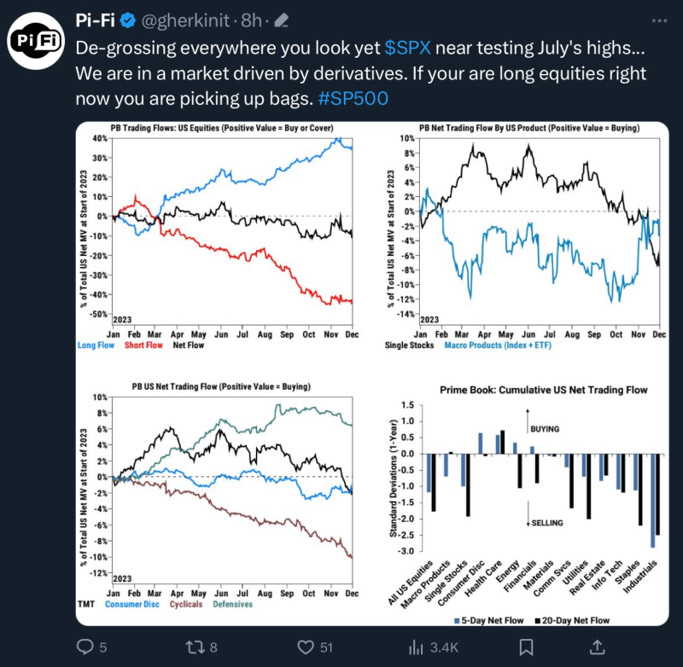

And now for what we see as the main drivers of November moves i.e. liquidity and flows.

Both US and global CBs liquidity were supportive enabling the short squeeze to materialize.

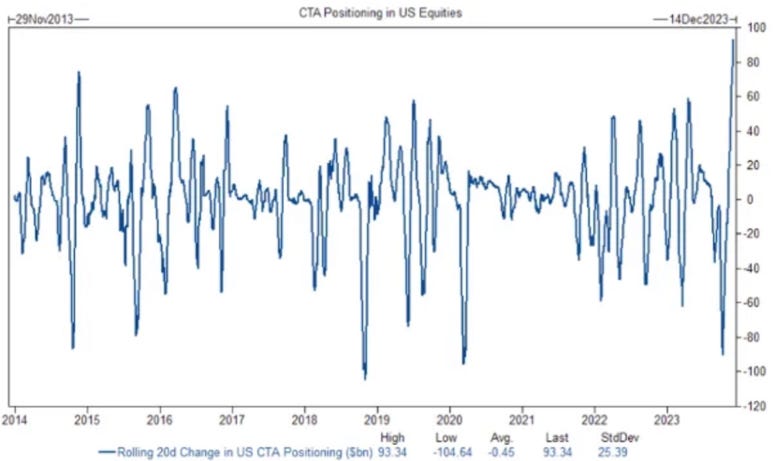

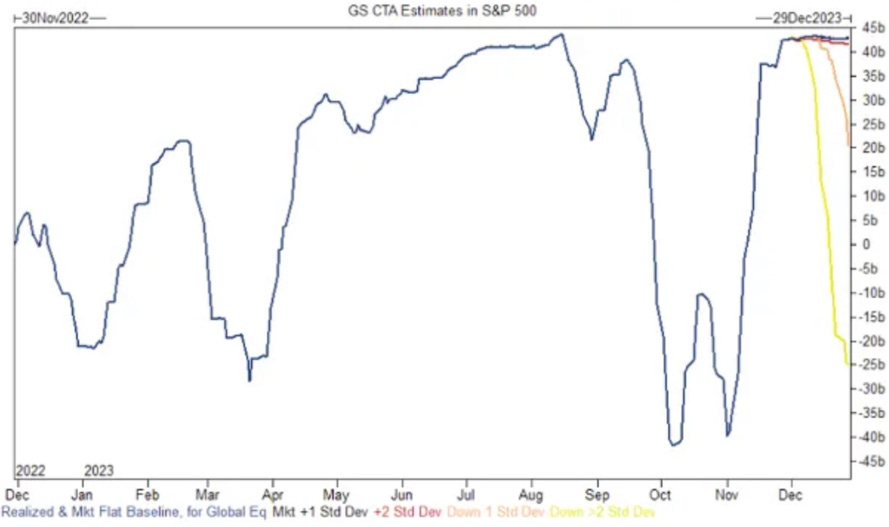

Looking at Goldman Sachs one month rolling CTAs net global equity futures flows, more than USD 225bn were bought. That’s more than USD 10bn per trading day.

US futures saw more than USD 8bn a day of buying in 2 weeks mid November…

We have now the opposite situation we described in our last MashUp. Lots of net selling if the markets decline and some net selling even if the markets rise strongly.

