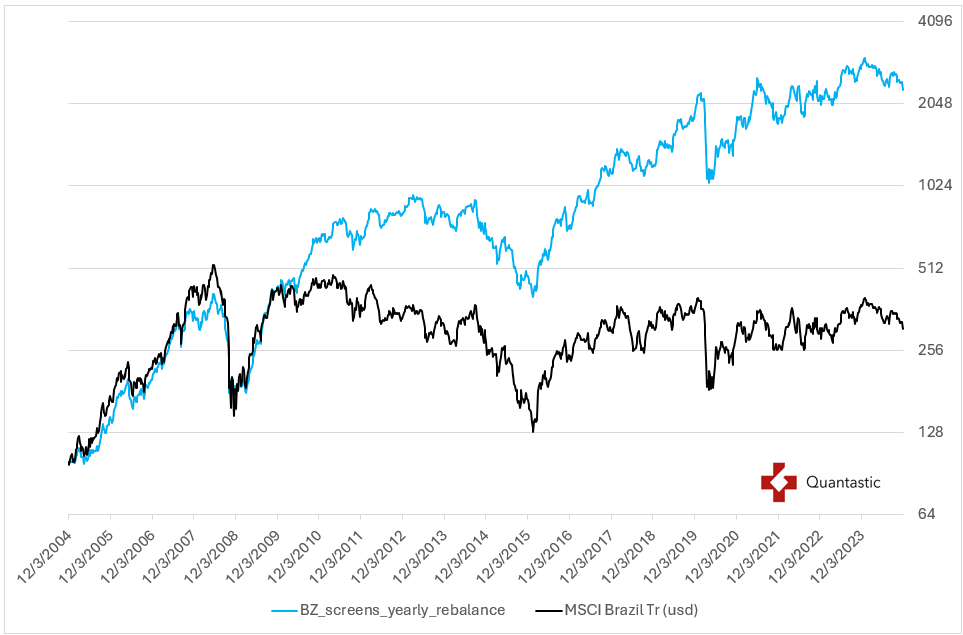

Before delving into Brazil's regulatory evolution, market dynamics, and the case for long-term investment in Brazilian equities (with lots of data and graphs), we present a key highlight:

Our proprietary quantitative stock selection framework, proven successful across global markets for nearly two decades, has demonstrated robust performance in the Brazilian market.

This strategy which can be run on a BRL 75-100 million portfolio, is available exclusively for family offices or small institutions seeking alpha in this dynamic market. (No management fees, only performance fees. We only make money if You make money).

Executive Summary: Prospects for Brazil’s Equity Market

Brazil's equity market is currently at a pivotal crossroads, shaped by a combination of historical transformations, institutional reforms, and evolving economic dynamics.

This note outlines Brazil's economic journey, the institutional evolution that has bolstered its stability, recent valuation trends, and the key risks and opportunities that investors must consider.

Historical Context: From Hyperinflation to Economic Stability

Brazil's economic narrative is marked by a dramatic transition from hyperinflation in the late 20th century to relative economic stability today. During the 1980s and early 1990s, annual inflation rates soared to 2,489% in 1994, severely undermining purchasing power and fostering economic unrest. The introduction of the Real Plan in 1994 was a critical turning point. This stabilization program involved:

Creation of a New Currency: The Real (BRL) was pegged to the US dollar to restore confidence and control inflation.

Fiscal Austerity Measures: The government implemented spending cuts and tax increases to reduce deficits.

Crawling Peg Exchange Rate System: This allowed gradual adjustments to the BRL, maintaining competitiveness in exports.

These measures successfully reduced inflation, paving the way for economic growth and increased foreign investment.

Institutional Evolution: Strengthened Credibility

The evolution of Brazil’s institutions has played a crucial role in fostering economic stability. A significant milestone was the independence granted to the Central Bank of Brazil (BCB) in 1999, which was formalized through legislation in 2021. This independence allows the BCB to focus on controlling inflation effectively, free from political pressures.The adoption of an inflation-targeting regime in 2000 further enhanced monetary policy credibility, setting clear targets to anchor inflation expectations. The Fiscal Responsibility Law established mechanisms to promote fiscal discipline, although challenges in compliance persist.

Current Economic Drivers: From Commodities to Structural Reforms

Brazil's economic landscape is currently influenced by several key factors:

Fiscal Policy: The government focuses on fiscal consolidation, balancing between revenue generation and spending control, which is essential for sustaining investor confidence.

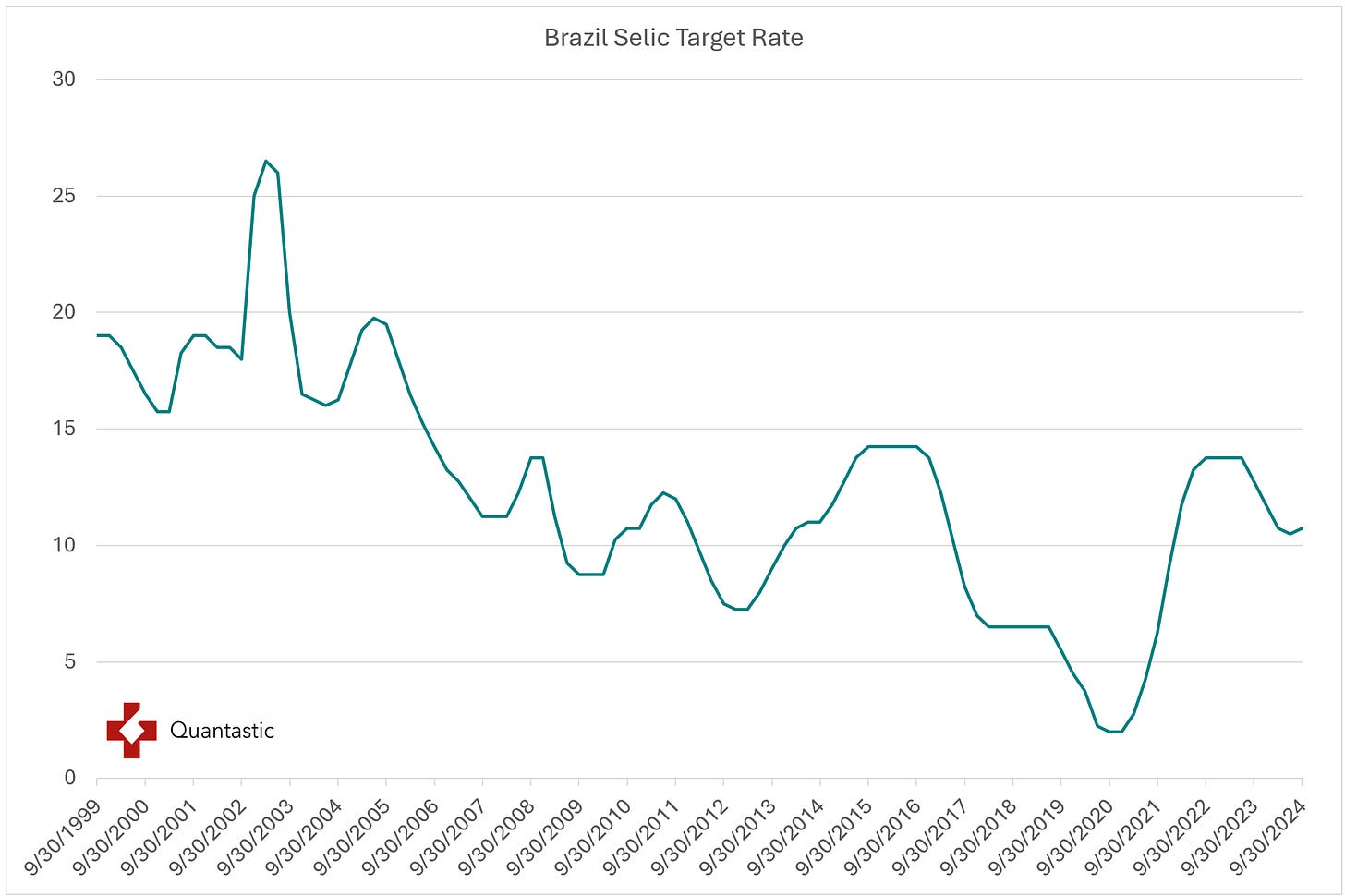

Monetary Policy: The BCB's management of interest rates plays a critical role in maintaining economic stability, especially in the face of recent inflationary pressures.

Technological Innovations: Brazil's tech sector is growing rapidly, particularly in fintech and e-commerce, acting as a new engine of economic growth.

Infrastructure Needs: Significant investment in infrastructure is necessary, presenting opportunities for long-term growth and development.

Market Valuation: Attractive Investment Opportunities

Current equity market valuations suggest that Brazilian stocks offer substantial investment potential:

Undervaluation: Brazilian equities trade at a discount to historical averages, signaling potential for price appreciation.

BRL valuation: The real is now undervalued and should not be the headwind it was for foreign investors since its 2008 and 2011 peaks when it was grossly overvalued.

