September 26, 2023

Summary

Soft Landing is the new “transitory”

Higher for longer becoming consensus narrative…wait until something break

Valuation agnostic strategies could put gas on the fire

Time to diverge from the benchmark?

Japan after 35 years of underperformance…

Macro - Soft Landing?

Here at Kroma we are in the middle of a marathon 2 weeks roadshow as such the current and next week mashups will be much shorter. We will start with two memes. The first one describes our views on what lies ahead while the second is a reflection on last weeks Fed decision.

Macro - Uncertainty

We have always treated macro forecast using decimal points, with a little humour. Broadly forecasting a recession has value as this impacts asset returns. Being right on 2.7% or 3.2% GDP growth has little value investment-wise.

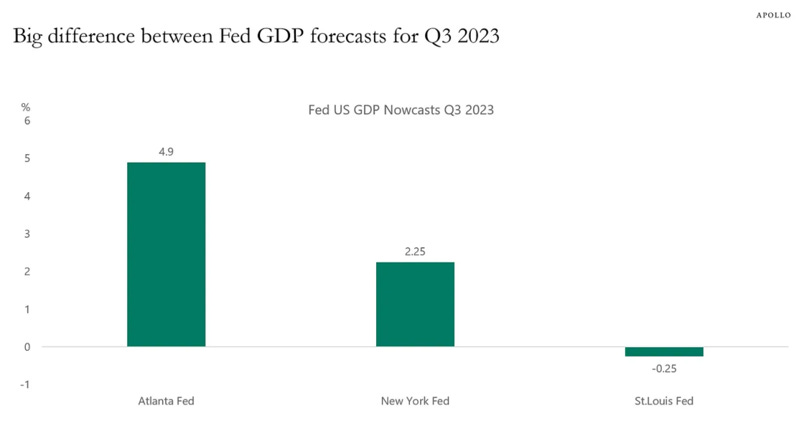

The Fed econometric models are all over the place right now. We do not see conditions as positive for medium-term growth.

Macro - Yield Curve

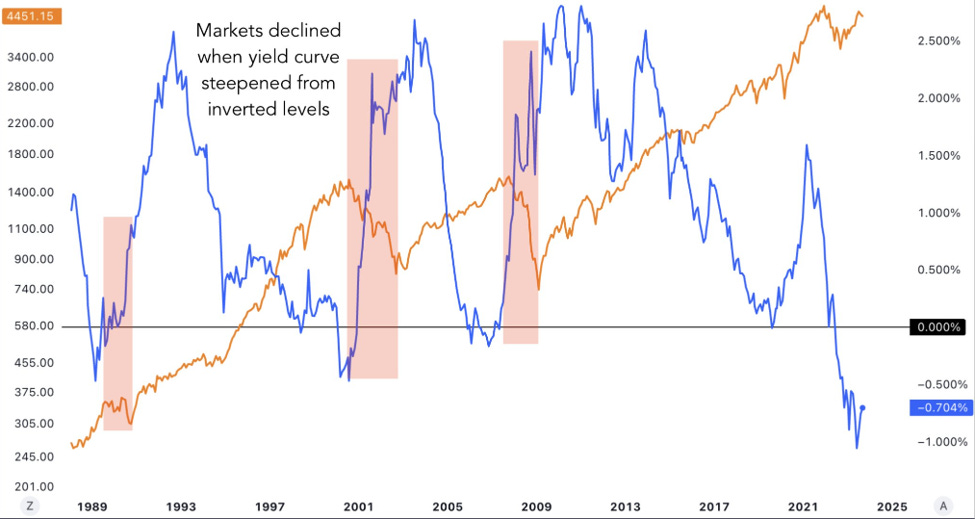

Once more… equity markets do not like it when the yield curve steepens from an inverted position.

Macro - Employment

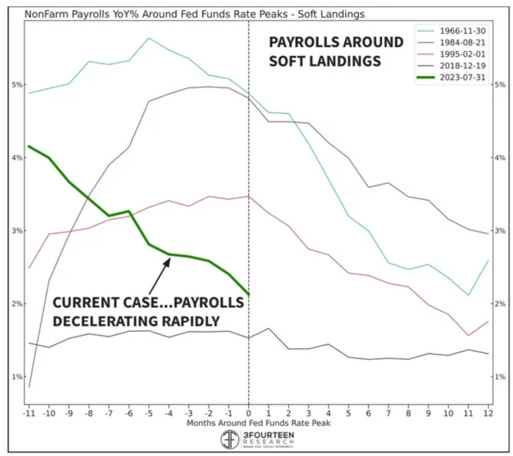

As with many other datapoints we have touched upon previously, employment is not behaving as might be expected for a soft landing…