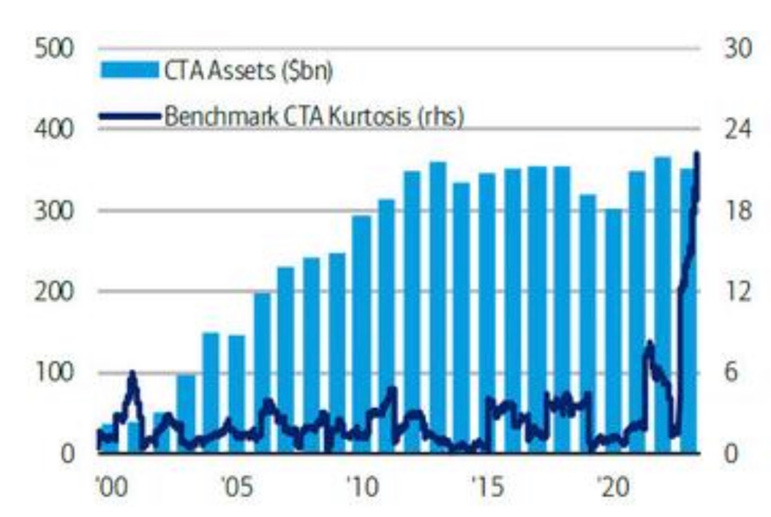

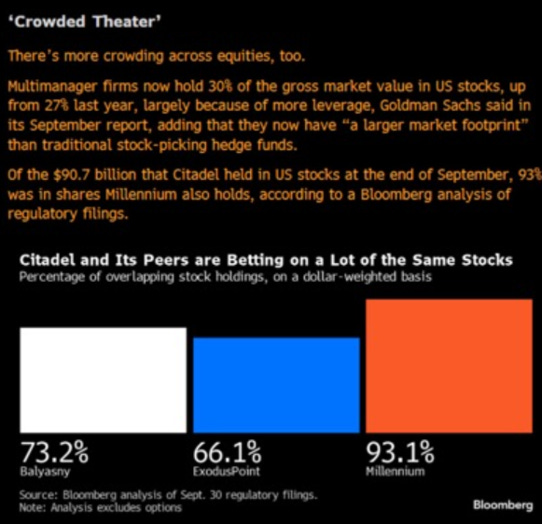

Looking at the CTA benchmark Kurtosis one can only see that the whole market has started to move on the same signal. We are all CTAs today and thanks to the bourgeoning Pods shops chasing short-term trends, the whole edifice is becoming less stable.

But fortunately Pods are not using too much leverage and are not all in the same positions (...), something which could be slightly problematic in case of a discontinuous market…

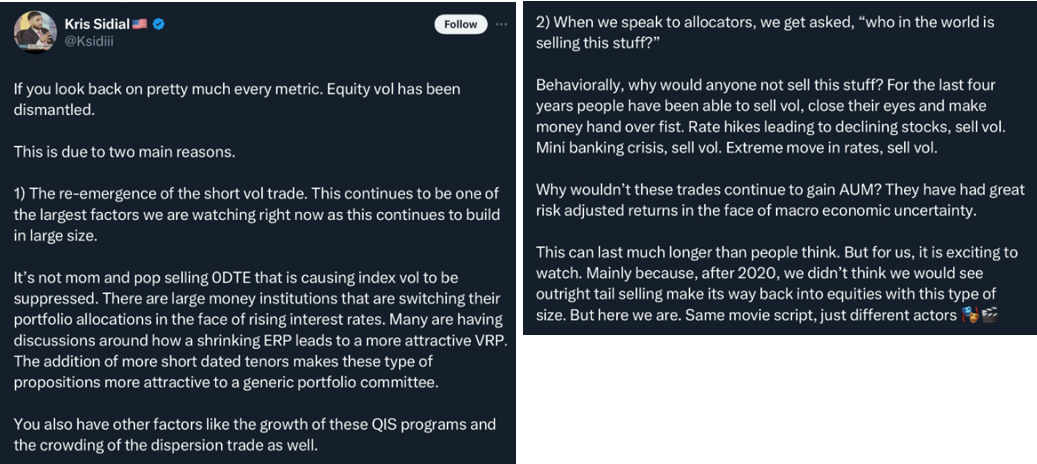

Discontinuous markets which could also be a problem for the short volatility crowd which is as big as it has ever been. Everybody is an expert volatility short seller nowadays…

And given the performance every short vol strategy has produced this year they are comforted in getting larger and larger exposure (adding to the fact that the strategies have to use more leverage now that the implied volatility is so low to get the return the new adept are looking for).

We had a graph in a previous MashUp on how deep out of the money puts performed during COVID (which we wouldn’t classify as a discontinued market). Suffice to say that even a 1% short exposure would have ended many careers.