Risks and Opportunities

While the prospects for Brazil's equity market appear promising, investors must navigate several risks:

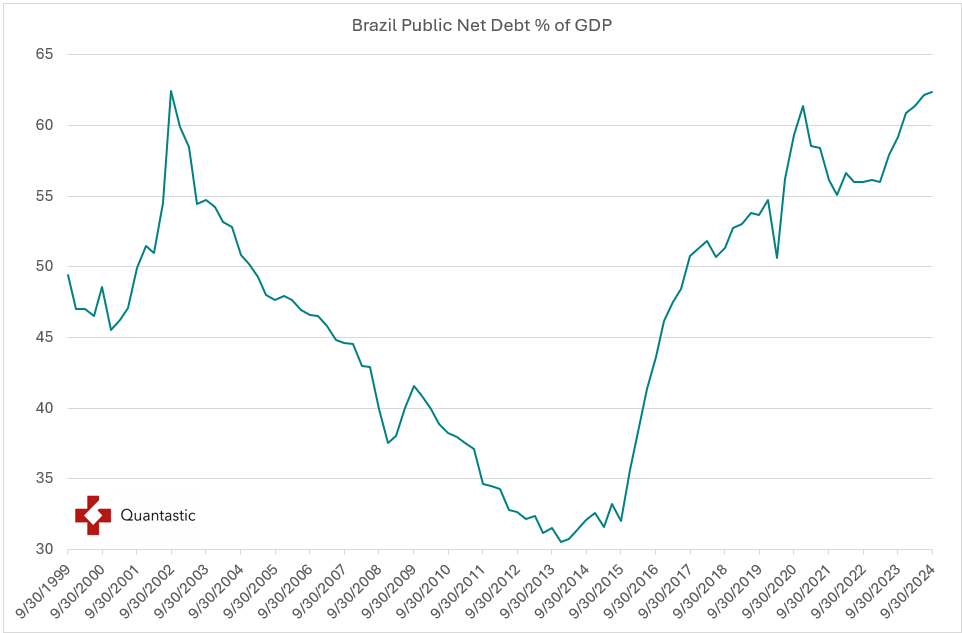

Fiscal Sustainability: High debt levels and ongoing fiscal deficits present concerns. Failure to implement effective fiscal measures could undermine market confidence.

Political Uncertainty: Upcoming elections heighten risks associated with potential policy shifts, affecting investor sentiment.

Global Economic Conditions: As a major commodity exporter, Brazil is vulnerable to fluctuations in commodity prices and global demand.

Conversely, significant opportunities exist:

Technological Growth: The tech sector is poised for further growth, offering substantial investment opportunities.

Infrastructure Investment: The need for upgrades in infrastructure aligns with Brazil's long-term development goals, presenting lucrative prospects for investors.

Green Economy: Brazil's expertise in renewable energy positions it well in the global shift towards sustainability.

Conclusion: A Forward-Looking Perspective

Brazil’s equity market is characterized by a unique mix of value and growth potential.

The journey from hyperinflation to relative stability, coupled with substantial institutional reforms, has created a solid foundation for future investment opportunities.

However, persistent challenges related to fiscal sustainability and political uncertainty require careful navigation.

Investors looking at Brazil's equity market should balance the attractive current valuations against the inherent risks.

With informed strategies and a clear understanding of the evolving landscape, investors can position themselves advantageously to benefit from Brazil's next chapter of economic development.

As the country continues to address its structural challenges, it may reveal compelling opportunities for those willing to engage with its dynamic and potentially undervalued market.

Now the deep dive part…

1. Historical Context: From Hyperinflation to Economic Stability

In the late 1980s and early 1990s, Brazil was ensnared by crippling hyperinflation, with annual rates reaching an astonishing 2,489% in 1994. This economic chaos necessitated urgent reforms..

The Real Plan: A Turning Point

The introduction of the Real Plan in 1994 marked a watershed moment in Brazil's economic history. This bold stabilization program, spearheaded by then-Finance Minister Fernando Henrique Cardoso, aimed to break the back of hyperinflation through a multi-faceted approach:

Introducing a new currency, the Real (BRL), pegged to the US dollar to stabilize the exchange rate and curb inflationary expectations.

Implementing fiscal austerity measures, including reducing government spending and raising taxes to control budget deficits.

Adopting a crawling peg exchange rate system, which allowed for gradual adjustments in the BRL's value to maintain export competitiveness while preventing overvaluation.

The Real Plan achieved remarkable success, dramatically reducing inflation and paving the way for renewed growth. This success demonstrated that a determined and well-designed policy approach could break the cycle of hyperinflation that had plagued Brazil for decades.

Embracing Market-Oriented Reforms

Alongside stabilization efforts, Brazil embraced a broader wave of economic liberalization:

Privatization: A large-scale program divesting from state-owned enterprises in sectors like telecommunications, energy, and mining to boost efficiency and attract private investment.

Trade liberalization: Reducing trade barriers to stimulate productivity, lower consumer prices, and integrate Brazil more fully into the global economy.

Financial market reforms: Modernizing and strengthening the financial sector through improved bank supervision, capital market development, and enhanced investor protection.

These reforms aimed to improve efficiency, attract private investment, and integrate Brazil more fully into the global economy.

2. Institutional Evolution: Building a Foundation for Stability and Growth

As Brazil emerged from hyperinflation, focus shifted to building robust institutions:

Central Bank Independence

A pivotal development in Brazil's institutional framework was the granting of independence to the Central Bank of Brazil (BCB) in 1999. This move aimed to shield the central bank from political interference, allowing it to focus solely on its mandate to control inflation.

In 2021, Brazil achieved a significant milestone with the approval of a law granting formal autonomy to the BCB. This long-sought-after independence, enshrined in legislation, aims to:

Shield the BCB from political interference by establishing fixed terms for the BCB's president and directors that do not coincide with presidential terms, thus insulating monetary policy from political cycles.

Enhance policy credibility and predictability by removing the threat of political intervention, thereby fostering a stable economic environment.

Adoption of Inflation Targeting

In 2000, Brazil formally adopted an inflation-targeting regime, marking a crucial step in its monetary policy framework. This approach involves:

Setting explicit inflation targets that are announced publicly, providing a clear anchor for expectations.

Using monetary policy tools, primarily interest rates, to achieve these targets, ensuring that inflation remains within a manageable range.

The inflation-targeting framework has proven effective in anchoring inflation expectations, reducing inflation volatility, and building credibility. While inflationary pressures have re-emerged in recent years, the BCB's commitment to inflation targeting remains a crucial anchor for economic policy.

Fiscal Responsibility Law

To enhance fiscal discipline and promote sustainability in government finances, Brazil introduced the Fiscal Responsibility Law in 2000. This law established rules and mechanisms to:

Control government spending by setting limits.

Manage public debt with transparency and accountability.

Enhance transparency in fiscal affairs to foster public trust.

While implementation and enforcement have faced challenges, the Fiscal Responsibility Law represents a crucial institutional framework for promoting fiscal responsibility.

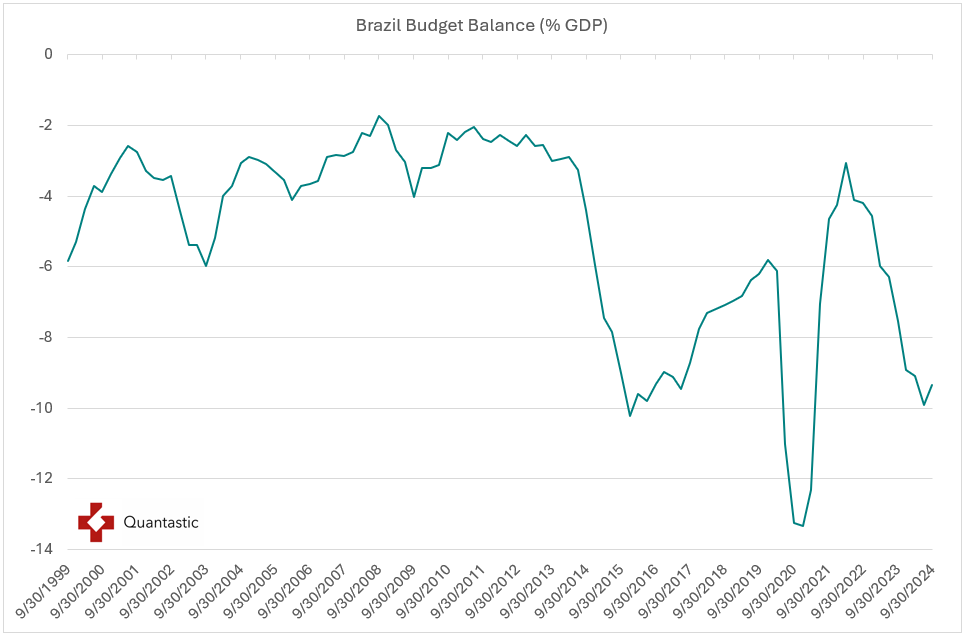

The budget balance has a large deficit as a consequence of the high short-term rates but the primary balance is close to its target and has a deficit of less than 1%

Financial Market Development

Brazil's financial markets have experienced significant growth and sophistication over the past two decades. Key developments include:

Expansion of capital markets, broadening access to financing for businesses through increased listings and bond issuance.

Rise of family offices, reflecting the increasing sophistication of Brazilian investors and their demand for tailored financial solutions.

Growth of the asset management industry, with Brazilian firms demonstrating competitiveness on the global stage, particularly in managing diversified investment portfolios.