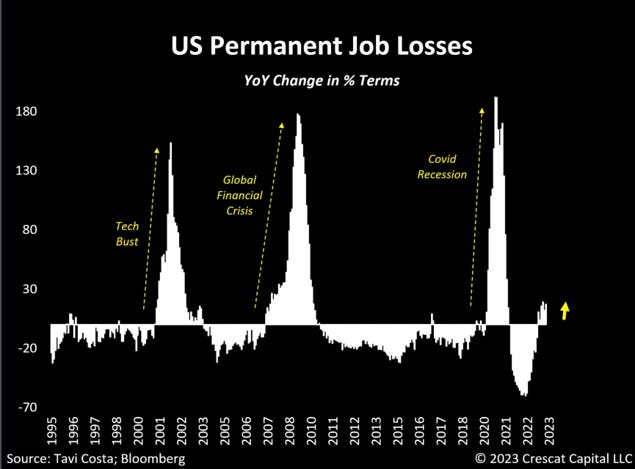

The persistance of permanent job losses is another sign that the job market is weaker than it appears.

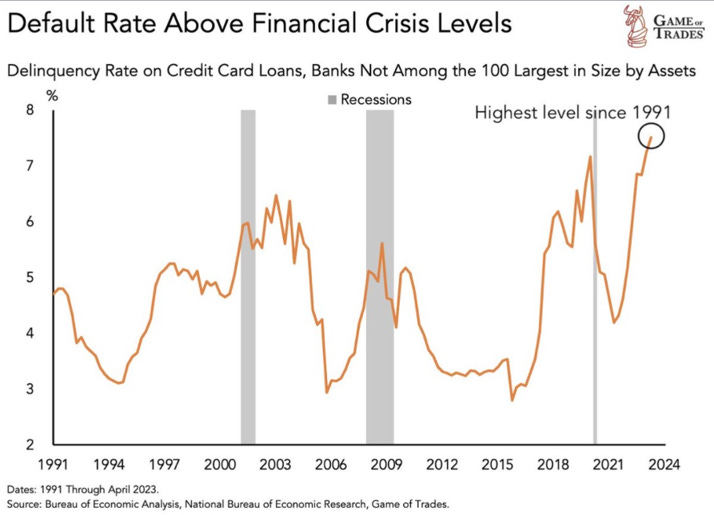

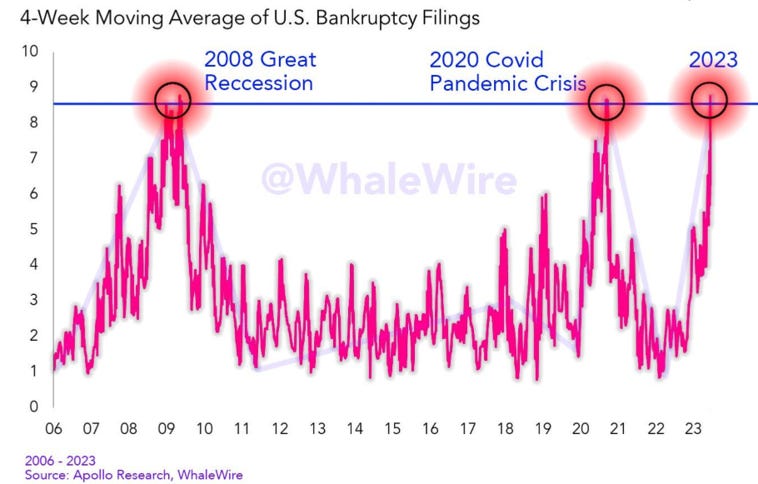

Macro - Defaults

Credit Card default rates are the highest since 1991 for the «non top 100» banks…

…while bankruptcy filings are reaching highs only seen during the 2008 GFC and 2020 Covid Crisis.

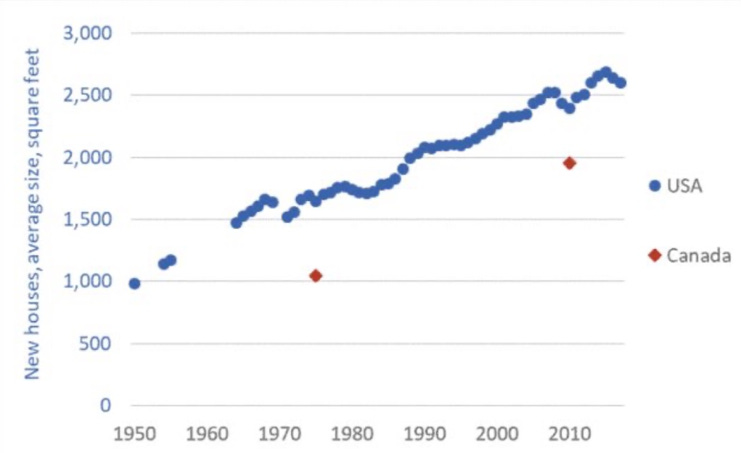

Macro - Housing

Here is a good long-term graph. The average size of new houses over time in the US and Canada. Bigger families is not likely to be the cause!