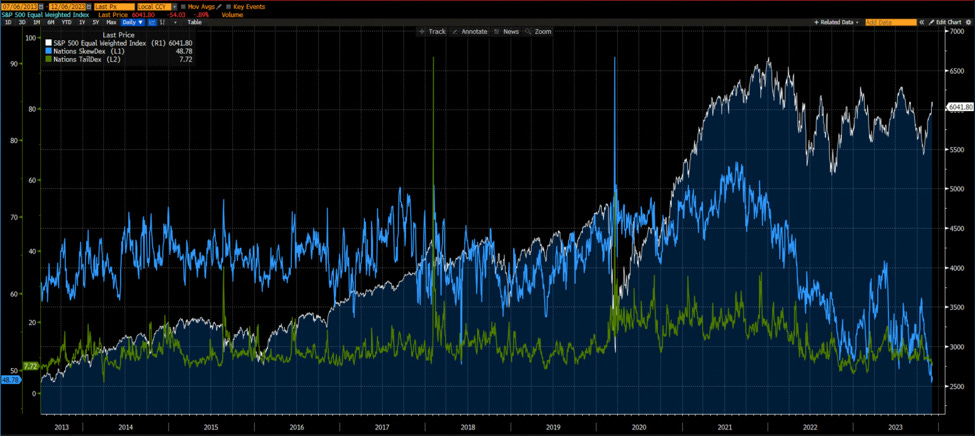

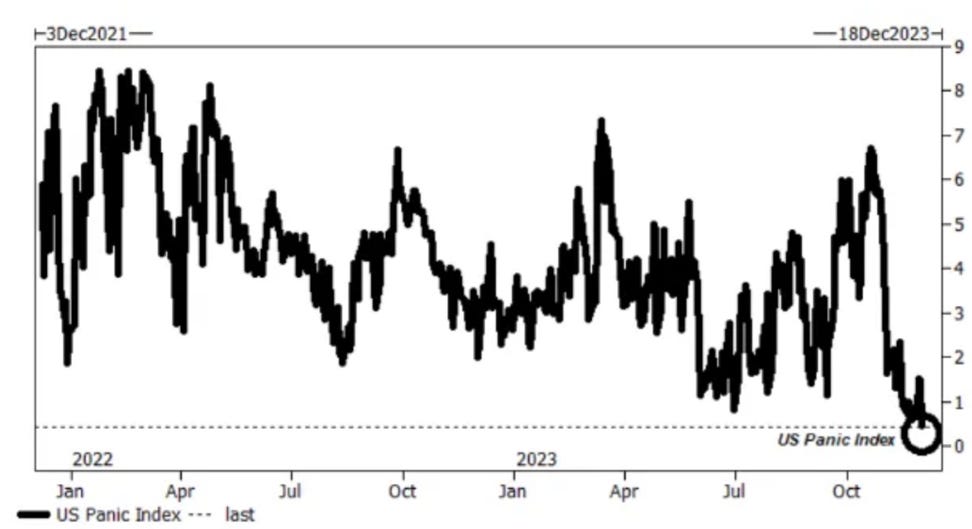

Nation Tail and Skew indices are showing how little risk is priced in the markets…

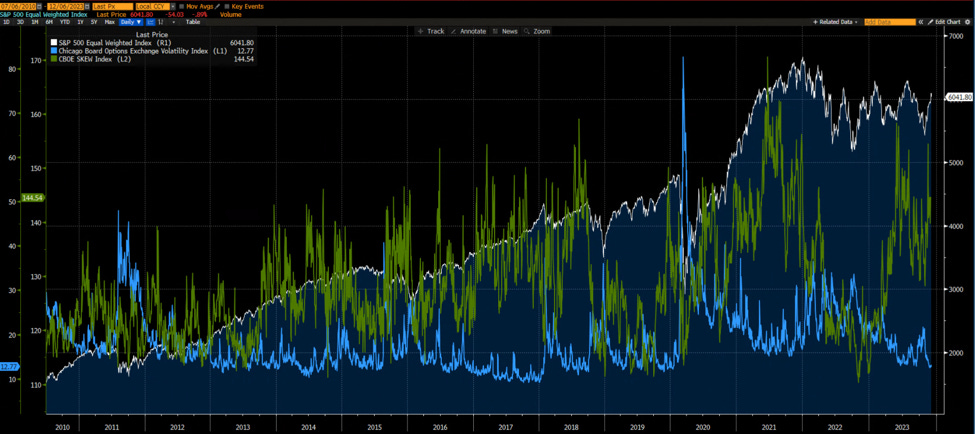

Large divergences between the Vix index and the CBOE Skew Index have historically resolved through rising volatility.