Technological innovation, particularly in the fintech sector, disrupting traditional banking models and expanding financial inclusion by serving previously unbanked populations.

3. External Debt Risk: From Vulnerability to Resilience

One of the most significant transformations in Brazil's economic landscape has been the reduction of external debt risk. In the 1980s and early 1990s, Brazil, like many Latin American countries, was highly vulnerable to external debt crises. However, a series of radical changes have dramatically improved Brazil's position:

1. Foreign Reserve Accumulation

One of the most significant transformations in Brazil's economic landscape has been the reduction of external debt risk. In the 1980s and early 1990s, Brazil, like many Latin American countries, was highly vulnerable to external debt crises. However, a series of radical changes have dramatically improved Brazil's position:

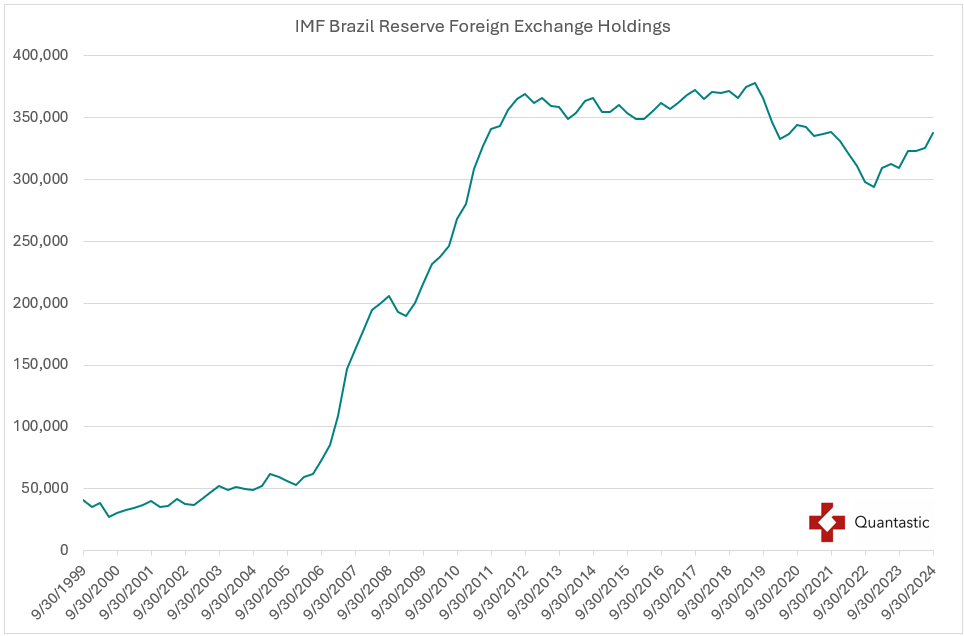

Foreign Reserve Accumulation: Brazil has substantially increased its foreign exchange reserves, providing a buffer against external shocks and reducing vulnerability to sudden stops in capital flows.

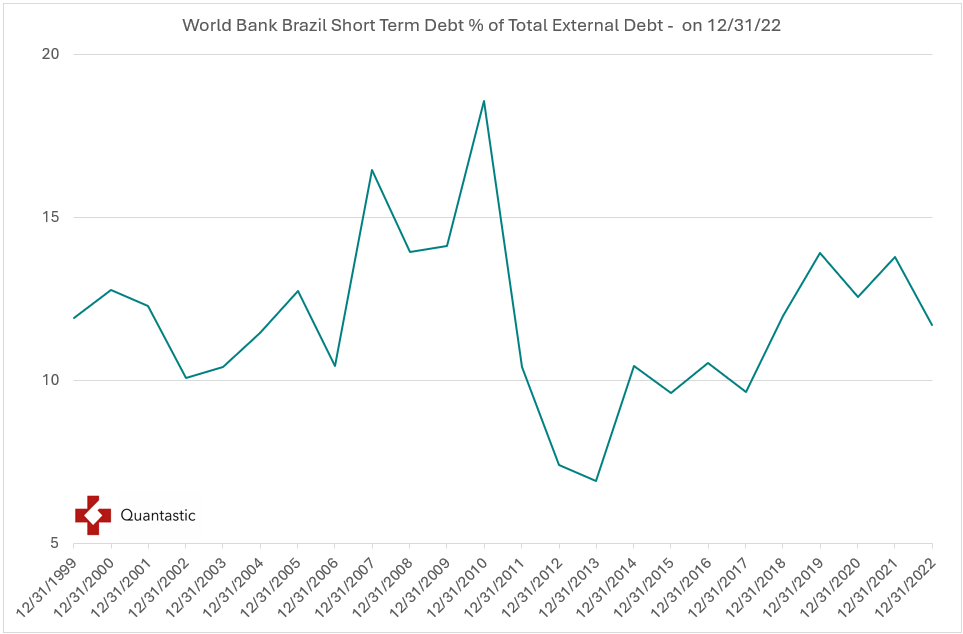

Shift in Debt Composition: The country has reduced its reliance on external debt, with a greater proportion of government debt now denominated in local currency, thereby minimizing exposure to exchange rate fluctuations.

Flexible Exchange Rate Regime: The adoption of a flexible exchange rate regime in 1999 has allowed the currency to act as a shock absorber, mitigating the impact of external factors on the domestic economy.

Improved Debt Management: Brazil has implemented more sophisticated debt management strategies, extending maturities and improving the overall debt profile to reduce refinancing risks.

Export Diversification: While still reliant on commodities, Brazil has made efforts to diversify its export base, reducing vulnerability to commodity price shocks by expanding into areas like manufactured goods and services.

These changes have significantly reduced Brazil's external debt risk, as evidenced by improved credit ratings and lower borrowing costs in international markets.

4. Drivers of Macroeconomic Performance: Past and Present

Understanding the factors that have driven Brazil's macroeconomic performance in the past and those shaping its current trajectory is crucial for assessing the prospects of its equity market.

Historical Drivers

Commodity Boom: Brazil's economy benefited significantly from the global commodity supercycle of the 2000s, driven by rising demand from China and other emerging markets.

Domestic Consumption: Expanding credit access and rising incomes fueled a consumption-driven growth model in the 2000s and early 2010s.

Government Spending: Expansionary fiscal policies, particularly during the Workers' Party governments, played a significant role in driving growth through public sector investments.

Foreign Investment: Brazil attracted substantial foreign direct investment, particularly in the aftermath of the global financial crisis, as investors sought higher yields in emerging markets.

Current Drivers

Fiscal Policy: The government's approach to fiscal consolidation and structural reforms is a key factor shaping Brazil's economic outlook, with current debates focusing on revenue increases versus spending cuts.

Monetary Policy: The BCB's management of inflation through interest rate adjustments remains crucial for macroeconomic stability, with recent rate hikes signaling a commitment to controlling inflation.

Global Economic Conditions: As a major commodity exporter, Brazil's economic performance is still influenced by global demand and commodity prices, which can lead to volatility in economic cycles.

Technological Innovation: The growing importance of Brazil's tech sector, particularly in areas like fintech and e-commerce, is emerging as a new driver of economic growth, contributing to GDP and job creation.

Infrastructure Investment: The need for significant infrastructure upgrades presents both a challenge and an opportunity for driving economic growth, with potential for high returns in sectors like energy and transportation.

Environmental Considerations: Balancing economic development with environmental protection, particularly in the Amazon region, is increasingly shaping Brazil's economic policies and international relations, affecting trade and investment flows.