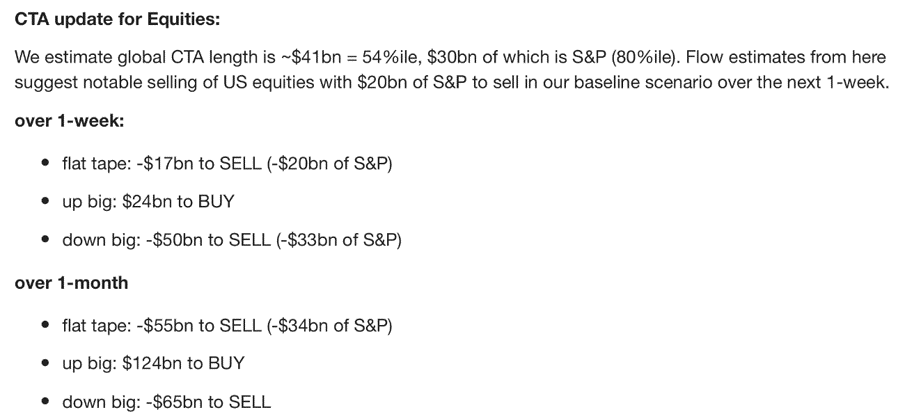

Markets - Liquidity

CTAs are now at a crossroads, if the markets fail to rebound from current levels they will experience significant downside pressure.

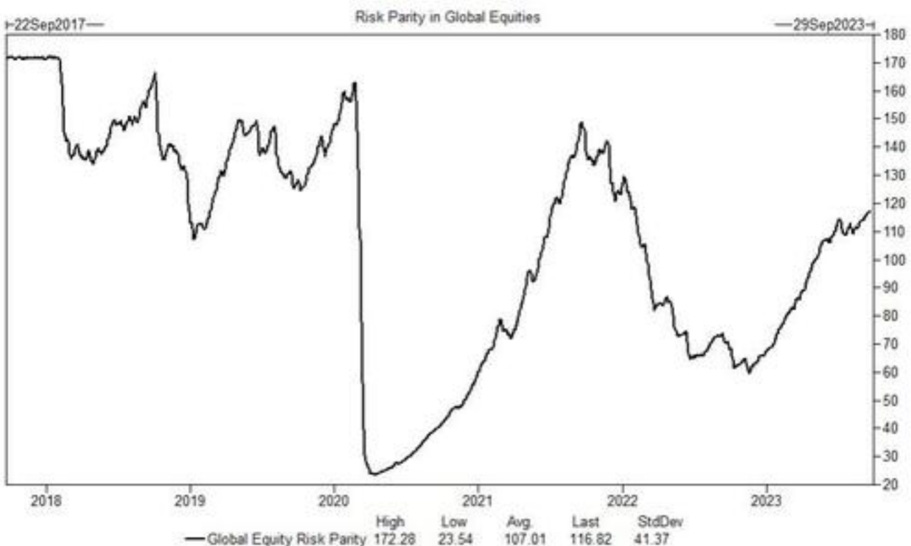

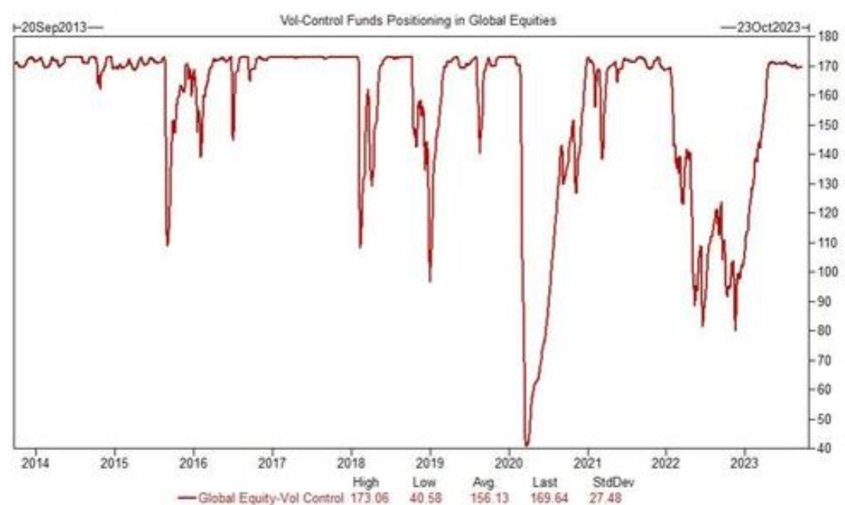

The same is true for risk parity and target volatility strategies…….

