The Swiss equity market presents an intriguing opportunity for investors, offering potential outperformance compared to U.S. markets over the next 5-10 years. While not cheap, Swiss equities are more attractively valued than their American counterparts.

Key Insights:

Valuation Metrics: The Swiss market's Cyclically-Adjusted Price Earnings (MAPE) ratio is currently just below 22, indicating moderate valuation levels.

Return Expectations: Investors can anticipate low single-digit annual returns over the next 7-10 years, with a possibility of slight negative returns. This outlook is more favorable than projections for U.S. markets.

Currency Advantage: Switzerland's low interest rates create an attractive opportunity for foreign investors. USD-based investors can potentially earn an additional 4.25-4.5% annual yield by selling CHF forward against their Swiss asset positions.

We will also give actionnable ideas at the end of the note. One will be our quant portfolio methodology we already presented in our Brazilian note. We will also look at the positions taken by a well-known successful long-term European activist fund, Cevian Capital.

Equity Valuation

The Swiss market Shiller Cyclically-Adjusted Price Earning Ratio is currently just below 24

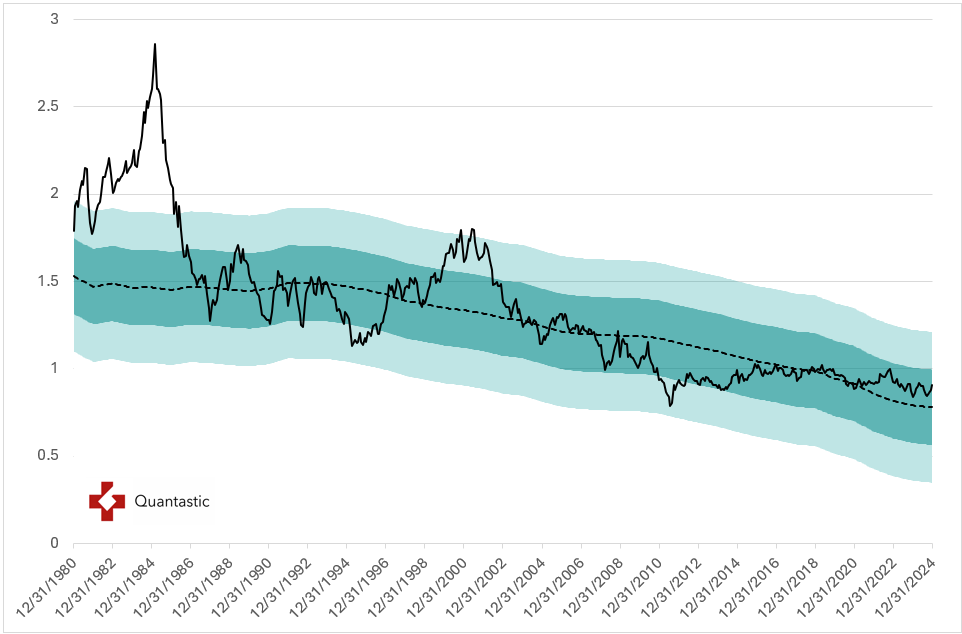

As you know if you read our piece on the US market valuation, The CAPE ratio can be distored if the profit margin embedded in the cyclically-adjusted earnings are significantly higher than historical one.

Let’s make the adjustment… The difference for the Swiss market are much more shallow than for the US market still the results are more robusts again.

Here is also our 0-50% graph (where the market will go to fall back into the 0-50% MAPE band)…

… and the forward total return forecast with a generous profit growth assumption (real Swiss GDP growth was between 1.65-1.85% in the past 40, 30 and 20 years respectively.

Forward return could be slighly supported if Swiss companies continue to be net buyers of their stocks (reasonably and not under the pressure of North American short-term activists as was the cas of Nestlé)

In conclusion, we can expect low single-digit annual returns over the next 7-10 years with a possible low single-digit negative total return.

This is still much better than what we can expect for the US markets.

Swiss Franc Valuation

The CHF is slightly undervalued against its main trading partners. It is mainly a function of the USD overvaluation as the CHF is overvalued against the JPY and the Euro.

Valuation against the USD using first OECD and then IMF data using centered PPP as using raw PPP assume fair value when the data serie beginn which is a stretch. The CHF is approximately 14% undervalued according to our model using IMF data and 36% using OECD data. The IMF model deviation is probably more accurate.

But remember that Swiss rates are very low against most, if not all, other currencies.