5. Equity Market Valuation and Currency Outlook

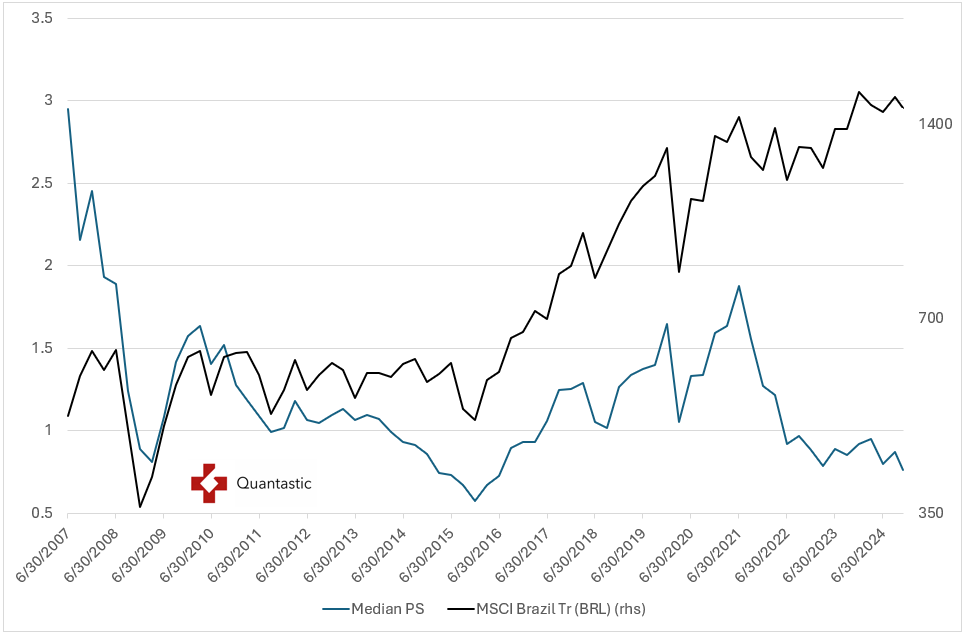

Equity Market Valuation

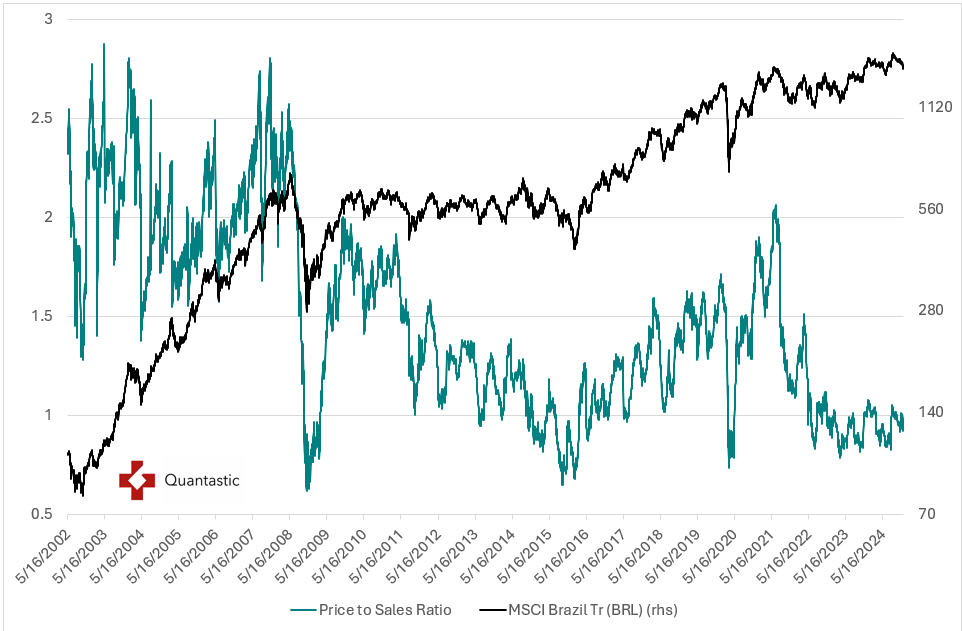

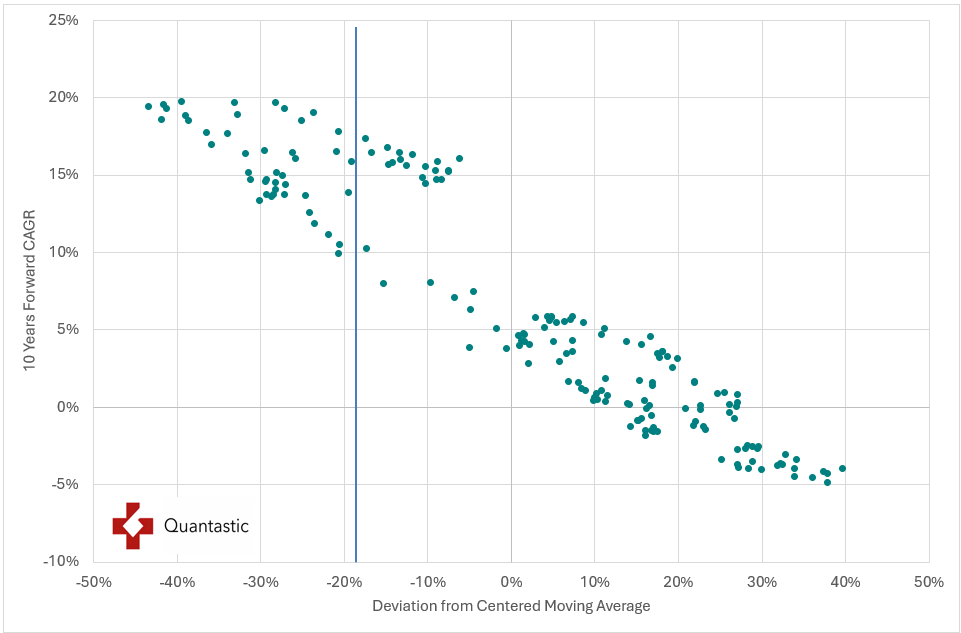

Current equity valuation models suggest that Brazilian stocks are attractively priced, offering significant upside potential:

Discount to Historical Averages: Brazilian equities are trading at a discount relative to their historical averages, indicating potential for price appreciation.