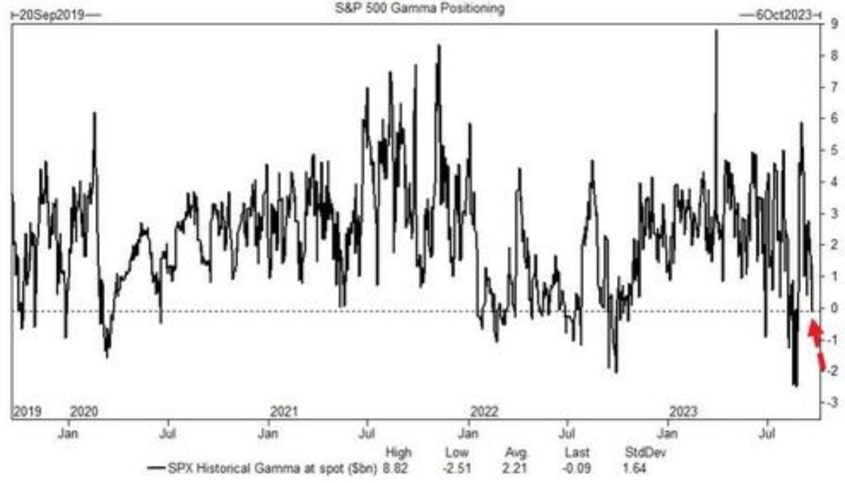

Furthermore, dealers have a negative aggregate gamma exposure which implies that they will sell declines and buy rallies……..

Markets - Breadth

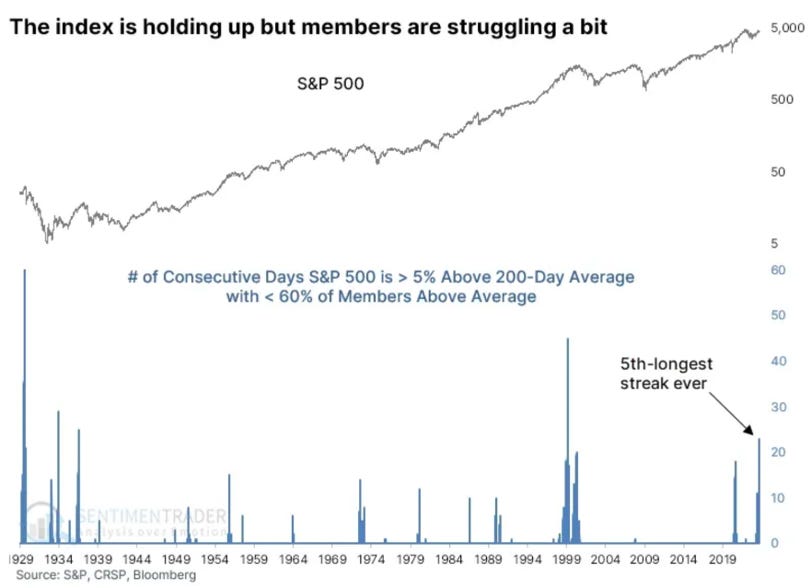

Market breadth continues to be really narrow, we see this as a really bad omen.

Markets - Intermarkets

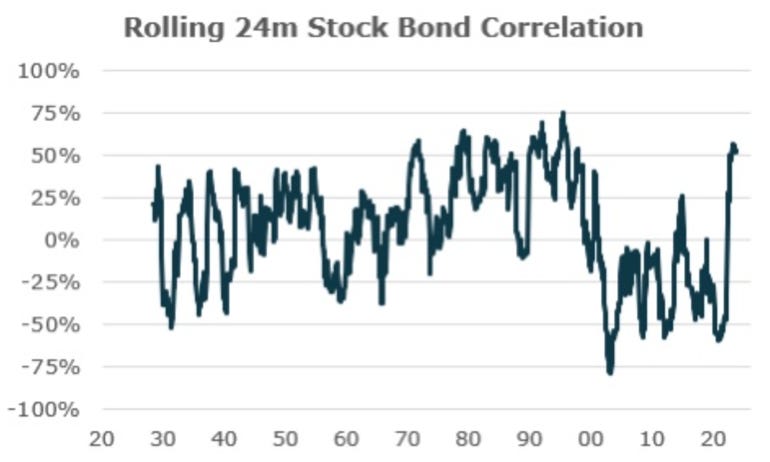

For those who think that the past 20 years Stocks-Bonds-Correlation was the norm, this graph will be dissapointing.

