I will start, as always, with the 90 second pitch à la Bill Miller, the whole analysis can be found afterwards.

Valeura Energy (VLE), a Canadian oil and gas company where management projects 2025 operating cash flow to exceed this EV, signaling an undervaluation opportunity.

Cash Flow Explosion: Management projects operating cash flow to surpass EV (~$317M) by 2025, with free cash flow (FCF) estimates for 2025 at ~$175M. At just 6x FCF, the company is worth $900M, representing a 100%+ upside.

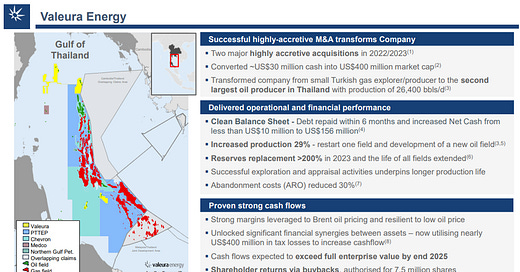

Growth Trajectory: Valeura is targeting 100,000 barrels per day (bbl/d) by 2026, up from 26,400 bbl/d in 2024, driven by high-return development drilling and accretive acquisitions.

Shareholder-Friendly Capital Allocation: The company is debt-free, has $133M in cash, and authorized a 10% share buyback program, further enhancing per-share value.

Proven Management Execution: Recent acquisitions added ~20,000 bbl/d of production at a minimal cost (~$15M), proving management’s ability to create value. Reserve replacement exceeded 200% in 2023, extending field life and ensuring operational longevity.

Deep Undervaluation: Trading at ~1-2x EV/FCF, Valeura is significantly discounted compared to peers at 6-8x FCF, offering substantial upside as the market recognizes its growth potential.

Key Risks

Dilution: ~4.4M shares (~4.1%) could dilute via options and RSUs. Mitigation: Offset by the 10% share buyback program.

Decommissioning Liabilities: Future costs of ~$138M. Mitigation: Extended field life delays liabilities.

Oil Price Volatility: Brent crude exposure. Mitigation: High margins and low production costs buffer against downside.

The stock is trading at $5.27. I think it's worth at least $10.50, representing a 100% upside. This is based on a 6x multiple on projected 2025 FCF of $175M.

Keep reading with a 7-day free trial

Subscribe to Stocks, Quants, and Global Market Shocks to keep reading this post and get 7 days of free access to the full post archives.