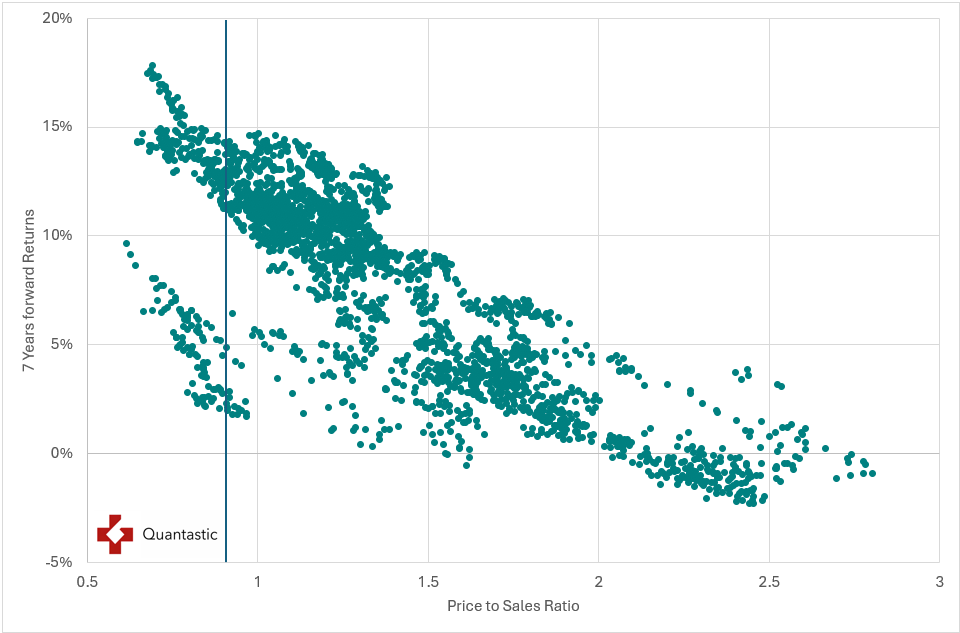

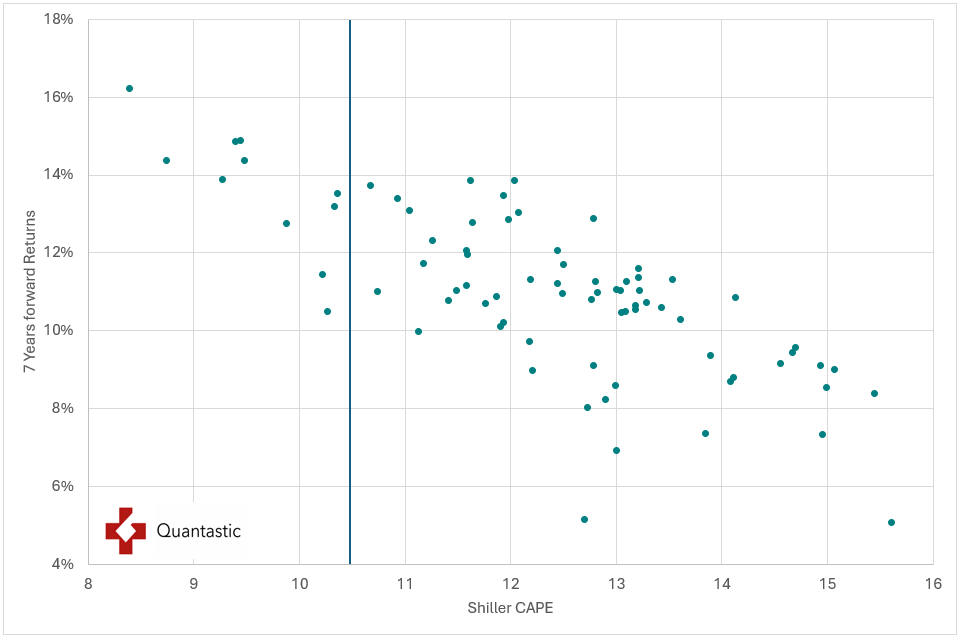

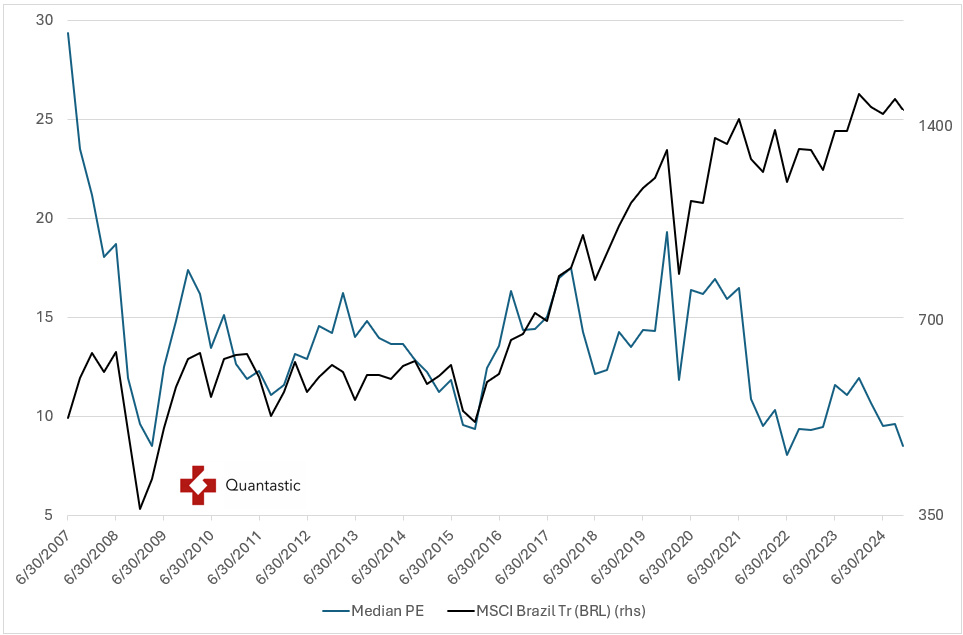

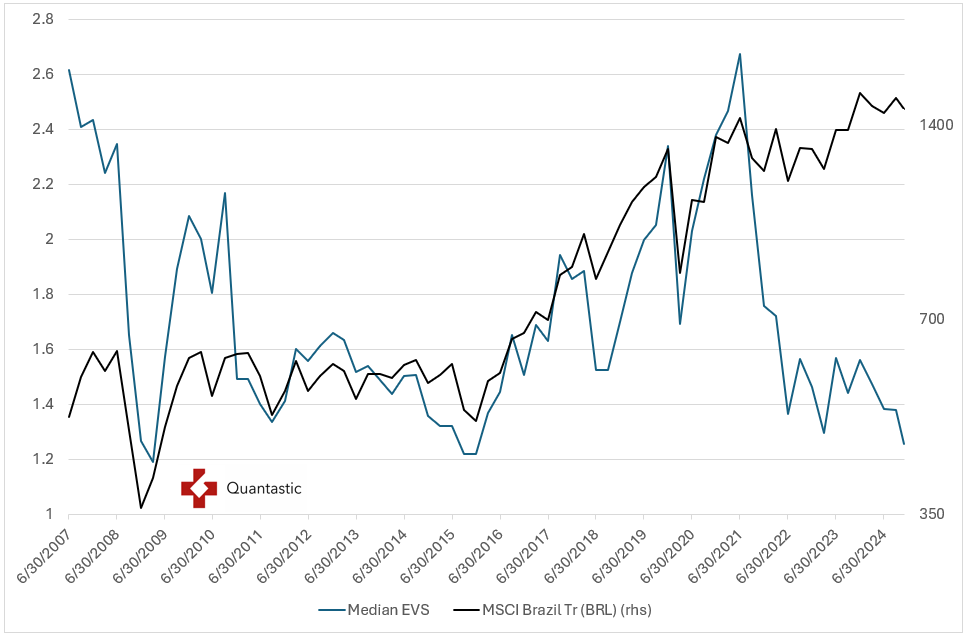

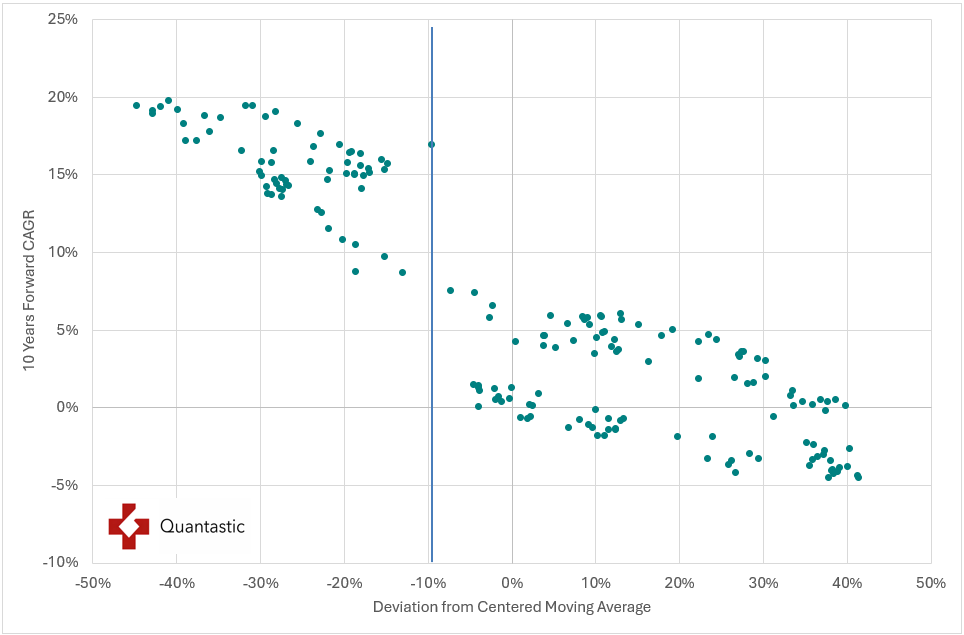

We use the Price to Sales ratio instead of the Shiller CAPE ratio as we only have 14 years of data for the later. Both tends to behave similarly and have the advantage of normalizing profit margins (even if profit margin remaining above competitive levels for > 10 years still can distort the message see:

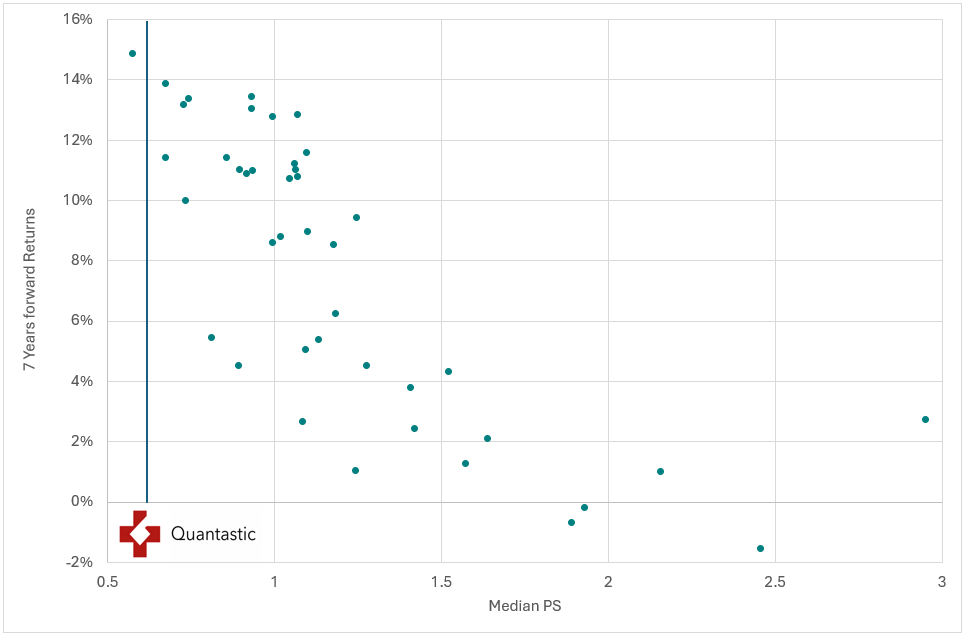

Here you can see the relationship between initial PS and forward 7 years total return.

Here is the same with the Shiller CAPE (data courtesy of Barclays) but with a much lower sample.

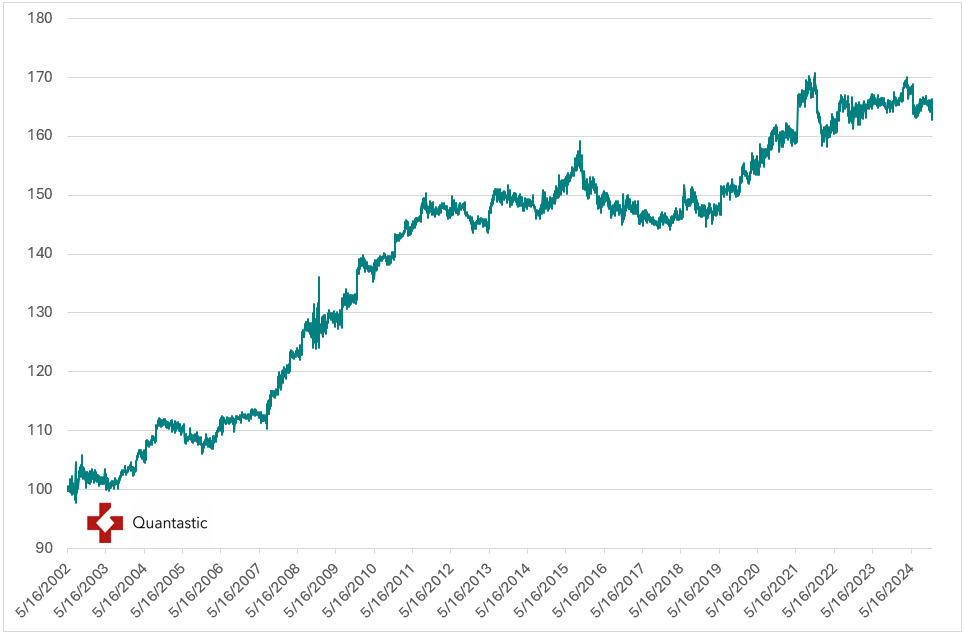

Sales, as in most emerging markets, have grown less than the economy but our dilution proxy (market cap/price index) is less dramatic than in many other places.