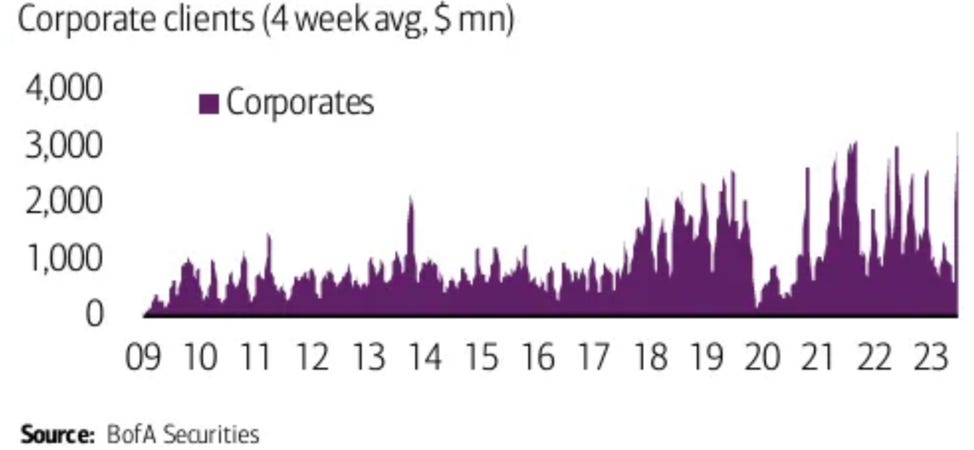

Buybacks were also much higher than what we had expected for November. In fact, it was the highest

4 weeks moving average for BoA clients since they started collecting the data.

It would imply more than USD 5bn buybacks a day in November. So just adding futures flows, it is between USD 10-15bn a day of value agnostic buying in a not so liquid market!

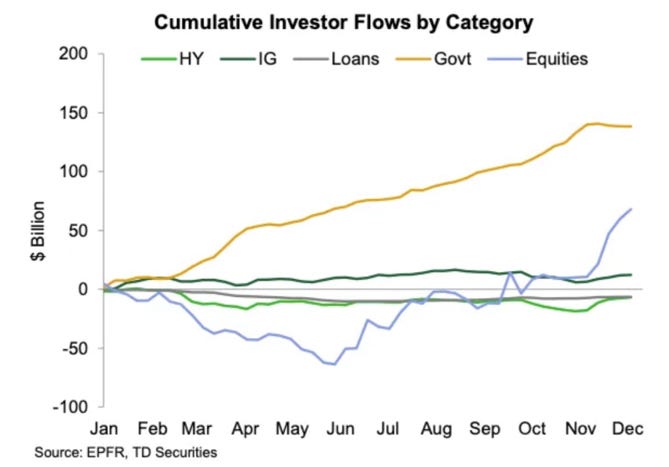

There was also almost USD 50bn flowing into equity funds…

Yet equity hedge funds were not net buyers in November…

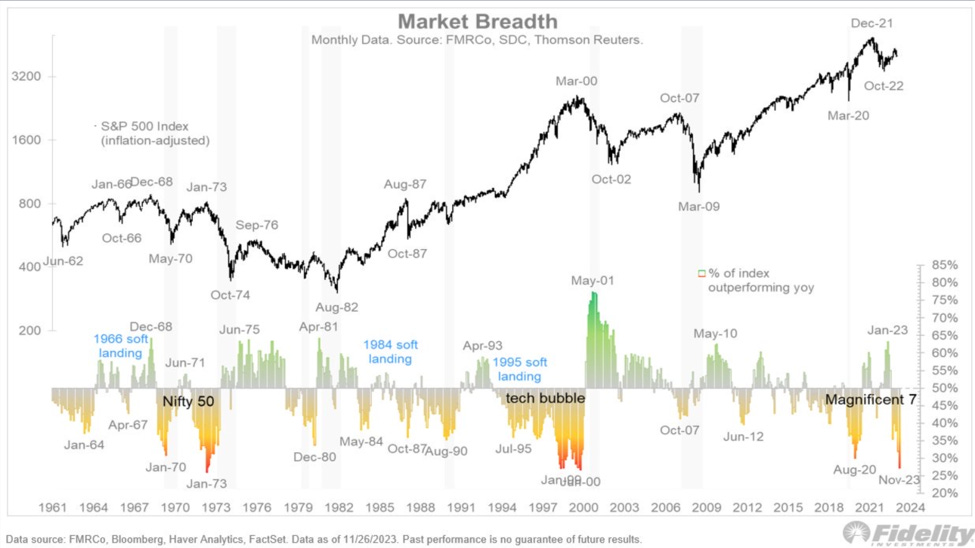

Market – Breadth

Breadth has improved in November but we need this improvement to persist to act on it.