Markets – Sentiment

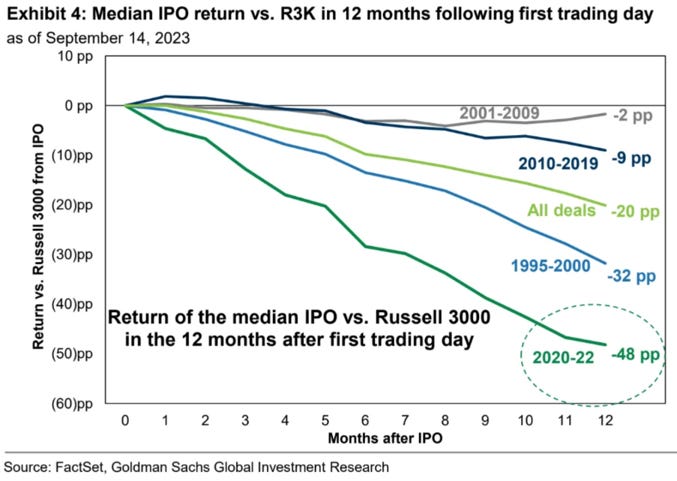

We showed before how Wall Street feasted on dumb money during 2020-2022, here is another way to view it ………

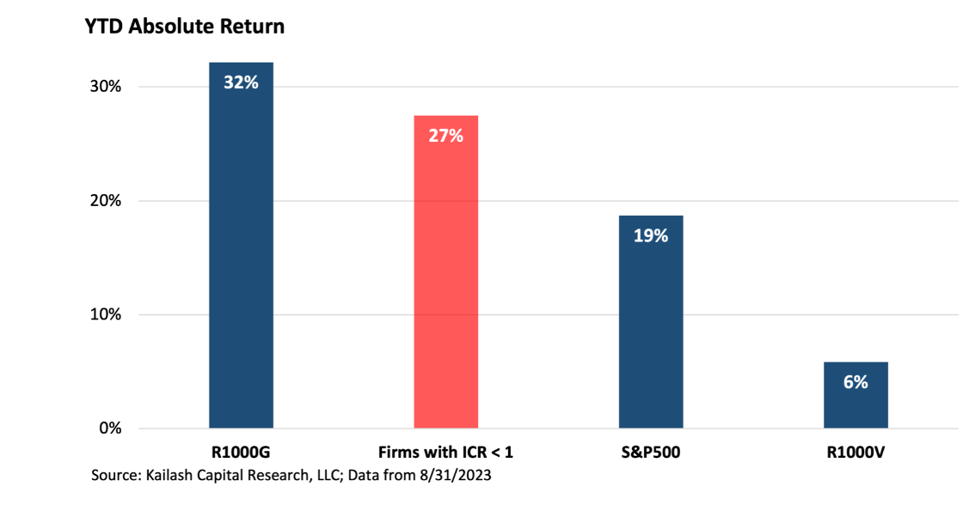

Firms unable to cover their interest payments have outpeformed the S&P 500 by almost 10% so far this year. This seems perfectly legitimate when the Fed is aggressively raising interest rates and telling anyone who is willing to listen that rates will stay high.

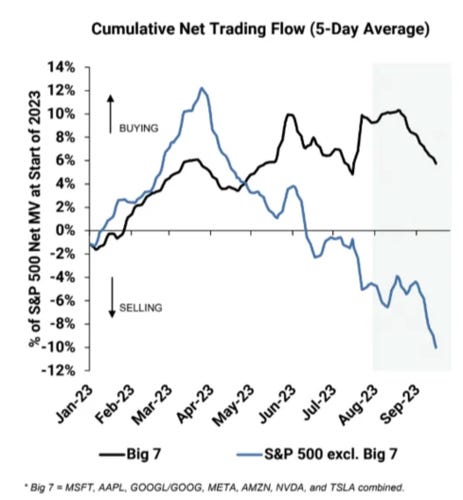

Cracks are starting to appear for even the «magnificient 7».

