As usual we will start with the 60 seconds stock pitch à la Bill Miller:

Sable Offshore is trading at $20.6, with a 52-week range of $20 to $30. I think it's a buy for the following five reasons:

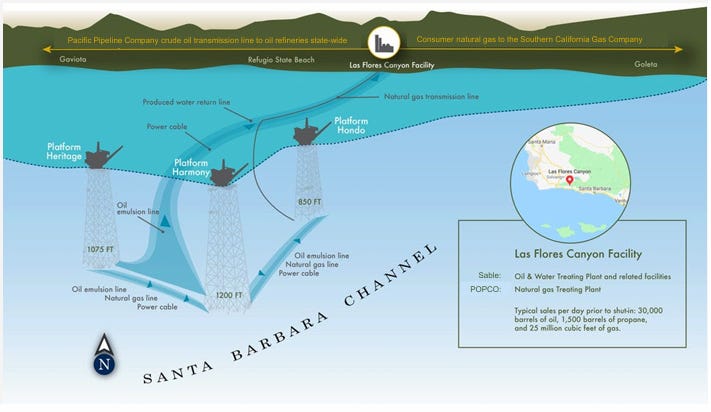

World-class asset: They acquired the Santa Ynez Unit (SYU) from ExxonMobil for $643 million, with over 1 billion barrels of recoverable resources.

Low-cost production: Operating costs of $17/barrel ensure profitability even in volatile markets.

Experienced leadership: Led by James C. Flores, with a proven track record of creating shareholder value.

Clear restart plan: Production expected to resume by Q4 2025, with key regulatory milestones already achieved.

Energy transition alignment: Positioned for Carbon Capture and Storage (CCS) and natural gas development.

The stock is trading at $20.6, but we think it's worth $40-$50. At projected production levels of 60,000 bbl/d by 2029, Sable could generate over $800 million in free cash flow annually.

Risks include regulatory challenges in California, commodity price volatility, and execution risks in restarting operations.That's it. Sable Offshore Corp. presents a rare opportunity to invest in a high-quality asset with significant growth potential.

Executive Summary:

Sable Offshore Corp. presents a compelling investment opportunity in the energy sector, centered around its recent acquisition of the Santa Ynez Unit (SYU) from ExxonMobil for $643 million.

Key Investment Highlights:

World-Class Asset: The SYU is a 76,000-acre offshore oil field with over 1 billion barrels of recoverable resources, capable of producing 60,000-100,000 barrels per day.

Low-Cost, High-Margin Production: Operating costs of $17/barrel ensure profitability even in volatile markets.

Experienced Leadership: Led by industry veteran James C. Flores, the management team has a proven track record of creating shareholder value.

Strategic Restart Plan: Clear roadmap for restarting production by Q4 2025, with significant regulatory milestones already achieved.

Financial Strength: Well-capitalized with $288 million in cash and over $590 million raised through investments.

Valuation Upside: Current market cap of $1.9 billion significantly undervalues potential future cash flows.

Energy Transition Alignment: Positioned for Carbon Capture and Storage (CCS) and natural gas development.

Risks and Mitigations:

Regulatory challenges in California's stringent environment

Commodity price volatility

Execution risks in restarting operations

Mitigated by management's expertise, stakeholder engagement, and financial hedging strategies.

Conclusion:

Sable Offshore Corp. offers a rare opportunity to invest in a high-quality asset with significant growth potential, led by an experienced team with a clear vision for value creation in the evolving energy landscape.

The stock is trading at $21.66, but we think it's worth $40-$50. At projected production levels of 60,000 bbl/d by 2029, Sable could generate over $800 million in free cash flow annually.

Keep reading with a 7-day free trial

Subscribe to Stocks, Quants, and Global Market Shocks to keep reading this post and get 7 days of free access to the full post archives.