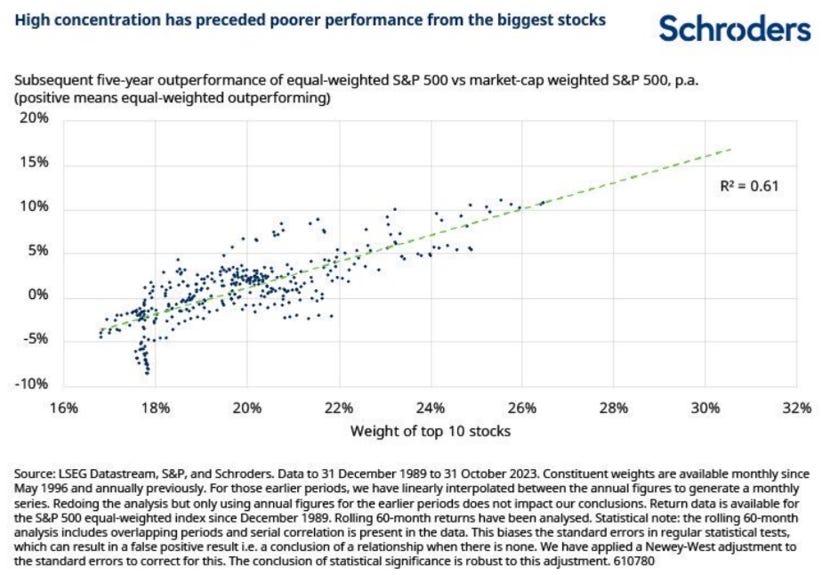

But the market remains awfully concentrated…

With very few stocks outperforming the S&P 500…

Do you smell an opportunity?

Market – Sentiment

Goldman Sachs Panic Index is not showing much fear here…

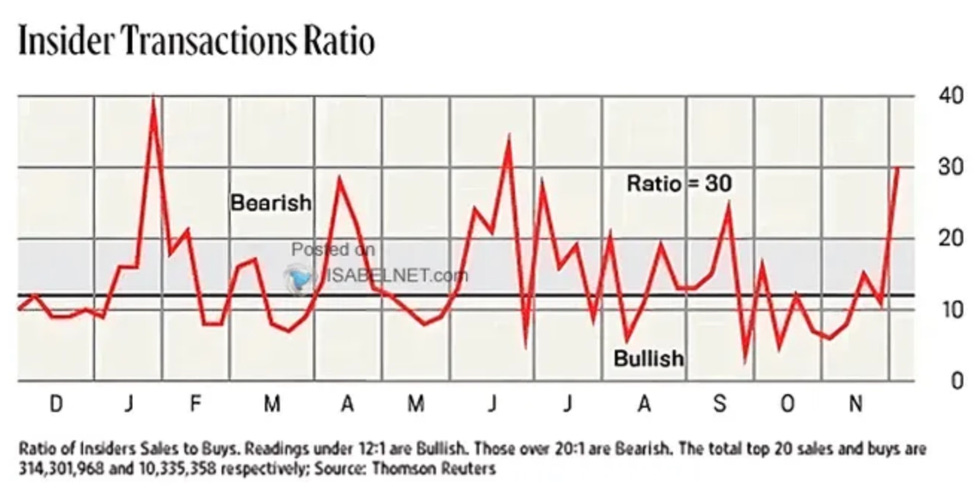

And while corporations are busy buying stocks, insiders are selling… Are corporations only managed to the profit of their managers? As long as shareholders sleep at the wheel (and we do not see any reasons why the Blackrock’s of the world would wake up as being asleep is to their advantage).