Markets - Valuations

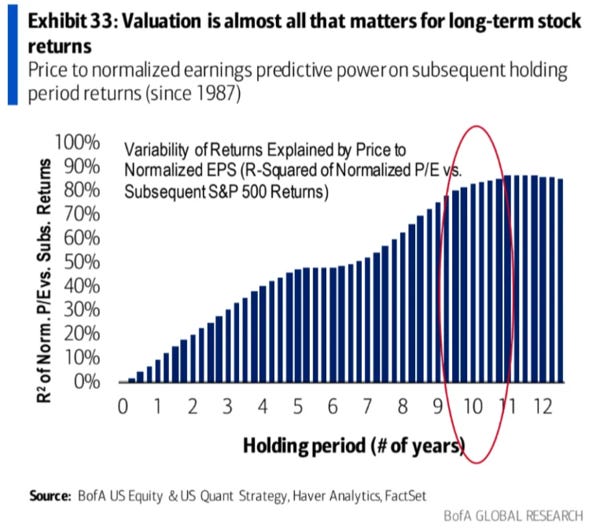

Valuations for the purpose of short-term market forecasts are useless, but the longer the holding period, the better (no surprise for many including old-time readers).

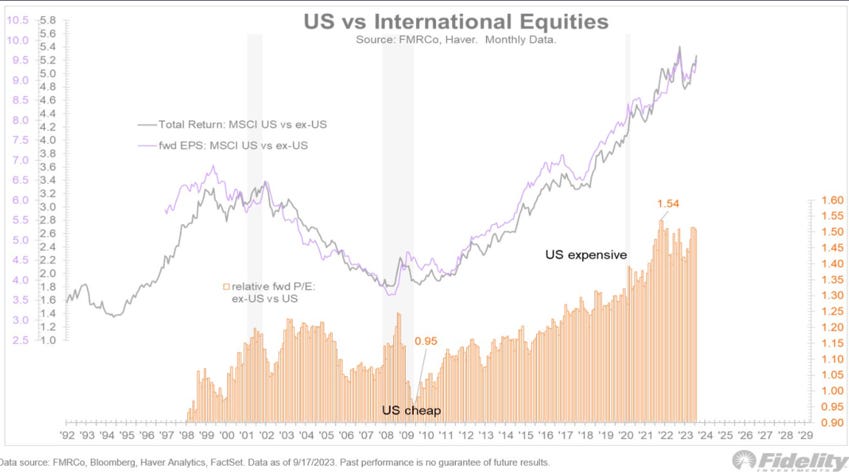

Is it time to deviate from the global benchmark?

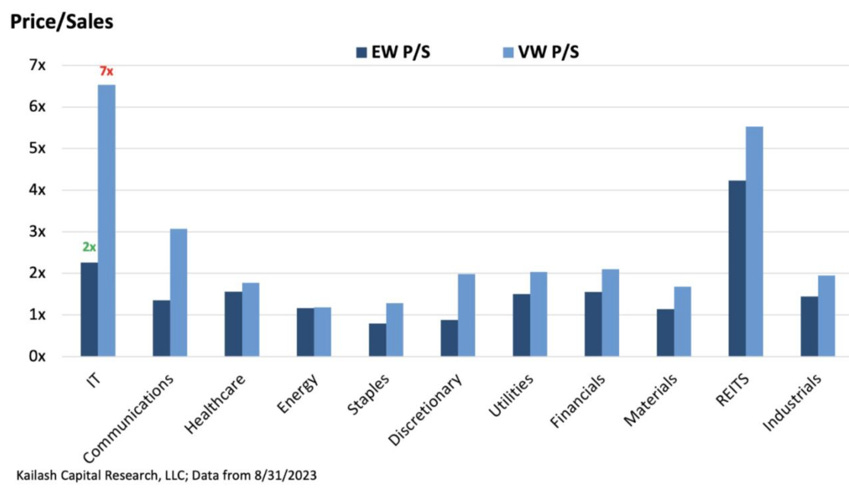

Time to move from cap weighted to equal weighted indices?