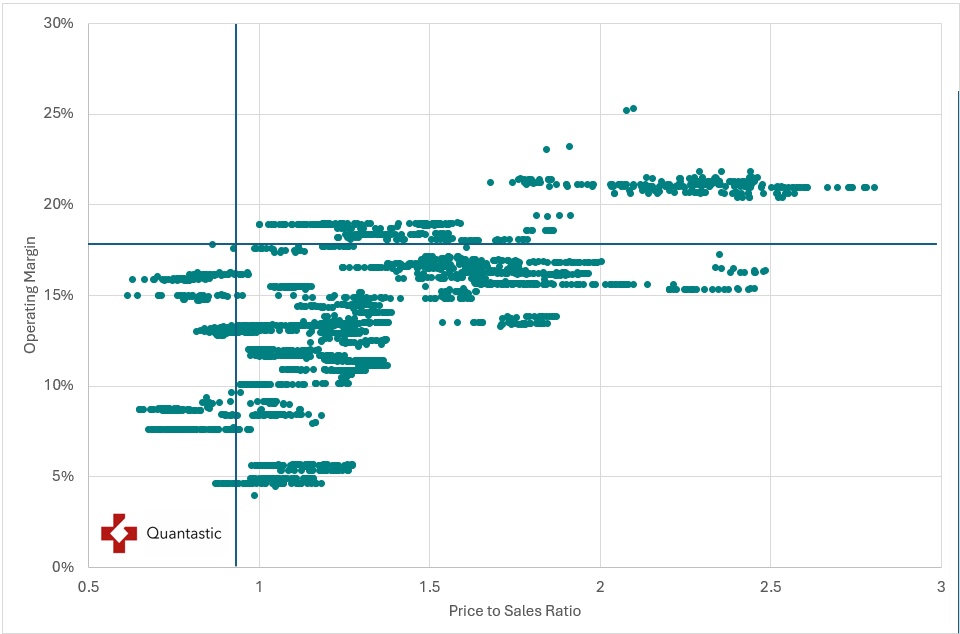

We can also see that, relative to profit margins, today’s PS is not demanding.

Total debt to enterprise value is much higher than in the early 2000’s but has declined substantially since its 2016 peak

For data nerds here are a few more graphs looking at the median value of various ratio (a concept we introduced in 2013)

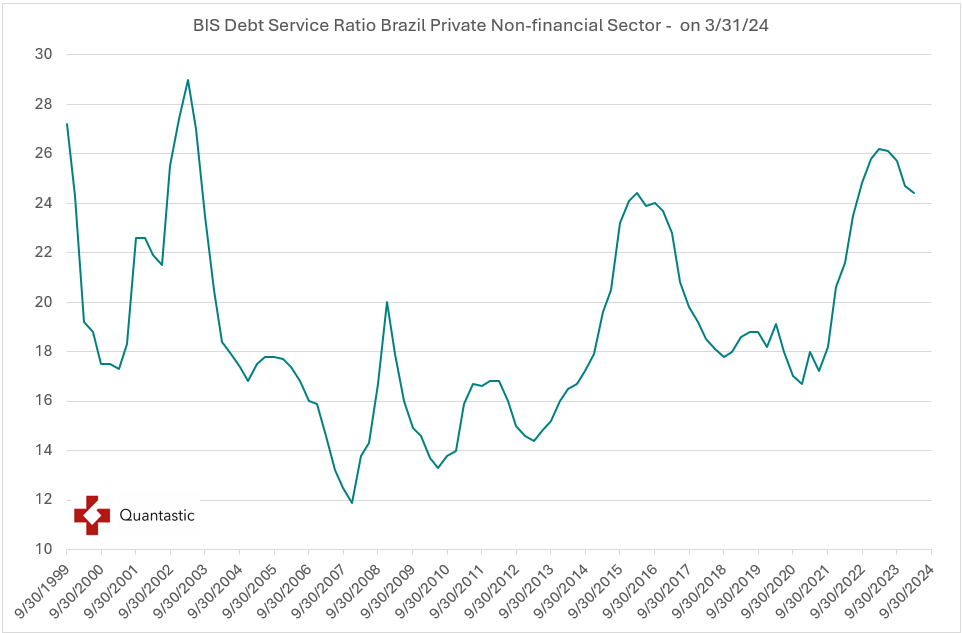

When evaluating Brazilian companies and managers, it's crucial to consider the unique economic environment they operate in. Brazil's high interest rate landscape has created a natural selection process where only the most resilient and efficient businesses can thrive. This stands in stark contrast to countries where central banks have maintained near-zero interest rates and engaged in extensive government debt purchases.In Brazil's challenging financial ecosystem:

Companies must be highly efficient and well-managed to generate returns above the high cost of capital.

Managers are forced to make strategic decisions under tighter financial constraints, fostering innovation and prudent resource allocation.

The market naturally weeds out weaker businesses, leaving a landscape of more robust and competitive firms.

This environment has prevented the "zombification" of markets seen in some developed economies, where ultra-low interest rates have allowed less productive firms to survive artificially. As a result, Brazilian companies that succeed in this high-stakes environment often demonstrate superior financial discipline and adaptability, potentially offering more sustainable long-term value for investors.

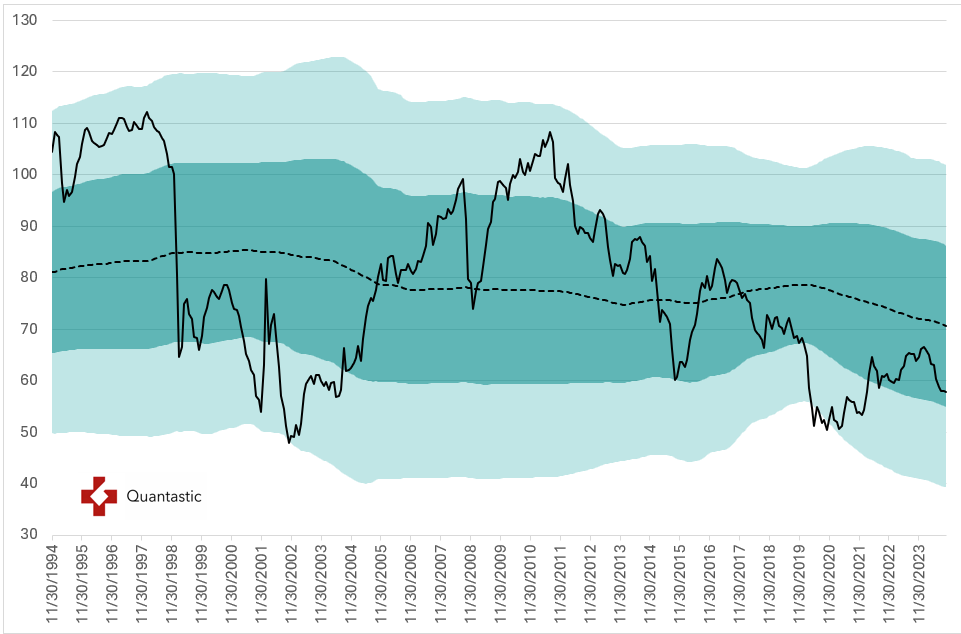

Brazilian Real Currency Model Valuation

Currency valuation models also point to a positive outlook for the Brazilian Real (BRL):