Market – Valuation

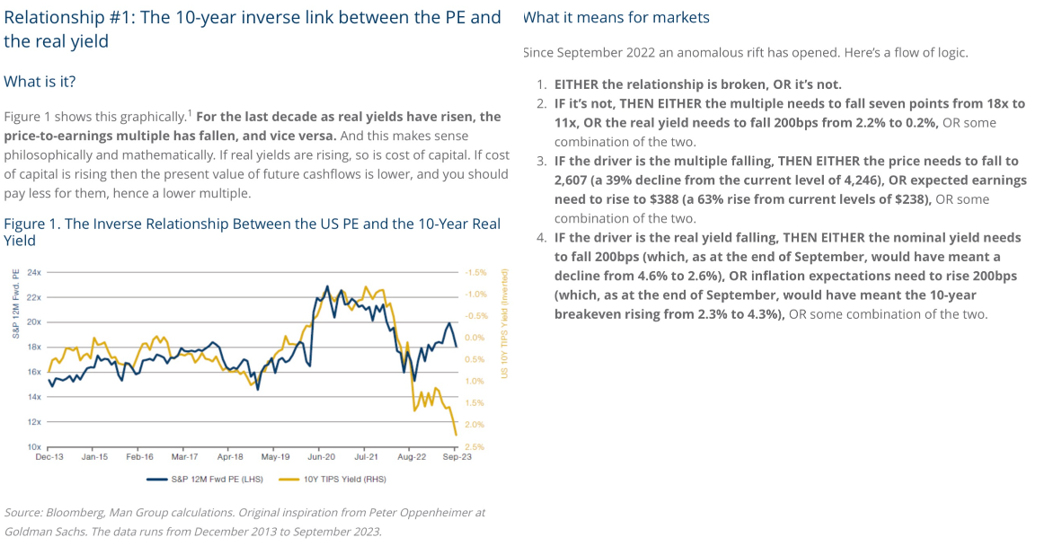

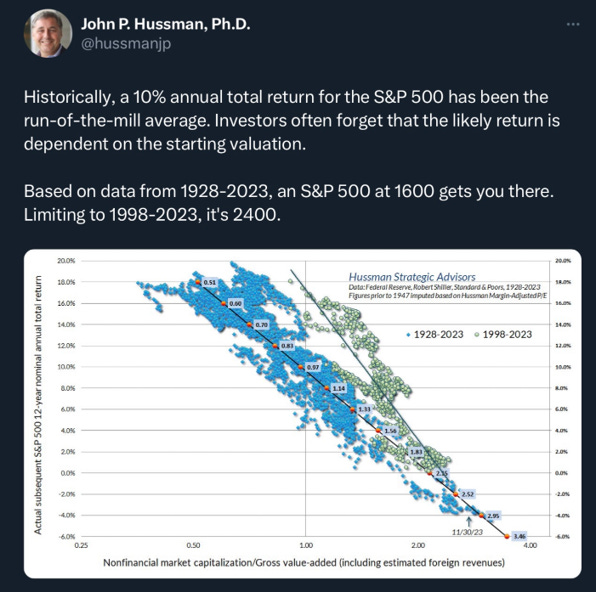

Let’s start the valuation section with a question from Man…

In the meantime, as crazy as it may seems…

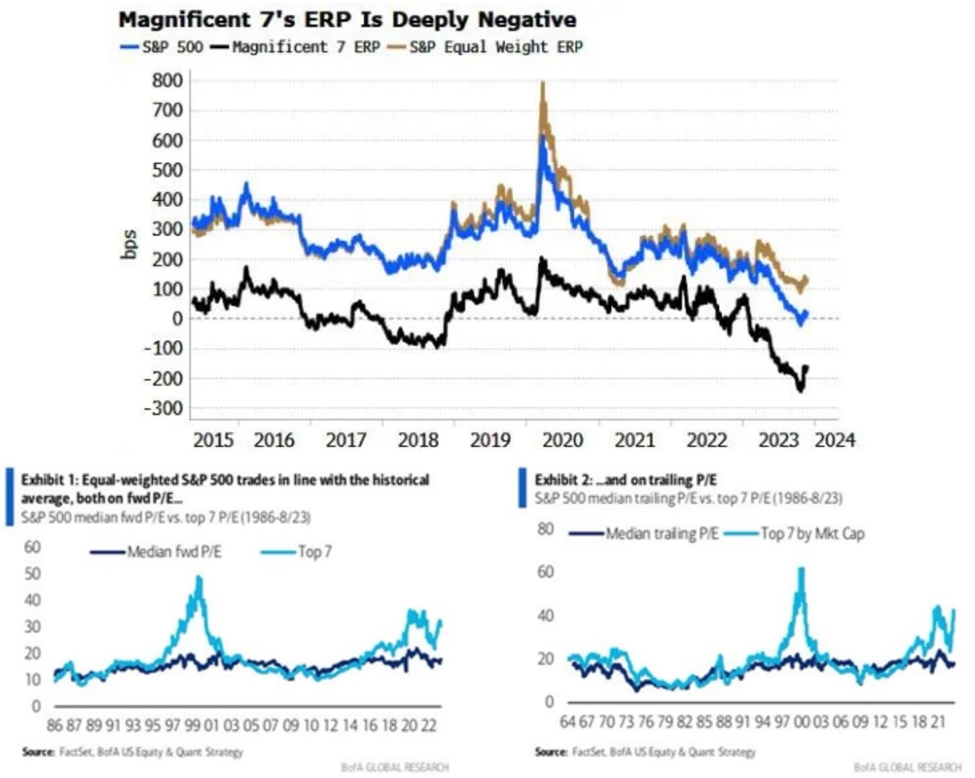

Those who know us for a long-time know that we have been strong supporters of the quality factor. Well, we think it is now expensive on a relative basis and is not going to offer the hedge it historically had in bear markets.