Given this, the CHF would have to appreciate by almost 30% over 5 years against the USD, for example, for an investor long the CHF against the USD to make money.

We therefore strongly recommend selling the CHF forward against the Swiss assets position.

Actionnable Recommendations

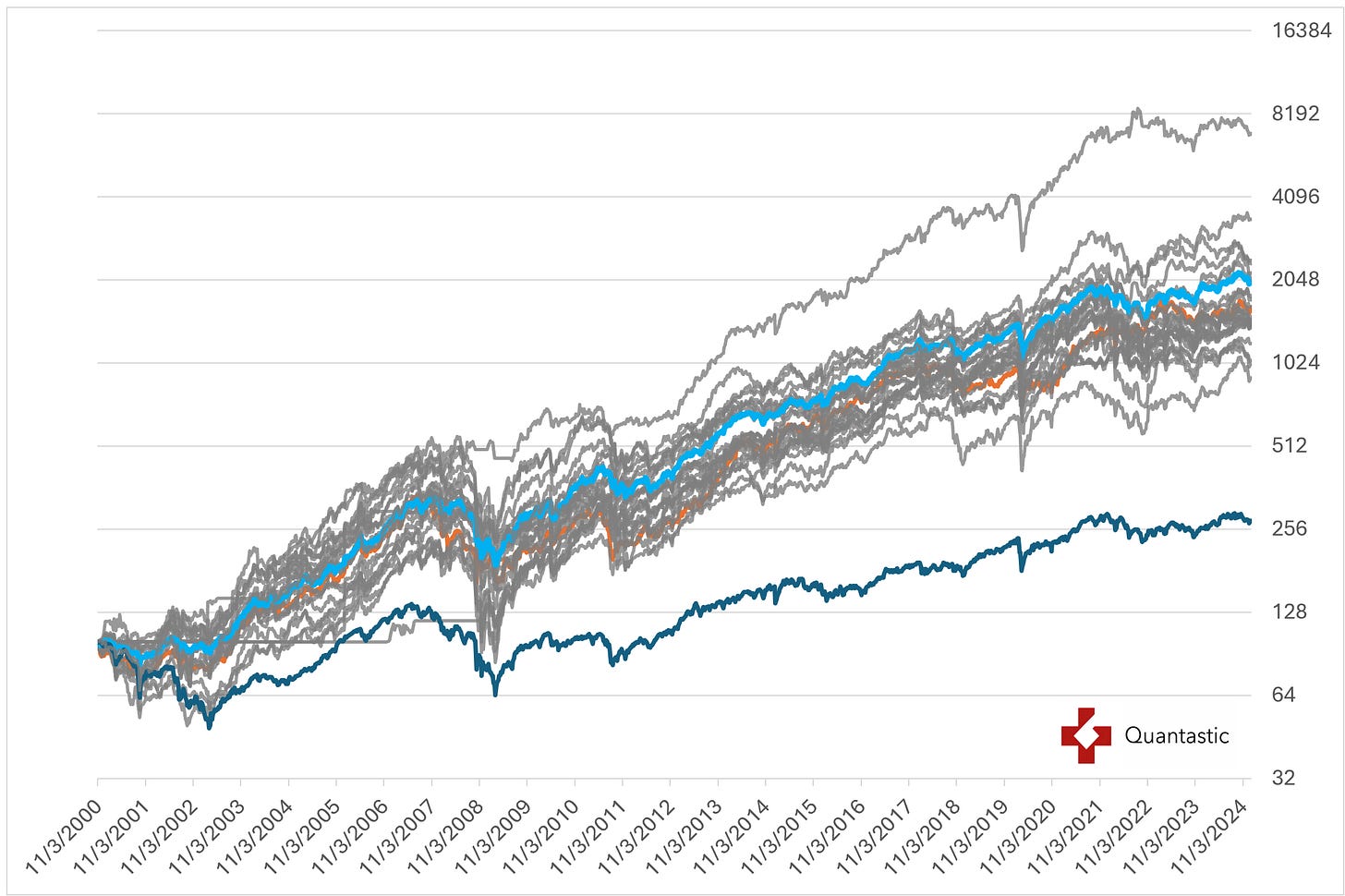

Around two decades ago, we started with diversified quant stock portfolios. We use around 30 different screens (the same for the various countries/regions they are run on, as for example the one on the Brazilian markets we presented in our note on Brazil).

Each screen is a combination of 2 to 3 factors run sequentially through the base universe.