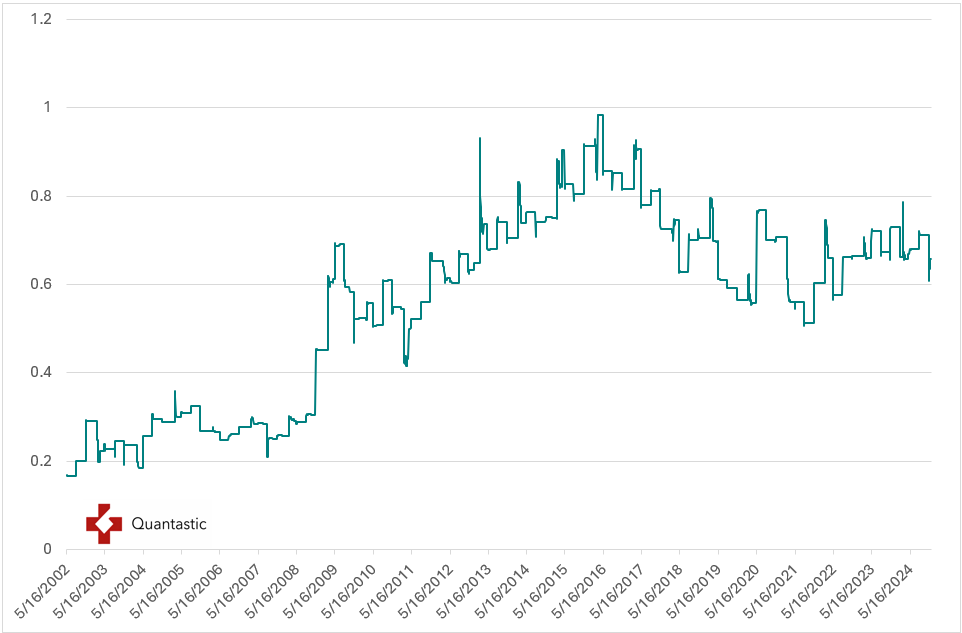

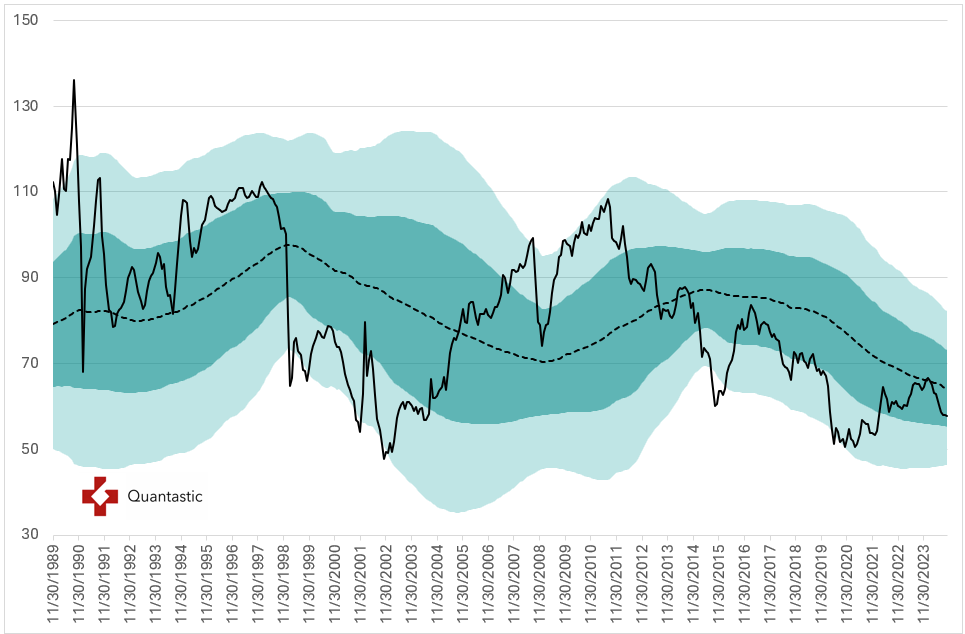

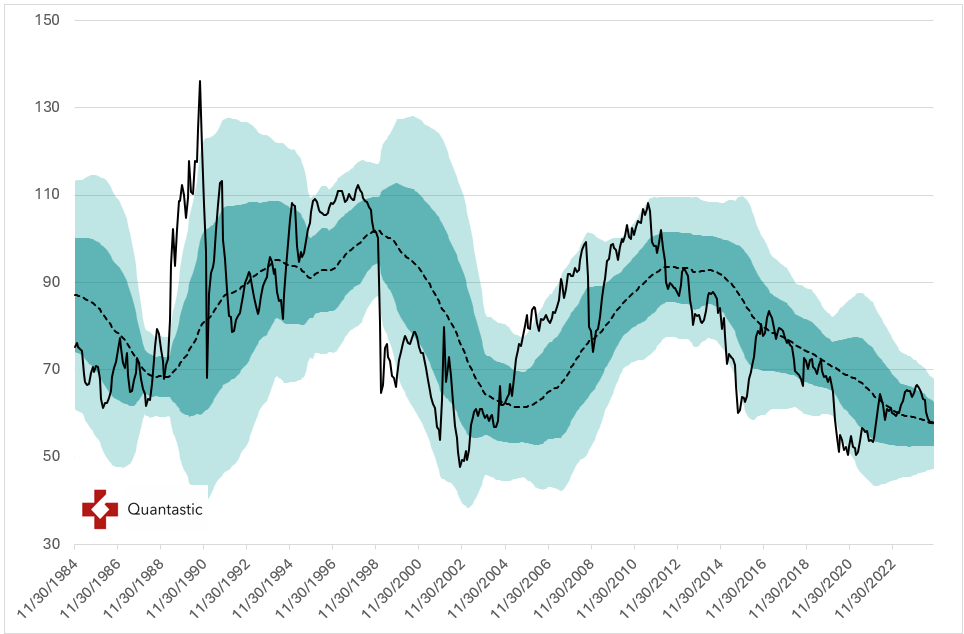

Undervaluation: We do not use fancy econometric models to value currencies. We stick to the deviation of the Real Effective Exchange Rate from a long-term centered moving average.

Let’s start with the 15 years average

What about shorter-term averages?

10 years

and 5 years with the 5 years centered moving average below its previous through.

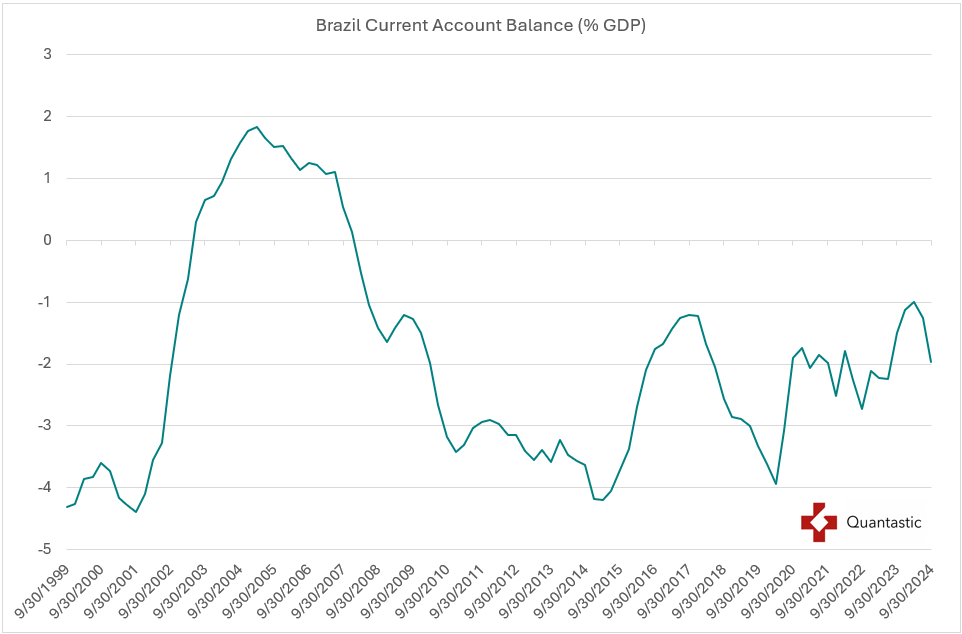

Let’s corroborate the message from the valuation model with some macro data.

The current account is still in deficit (not the 2% surplus from 2003-2004 when the valuation model was indicating similar undervaluation).

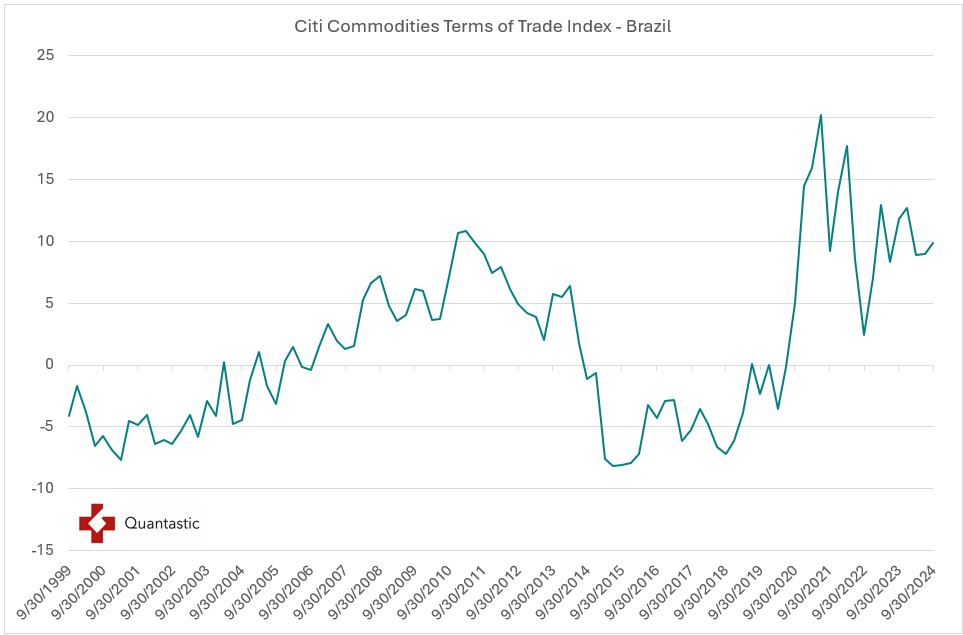

The term of trade is still relatively high and it usually correlate well with valuation (a high term of trade index is usually accompanied by a large overvaluation).

If one adds:

Interest Rate Differentials: Brazil's relatively high interest rates compared to developed markets support the currency's attractiveness for carry trade strategies.