And most of the Magnificent 7’s are dominating the quality factor… (and don’t get us wrong they are superbly managed companies with incredible (challenged when/if regulators wake up) moats).

Time to stop looking at the global benchmark allocation and be bold! Try to be benchmark and career risk-free.

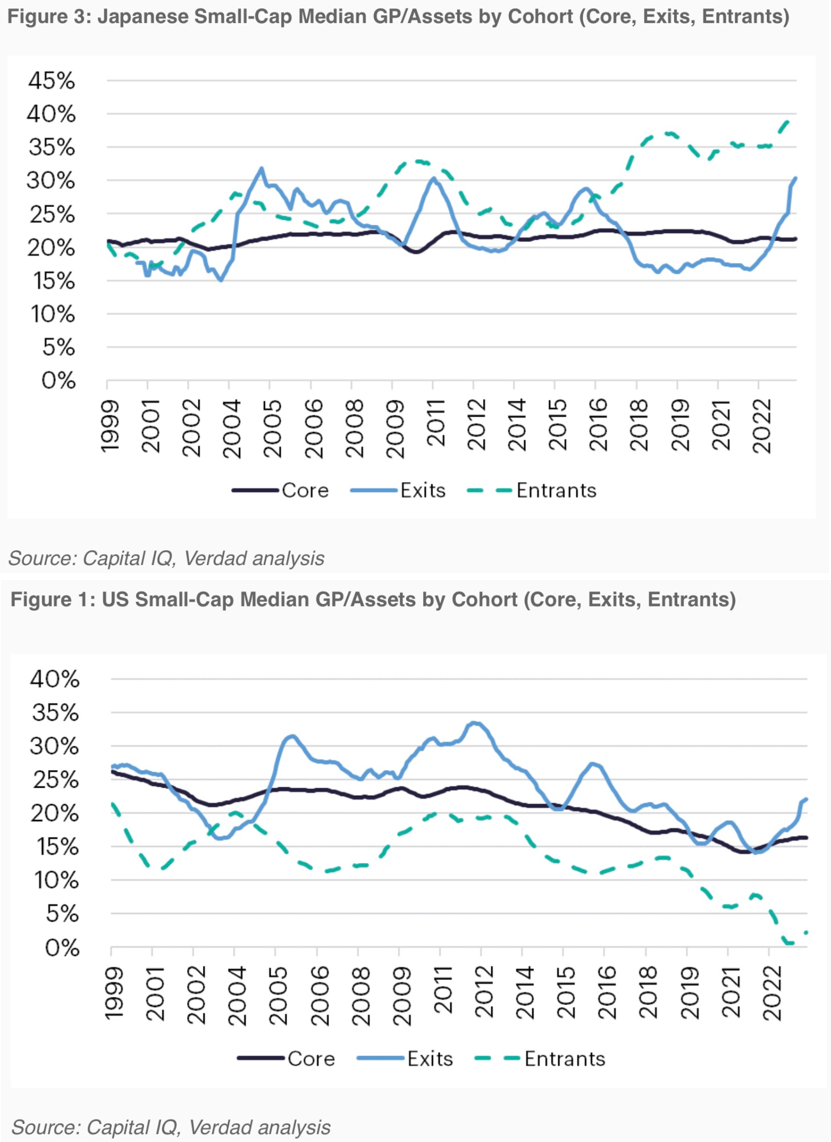

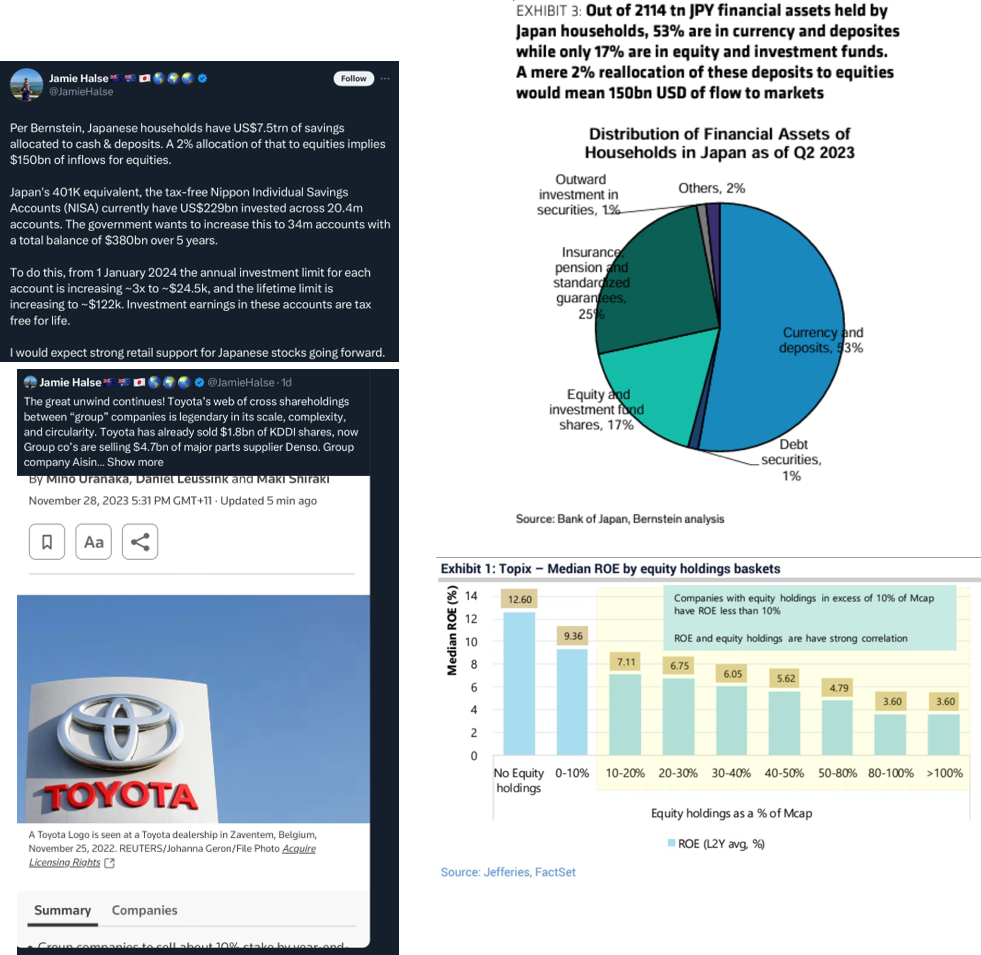

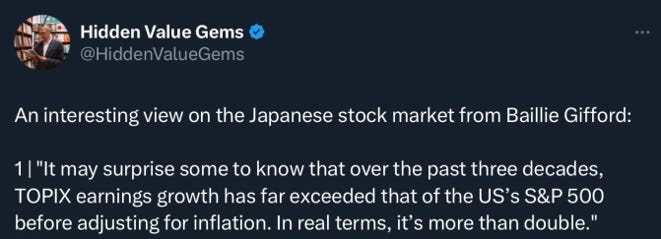

And as we have been pounding the table, consider Japan. The Yen is grossly undervalued and small and mid caps are cheap. Favor companies with a domestic market vs exporters given the impact a rising Yen will have on the latter.