The factors are expressed differently each time they are used in various screens to be agnostic to the way they are expressed.

Each screen aims at the tail of the distribution of the factors and as such only selects 5-10 stocks.

We equal weight each screen.

The end result is a portfolio comprising approximately 25% of the base universe with some cyclical factor bias but no long-term one.

Most of the outperformance cannot be explained by factor model regressions. They produce true alpha as per A. Frazzini, D. Kabiller and L.H. Pedersen methodology.

The country/region portfolio are available either through private AMCs with UBS (minimum investment USD 3 mios or equivalent), managed accounts or through subscription.

For the curious, you will find below the performance of each individual screens.

The current portfolio is:

Another way to find opportunities in Switzerland is to look at what successful activists are doing.

For this note, we will examine the positions of Cevian Capital, which has successfully navigated the European markets in the past 20 years and has taken large positions in some Swiss companies.

They currently hold 3 Swiss stocks: ABBN SW, UBSG SW and BALN SW

ABB:

Source: Bloomberg

Investment Rationale

Cevian invested in ABB because:

Strong market positions: ABB has leading positions in electrification, robotics, automation, and motion technologies.

Attractive end markets: ABB's markets have good long-term growth drivers, including electrification, automation, and digitalization trends.

Significant value creation potential: Cevian saw opportunities to improve ABB's operational performance and strategic focus.

Value Creation Agenda

Cevian has been working with ABB to drive several key initiatives:

Portfolio optimization:

Divesting non-core businesses (e.g. Power Grids division sold in 2020)

Focusing on core, high-growth and high-margin segments

Decentralization and simplification:

Moving from a matrix structure to a simpler business area-led organization

Empowering business units with more autonomy and accountability

Operational improvements:

Enhancing efficiency and productivity

Streamlining corporate functions

Optimizing manufacturing footprint

Capital allocation:

Increasing focus on ROCE and economic value add

Implementing a more active portfolio management approach

Returning excess cash to shareholders through dividends and buybacks

Results and Expectations

Cevian's efforts appear to be paying off:

ABB achieved a record high EBITA margin of ~19% in Q2 and Q3 2024, up 160 bps vs Q3 2023

The company has delivered strong operating results, reflecting past value-creation work

ABB's share price performance has been strong, with the stock one of the best performers in Cevian's portfolio over the last 12-36 months

Going forward, Cevian expects:

Further margin expansion as operational improvements continue

Sustained organic growth driven by strong market positions and favorable end-market trends

Continued strong cash generation and capital returns to shareholders

Potential for additional value-accretive portfolio changes

A potential re-rating of ABB's valuation multiple as the market recognizes its improved profitability and growth profile

UBS:

Source: Bloomberg

Investment Rationale

Cevian invested in UBS because:

Transformative acquisition: UBS acquired Credit Suisse in 2023, which was a major deal that reshaped the Swiss banking landscape.

Integration progress: The integration of Credit Suisse is proceeding ahead of schedule, with upgraded targets for cost reductions.

Strong financial performance: UBS achieved a return on CET1 capital (RoCET1) in H1 2024 that was already above both its full-year 2024 target and its 2025 target.

Market leadership: The combined entity solidifies UBS's position as a global wealth management leader and the largest bank in Switzerland.

Value Creation Expectations

Cevian expects the following from UBS:

Synergy realization: Continued capture of cost and revenue synergies from the Credit Suisse integration, potentially exceeding initial targets.

Profitability improvement: Further increases in return on equity and other profitability metrics as the integration progresses and efficiencies are realized.

Market share gains: Leveraging the combined entity's scale and capabilities to grow market share in key business segments, particularly in wealth management.

Capital return: Ongoing strong capital generation, with the potential for increased shareholder returns through dividends and share buybacks once the integration is complete.

Valuation re-rating: A potential re-rating of UBS's valuation multiple as the market recognizes the benefits of the acquisition and improved profitability profile.

Outlook

Cevian appears optimistic about UBS's prospects:

Integration execution: UBS seems well-positioned to continue realizing benefits from the Credit Suisse deal in the coming quarters and years.

Earnings potential: The bank's ability to exceed profitability targets so quickly after the acquisition bodes well for future performance.

Competitive positioning: The combined entity should have a strengthened competitive position in key markets and business lines.

Risk management: Cevian likely expects UBS to successfully manage and reduce risks associated with the Credit Suisse portfolio over time.