Central Bank Credibility: The BCB's commitment to inflation targeting and its newly granted independence support confidence in the currency, reducing speculative attacks.

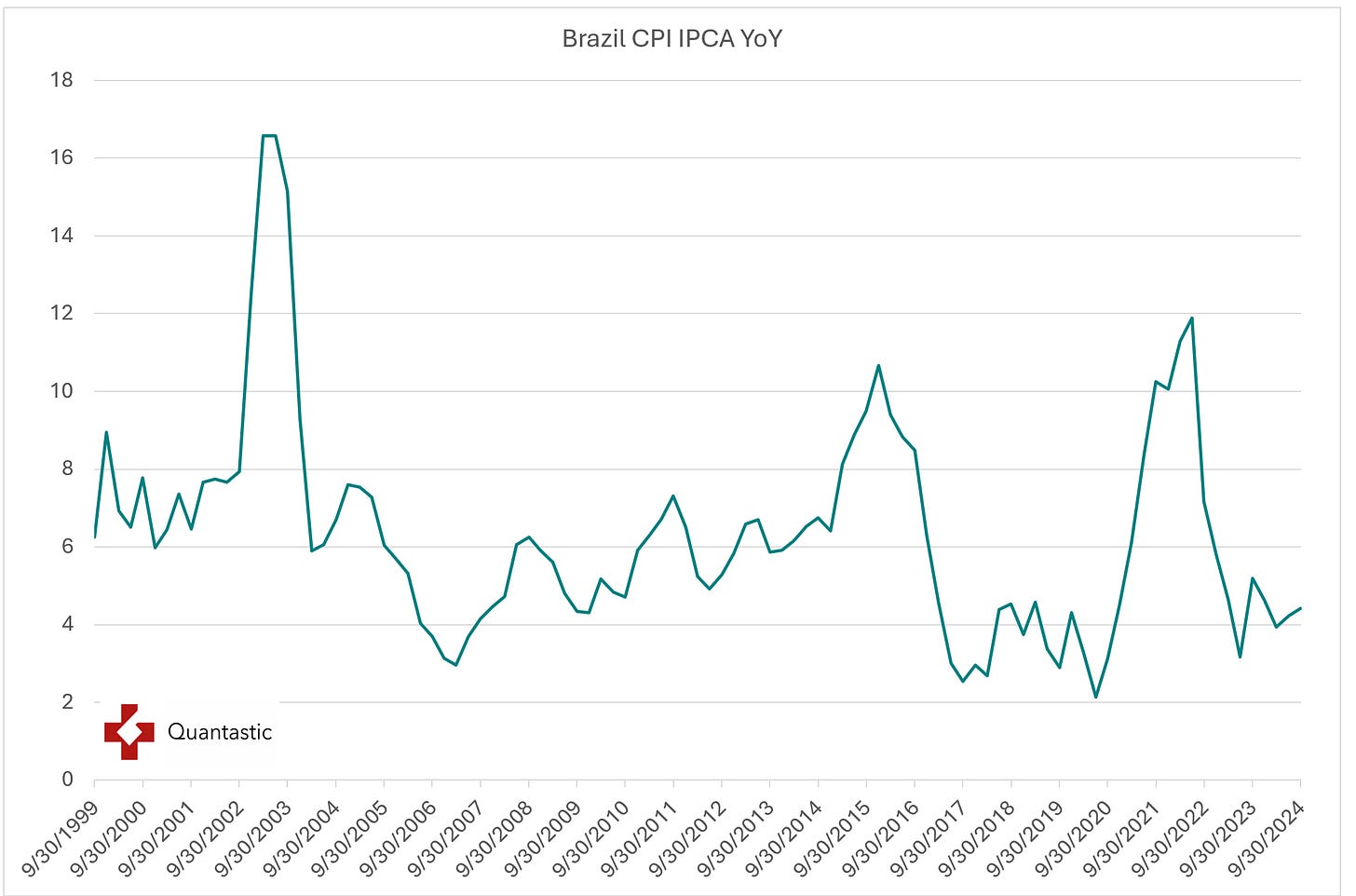

Inflation is higher in Brazil than in the USA but…

… real rates are much higher and if we had to bet on whether the BCB or the Fed has the strongest desire to do whatever it takes to push back inflation to their target, we would bet on the BCB.

6. Risks and Opportunities Going Forward

While the outlook for Brazil's equity market appears promising, investors must carefully consider both the risks and opportunities that lie ahead.

Risks

Fiscal Sustainability: Brazil's high public debt levels and ongoing fiscal deficits remain a key concern. Failure to implement effective fiscal consolidation measures could undermine investor confidence and lead to market volatility.

Political Uncertainty: The upcoming 2026 presidential election and potential shifts in economic policy direction could create uncertainty in the markets, affecting investor sentiment.

Inflationary Pressures: While the BCB has been proactive in addressing inflation, persistent price pressures could necessitate further monetary tightening, potentially impacting economic growth.

Global Economic Slowdown: As a major commodity exporter, Brazil remains vulnerable to fluctuations in global demand and commodity prices, which could adversely affect export revenues.

Environmental Concerns: International pressure regarding Amazon deforestation could impact trade relations and foreign investment, particularly from environmentally conscious investors.

Structural Challenges: Issues such as bureaucracy, a complex tax system, and infrastructure deficiencies continue to hamper Brazil's competitiveness and economic growth.

Opportunities

Technological Innovation: Brazil's growing tech sector, particularly in areas like fintech, e-commerce, and agtech, presents significant investment opportunities with potential for high growth.

Infrastructure Development: The need for substantial infrastructure investment across various sectors (transportation, energy, sanitation) offers potential for long-term growth and high real internal rates of return (IRR) for investors.

Green Economy Transition: Brazil's natural resources and expertise in renewable energy position it well to benefit from the global shift towards sustainability, with potential in sectors like ethanol, solar, and wind energy.

Financial Inclusion: The large unbanked population represents a significant growth opportunity for financial services providers, particularly in digital banking and microfinance.

Consumer Market Potential: Brazil's large and young population offers a substantial consumer market, particularly as incomes rise and credit access expands, driving demand in consumer goods and services.

Privatization and Concessions: Ongoing privatization efforts and infrastructure concessions present opportunities for investors to participate in key sectors of the economy, potentially leading to operational efficiencies and growth.

Agricultural Innovation: As a global agricultural powerhouse, Brazil is well-positioned to benefit from advancements in agtech and sustainable farming practices, enhancing productivity and market access.

Conclusion

Brazil's equity market stands at a compelling juncture, offering a unique blend of value and growth potential. The country's journey from hyperinflation to relative economic stability, coupled with significant institutional reforms and a maturing financial market, has laid the groundwork for a potentially rewarding investment landscape.

The current attractive valuations in both the equity market and currency suggest that investors may be underappreciating the progress Brazil has made and its future potential. However, realizing this potential will require continued commitment to fiscal discipline, structural reforms, and prudent economic management.

For investors willing to navigate the complexities of the Brazilian market, the rewards could be substantial. The country's vast natural resources, large domestic market, and growing innovation ecosystem provide a solid foundation for long-term growth. Yet, as with any emerging market investment, a thorough understanding of the risks – from fiscal challenges to political uncertainties – is essential.

As Brazil's dynamic equity market evolves, the opportunities for informed investors have never been more compelling.

Our proven quantitative stock selection framework offers a unique advantage in this environment. Whether you're a family office or a small institution seeking alpha, we invite you to connect with us. Together, we can navigate the complexities of this vibrant market and position your portfolio for long-term success.

Contact us today to learn more about how we can help you achieve your investment goals.

Disclaimer

The views and opinions expressed in this post are solely those of the author. This content does not reflect the views or positions of any entities where the author works or is contracted from. This stock report is provided for informational purposes only and represents the author's personal opinions based on research and analysis conducted at the time of writing. The information contained herein should not be construed as financial, legal, or investment advice.

Not a Recommendation: This report does not constitute a recommendation to buy, sell, or hold any security or financial instrument. Any action taken based on the information presented is at the reader's own risk and discretion.

Do Your Own Research: Readers are strongly encouraged to conduct their own due diligence and consult with qualified financial advisors before making any investment decisions. The author is not responsible for any actions taken based on the information provided in this report.

No Guarantee of Accuracy: While efforts have been made to ensure the accuracy and reliability of the information presented, the author makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained in this report.

Past Performance: Any references to past performance of securities or markets are not indicative of future results. Investments can go up or down in value, and there is always the potential for loss as well as profit.

Forward-Looking Statements: This report may contain forward-looking statements that are based on current expectations, forecasts, and assumptions. These statements involve risks and uncertainties, and actual results may differ materially from those expressed or implied.

Conflicts of Interest: The author may hold positions in the securities discussed in this report. Readers should be aware that the author may have a conflict of interest that could affect the objectivity of this analysis.

Not Tailored Advice: This report does not take into account the specific investment objectives, financial situation, or particular needs of any individual person or entity. It is not personalized advice or a solicitation for any specific investment product or service.

Subject to Change: The opinions and information presented in this report are subject to change without notice. The author is under no obligation to update or amend this report based on new information, future events, or for any other reason.

Jurisdiction: This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation.

By accessing and reading this stock report, you acknowledge that you have read, understood, and agree to be bound by the terms of this disclaimer.