And contrarily to the US where small caps quality has decreased (especially for new entrants) the reverse has been true for the Japanese market.

Market – Japan Catalysts

Some other reasons to like Japan…

And who would have guessed…

Market – Treasuries

A few graphs on Treasuries supply-demand and why we won’t always have positively surprising QRAs…

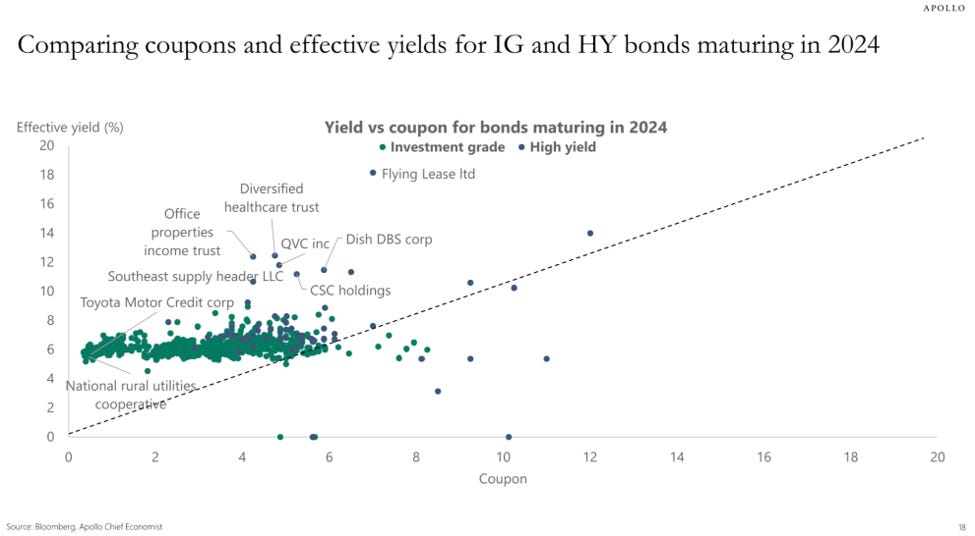

Corporations better hope that rates will plunge quickly. The first graph shows the current aggregated corporate yield minus the coupon they are currently paying on their debt. YTM would have to fall by 2% for interest cash outflow not to increase.

Others

A bit of humor…