The Art of Valuation: Episode I

Unveiling the Intrinsic Worth of AAPL

This note marks the first in a series aimed at valuing mature stocks, where we will employ a structured Discounted Free Cash Flow (DFCF) model to assess intrinsic value.

Our focus on established companies, like Apple Inc. (AAPL), allows us to provide insightful analyses that can inform investment decisions.

We welcome requests for additional stock evaluations as we explore the nuances of stock valuation together.

We acknowledge that market structures—both micro and macro—are evolving. The surge in passive investing, as well as the extensive use of buybacks, have made mean reversion to fair value increasingly challenging. However, we remain confident that this anomaly will eventually correct, allowing intrinsic values to regain prominence over market prices.

Executive Summary

In this analysis, we employ a Discounted Free Cash Flow (DFCF) model to evaluate Apple Inc. (AAPL), a mature company characterized by stable cash flows and a strong market presence. The DFCF methodology focuses on projecting future free cash flows (FCF), adjusting for changes in share count through buybacks or dilution, and discounting these cash flows to their present value using the Weighted Average Cost of Capital (WACC).

Key Findings:

High-Growth Phase (for 5 or 10 years): The model projects a high growth rate based on historical FCF performance, estimating a potential growth rate of 9.7%.

Stable Growth Phase: Following this period, the stable growth rate is set at around 2.00%, aligning with long-term GDP growth expectations.

Valuation Insight: The calculated fair value for AAPL shares is between $130 and $180 when using the model calculated potential growth rate of 9.7%.

However, we found this growth assumptions too high and estimate that the fair value is closer to $125 and $145, indicating potential significant overvaluation in the current market price.

Sensitivity Analysis: Variations in growth assumptions and share buyback rates showcase the impact on fair value, emphasizing the model's adaptability to different market conditions.

In conclusion, while the DFCF model provides a structured and data-driven approach to valuing AAPL, it is essential to approach its outputs with a critical mindset, recognizing the inherent uncertainties in projections.

Introduction

Valuing a company’s stock is both an art and a science, requiring a blend of quantitative analysis and qualitative judgment. Numerous models exist, ranging from straightforward multiples-based approaches to more intricate discounted cash flow (DCF) methods.

The DCF model described here is particularly suited for mature companies—those with a proven track record of generating free cash flow (FCF) and a relatively predictable growth trajectory.

This model aims to project future FCFs, adjust for anticipated changes in share count due to buybacks or dilution, and discount these cash flows back to the present using an appropriate rate, such as the Weighted Average Cost of Capital (WACC).

We aim to be approximately right now precisely wrong!

Core Concept: Free Cash Flow and Discounting

The foundation of the DFCF methodology lies in understanding free cash flow.

FCF represents the cash generated by a business after accounting for necessary investments to maintain and expand its asset base. It is often viewed as a more reliable indicator of a company’s earning power compared to reported earnings, which can be influenced by accounting practices and non-cash items.

To begin, the model identifies the trailing FCF by extracting data from the company’s cash flow statement and summing the last four quarters to approximate annual FCF.

With this baseline established, the model projects future cash flows in two distinct phases:

High-Growth Phase (Years 1 to 5 or 10):

During this initial projection period, the company is assumed to grow its FCF at a higher rate, reflecting market share gains, improving margins, or product/service expansion. The model arrive at a growth rate by looking historically at the company’s FCF growth (over multiple 3, 4, or 5 years overlaping periods) and using a median figure to represent a plausible high-growth expectation.

Stable Growth Phase (Beyond High-Growth Years):

Following the high-growth period, the model transitions to a stable growth rate that aligns with long-term GDP growth or slightly above inflation rates. This phase represents a sustainable growth pace that the company can maintain indefinitely.

Discounting Future Free Cash Flows

To account for the time value of money, future projected cash flows are discounted back to their present value using WACC or another user-defined discount rate (our model use WACC). WACC reflects the cost of both debt and equity, encapsulating the returns that investors expect. A higher discount rate results in lower present values of future cash flows, while a lower rate increases them.

Terminal Value Calculation

At the conclusion of the explicit high-growth projection period, the model calculates a terminal value. This value aggregates all future cash flows beyond the projection horizon under the assumption that stable growth continues indefinitely. The terminal value is also discounted back to present value.

Integrating Net Dilution or Buybacks

A significant enhancement in this DFCF model is its ability to adjust for changes in shares outstanding due to buybacks or dilution. Companies may issue new shares, leading to dilution, or repurchase shares from the market, which reduces total shares outstanding.

Buyback Rate Calculation: The model estimates share buyback rates by analyzing historical changes in outstanding shares over time. If shares have decreased over a specified historical period (e.g., five years), it calculates a Compound Annual Growth Rate (CAGR) for this reduction. Conversely, if shares have increased, it captures a dilution rate.