Long-term value creation: The expectation is for UBS to emerge as a stronger, more profitable institution with significant long-term value creation potential.

Baloise:

Source: Bloomberg

Investment Rationale

Cevian invested in Baloise because:

Attractive core businesses: Baloise has strong market positions in profitable insurance markets, particularly Switzerland (70% of earnings) and Belgium.

Significant value creation potential: Baloise has underperformed in recent years due to poor operational performance and strategic decisions. Cevian sees opportunity to substantially improve profitability and shareholder returns.

Improved influence situation: The removal of voting rights limitations in April 2024 opened up the ability for shareholders like Cevian to drive change.

Value Creation Agenda

Cevian is pursuing several key initiatives to improve Baloise:

Operational improvements:

Addressing execution issues in Orthopaedics business

Right-sizing G&A and corporate costs

Strengthening performance of Advanced Wound Management and Sports Medicine segments

Portfolio optimization:

Focusing on core markets where Baloise has strong positions

Potentially exiting subscale or underperforming businesses (e.g. Germany)

Improved capital allocation:

Focusing capital deployment on core assets

Returning excess cash to shareholders

Governance enhancements:

Decentralizing business units to improve accountability

Strengthening the board with more insurance industry expertise

Instilling a shareholder value mindset

Expectations

Cevian expects these initiatives to drive:

Significant profitability improvement: Potential to more than double return on equity from current 3% to peer average of 8%+

Valuation re-rating: As performance improves, Cevian expects Baloise's valuation discount to peers to narrow

Potential for corporate activity: If performance improvements do not lead to re-rating, Cevian sees potential for M&A given Baloise's attractive assets

Overall, Cevian sees potential for over 100% upside in Baloise's share price over the next 4-5 years through operational improvements and closing the valuation gap to peers. The fund views Baloise as a classic Cevian investment with an attractive core business, significant value creation potential, and an improved ability to drive change.

And has most foreign investors know Nestlé, you will find here below our discounted Free Cash Flow valuation. Note that fair value has been declining along a deteriorating balance sheet under the previous CEO (who listened too much to US activists). Nestlé has learned from its mistake.

So you have 4% dividend yield, 4.25-4.5% CHF forward selling against USD pickup and a stock which is fairly valued at worst. What are the return assumptions of US pension funds? It seems that a Nestlé position would be a must have…

Conclusion

The Swiss equity market is not cheap but is likely to outperform the US markets in the coming 5-10 years.

Switzerland low relative interest rates enable foreign investors to lock in the interest rate differential by selling the CHF forward for a 4.25-4.5% yearly annual yield pick up for USD based investors for example.

One could invest following our quant portfolio methodology and, in parrallel invest in some of the stocks owned by succesfull long-term activist investors like Cevian.

Disclaimer

The views and opinions expressed in this post are solely those of the author. This content does not reflect the views or positions of any entities where the author works or is contracted from. This stock report is provided for informational purposes only and represents the author's personal opinions based on research and analysis conducted at the time of writing. The information contained herein should not be construed as financial, legal, or investment advice.

Not a Recommendation: This report does not constitute a recommendation to buy, sell, or hold any security or financial instrument. Any action taken based on the information presented is at the reader's own risk and discretion.

Do Your Own Research: Readers are strongly encouraged to conduct their own due diligence and consult with qualified financial advisors before making any investment decisions. The author is not responsible for any actions taken based on the information provided in this report.

No Guarantee of Accuracy: While efforts have been made to ensure the accuracy and reliability of the information presented, the author makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained in this report.

Past Performance: Any references to past performance of securities or markets are not indicative of future results. Investments can go up or down in value, and there is always the potential for loss as well as profit.

Forward-Looking Statements: This report may contain forward-looking statements that are based on current expectations, forecasts, and assumptions. These statements involve risks and uncertainties, and actual results may differ materially from those expressed or implied.

Conflicts of Interest: The author may hold positions in the securities discussed in this report. Readers should be aware that the author may have a conflict of interest that could affect the objectivity of this analysis.

Not Tailored Advice: This report does not take into account the specific investment objectives, financial situation, or particular needs of any individual person or entity. It is not personalized advice or a solicitation for any specific investment product or service.

Subject to Change: The opinions and information presented in this report are subject to change without notice. The author is under no obligation to update or amend this report based on new information, future events, or for any other reason.

Jurisdiction: This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation.

By accessing and reading this stock report, you acknowledge that you have read, understood, and agree to be bound by the terms of this disclaimer.