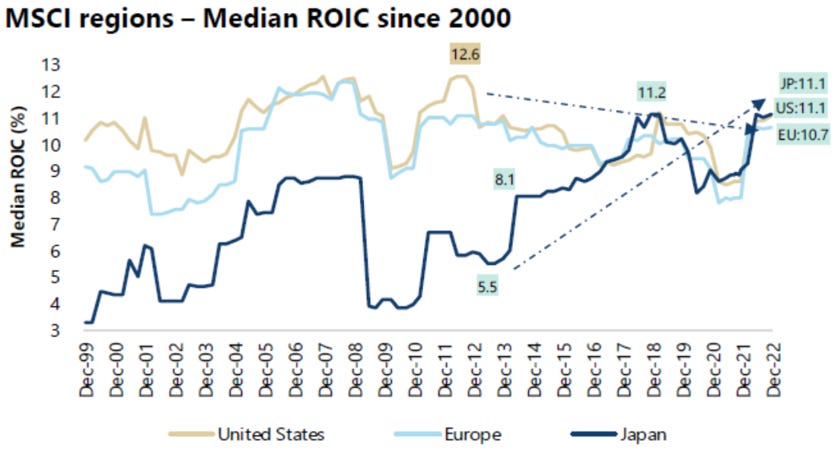

Markets - Japan - Valuations

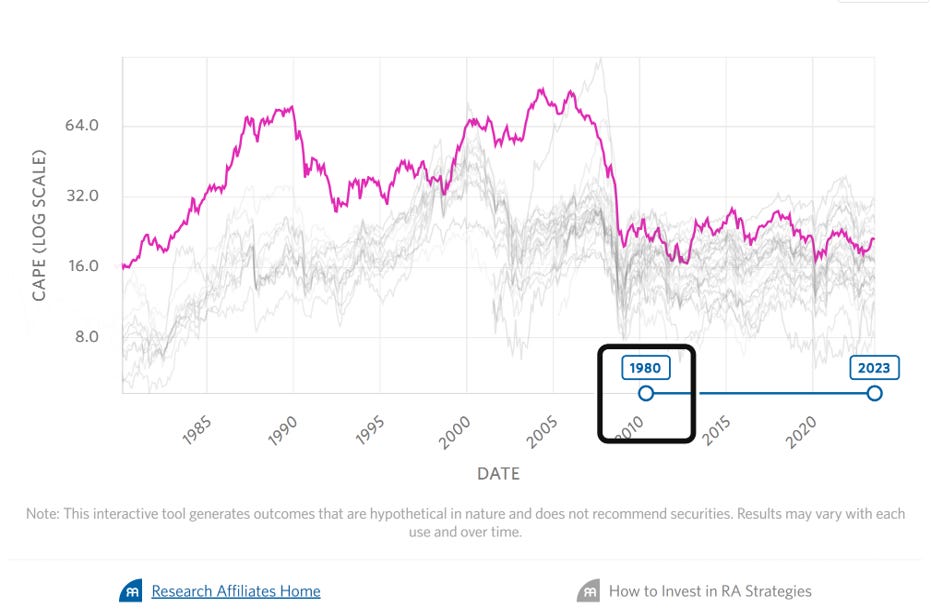

Japan has been a focus for us for some time. Equity markets have risen substantially while as expected the Yen has fallen. Currently the Yen is historically cheap while the life expectancy of the Japanese YCC experiment is getting shorter by the day.

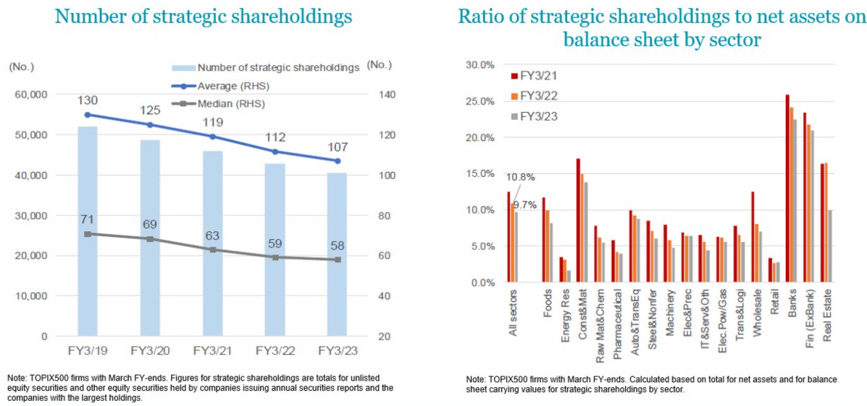

The equity markets has been rerated but remain relatively cheap compared to other markets, and balance sheets are of much higher quality on the liability side while there are strong regulatory pressures to improve the asset side.

Lots of progress has already been made, mostly for the bigger, export-oriented companies but more needs to be done.