Impact on Fair Value per Share: Dividing the same cash flows among fewer shares increases each share's portion of those cash flows. Conversely, issuing new shares dilutes this value. The model adjusts share counts annually based on projected buyback or dilution rates before calculating fair value per share.

Arriving at Fair Value

The fair value estimate is derived by summing the present values of all forecasted FCFs per share along with the discounted terminal value. This intrinsic value is then compared against current market prices. If the calculated fair value exceeds market price, it may indicate that the stock is undervalued; conversely, if it falls short, market expectations may be overly optimistic.

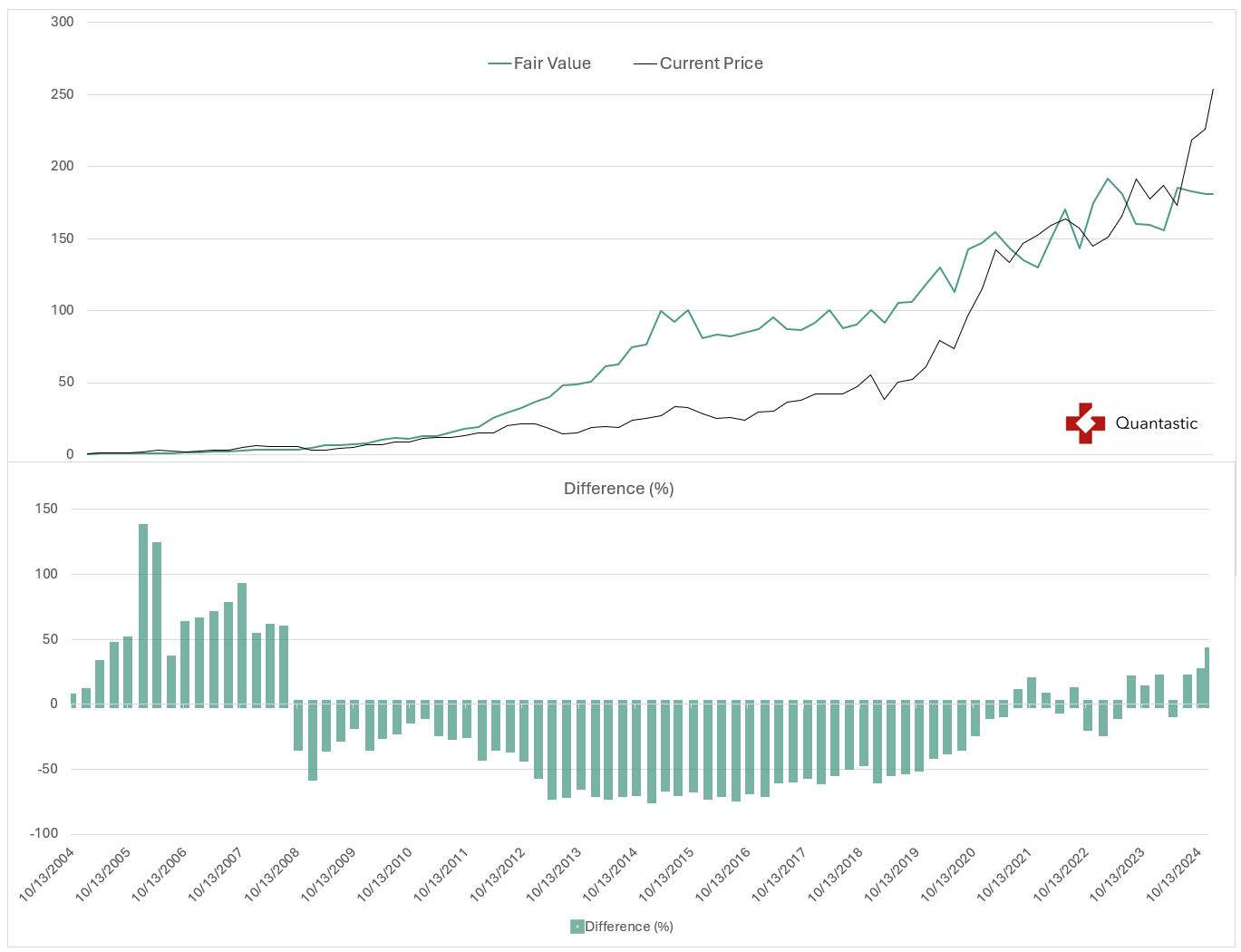

Historical Fair Values

In addition to providing current valuations, our model computes historical fair values over time. By analyzing available financial data from past periods, it recalculates what fair values would have been based on information available at those times.

Recalculation at Prior Dates: For each historical period examined, the model uses only data available up to that date for valuation purposes.

Comparing Historical Fair Values to Actual Prices: By plotting these historical fair values against actual stock prices, investors gain insights into how frequently the company traded above or below intrinsic value estimates.

You will find below the example of AAPL.