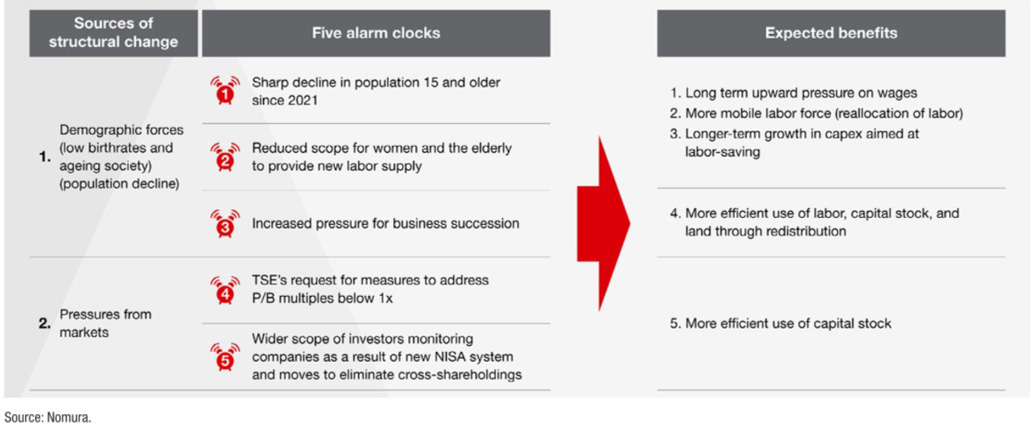

Nomura gives a nice summary of the challenges ahead and how it could benefit makets going forward.

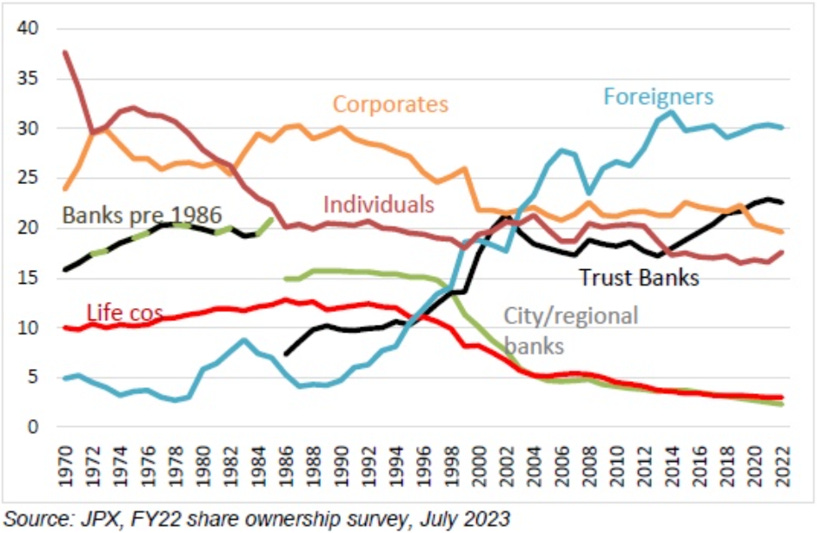

Markets - Japan - Shareholdings

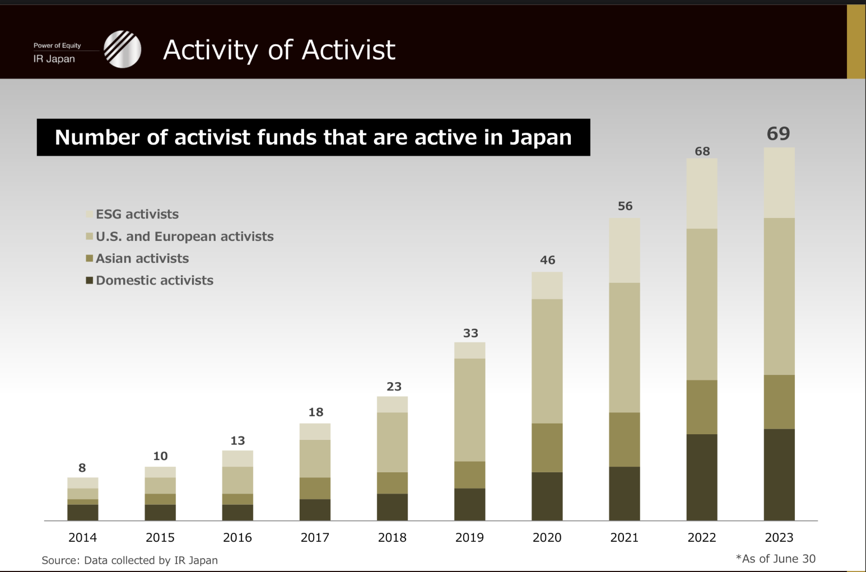

The shareholding dynamic is also a positive. Corporates cross-shareholding is slowly melting while city and regional banks relative importance is declining. No more “Japan Inc.’s Love Affair With Itself” as the WSJ put it in the past. No more “copinage”.

This will enable activist funds to push for more shareholder friendly management.

We will have much more to say on Japan going forward…..