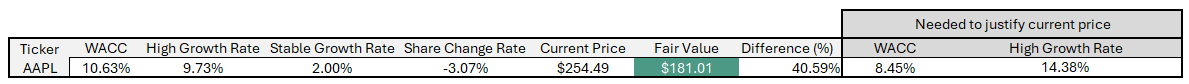

Lets’s first start with the WACC, Share Change Rate and High Growth rate the model extract from past data and the implied fair value

We will always show 2 scenarios

10 years high growth followed by stable growth

5 years high growth followed by stable growth

As one can see, despite the high free cash flow rate computed by the models and, assuming that the company will continue to buyback more than 3% of its shares during the high growth phase, AAPL shares seem to be significantly overvalued.

If we look at the fair value the model calculated for each past quarters it has sufficient data to do so, one can see how AAPL Over/Undervaluation has evolved over the past 20 years.

10 years high growth phase:

5 years high growth phase:

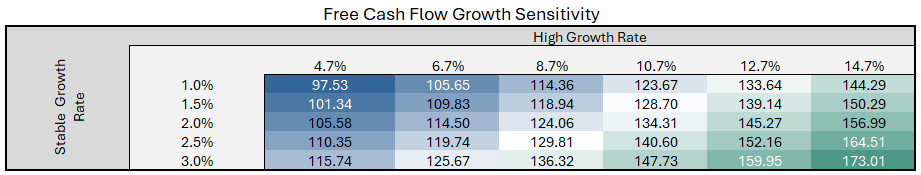

Sensitivity Analyses

Valuation is inherently uncertain; small changes in assumptions regarding growth rates, discount rates, or share counts can lead to significant variations in fair values.

To address this uncertainty, sensitivity tables are produced:

Buyback Sensitivity Table: This table illustrates how fair value per share fluctuates with varying buyback or dilution rates. Each entry corresponds to different hypothetical scenarios regarding share count changes.

10 years high growth:

5 years high growth:

Stable vs. High Growth Rate Sensitivity Table: This matrix displays how fair values change based on different assumptions about stable and high-growth rates. Each cell reflects recalculated fair values given specific combinations of these assumptions.

10 years high growth:

5 years high growth:

These sensitivity analyses help investors understand which inputs most significantly impact valuation outcomes and provide a range of potential valuations rather than a single point estimate.

Conclusion: Use with Caution and Context

In summary, our analysis of Apple using the Discounted Free Cash Flow (DFCF) model reveals a significant disparity between its intrinsic value and its current market price. While the model’s initial growth projection of nearly 10% aligns with Apple’s historical performance, we find this assumption overly optimistic given the competitive pressures and market maturity Apple faces.

A more realistic growth rate of 4.7% to 6.7%—derived from sensitivity analysis—seems more likely, even under optimistic scenarios. Based on these adjusted assumptions, our model estimates a fair value for AAPL shares in the range of $125 to $145. This underscores the potential overvaluation of AAPL in the current market.

While market sentiment and external factors may sustain elevated prices in the short term, understanding these valuation dynamics equips investors with a critical edge. We emphasize that valuation models like DFCF serve as structured frameworks to guide decision-making rather than as precise predictions. As we continue this series, we will explore additional stocks, offering data-driven insights to help investors navigate an ever-evolving market landscape with confidence and clarity.

Disclaimer

The views and opinions expressed in this post are solely those of the author. This content does not reflect the views or positions of any entities where the author works or is contracted from. This stock report is provided for informational purposes only and represents the author's personal opinions based on research and analysis conducted at the time of writing. The information contained herein should not be construed as financial, legal, or investment advice.

Not a Recommendation: This report does not constitute a recommendation to buy, sell, or hold any security or financial instrument. Any action taken based on the information presented is at the reader's own risk and discretion.

Do Your Own Research: Readers are strongly encouraged to conduct their own due diligence and consult with qualified financial advisors before making any investment decisions. The author is not responsible for any actions taken based on the information provided in this report.

No Guarantee of Accuracy: While efforts have been made to ensure the accuracy and reliability of the information presented, the author makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained in this report.

Past Performance: Any references to past performance of securities or markets are not indicative of future results. Investments can go up or down in value, and there is always the potential for loss as well as profit.

Forward-Looking Statements: This report may contain forward-looking statements that are based on current expectations, forecasts, and assumptions. These statements involve risks and uncertainties, and actual results may differ materially from those expressed or implied.

Conflicts of Interest: The author may hold positions in the securities discussed in this report. Readers should be aware that the author may have a conflict of interest that could affect the objectivity of this analysis.

Not Tailored Advice: This report does not take into account the specific investment objectives, financial situation, or particular needs of any individual person or entity. It is not personalized advice or a solicitation for any specific investment product or service.

Subject to Change: The opinions and information presented in this report are subject to change without notice. The author is under no obligation to update or amend this report based on new information, future events, or for any other reason.

Jurisdiction: This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation.

By accessing and reading this stock report, you acknowledge that you have read, understood, and agree to be bound by the terms of this disclaimer.