Unlocking Value: A Deep Dive into Brazilian Equity Valuation

As the equity valuation section was lost in the middle of our long analysis of the institutional evolution of Brazil, we realize that many probably did not reach the part where we discussed about the valuation of the Brazilian market and what it means for future return so here it is… We will do the same for the currency valuation and another piece on our stock selection methodology.

Current equity valuation models suggest that Brazilian stocks are attractively priced, offering significant upside potential:

We use the Price to Sales ratio instead of the Shiller CAPE ratio as we only have 14 years of data for the latter.

Both tends to behave similarly and have the advantage of normalizing profit margins (even if profit margin remaining above competitive levels for > 10 years still can distort the message see:

https://quantasticworld.substack.com/p/us-market-valuation-one-for-the-history

https://quantasticworld.substack.com/p/unlocking-the-secrets-of-american

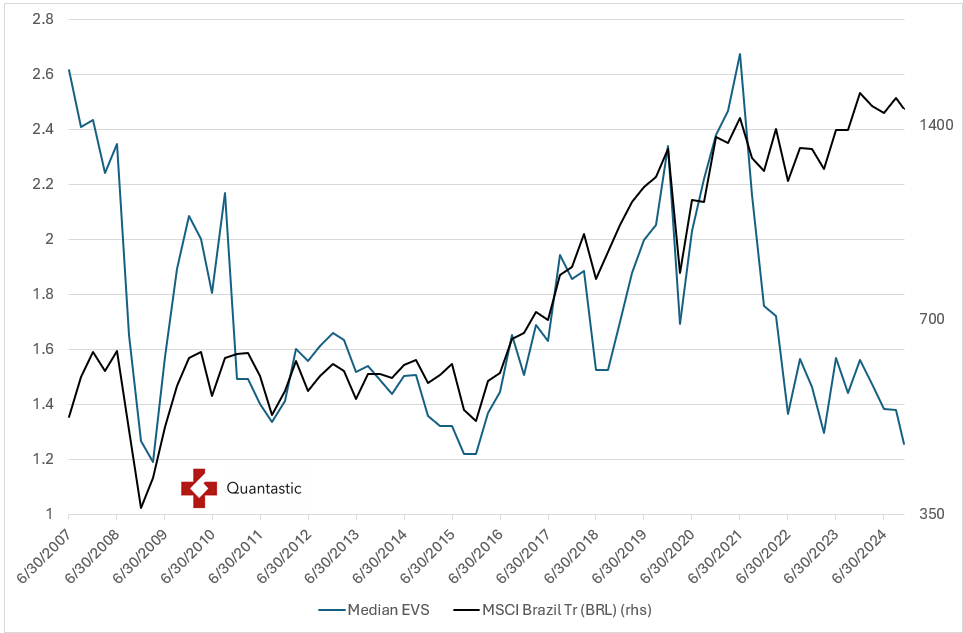

We have also added our median ratios graphs even though the data is only limited.

Here you can see the relationship between initial PS and forward 7 years total return.

Here is the same with the Shiller CAPE (data courtesy of Barclays) but with a much lower sample.

Sales, as in most emerging markets, have grown less than the economy but our dilution proxy (market cap/price index) is less dramatic than in many other places.

We can also see that, relative to profit margins, today’s PS is not demanding.

Total debt to enterprise value is much higher than in the early 2000’s but has declined substantially since its 2016 peak.

For data nerds here are a few more graphs looking at the median value of various ratios (a concept we introduced in 2013). It has the advantage of not having a few mega cap distorting the message.

When evaluating Brazilian companies and managers, it's crucial to consider the unique economic environment they operate in. Brazil's high-interest rate landscape has created a natural selection process where only the most resilient and efficient businesses can thrive. This stands in stark contrast to countries where central banks have maintained near-zero interest rates and engaged in extensive government debt purchases.

In Brazil's challenging financial ecosystem:

Companies must be highly efficient and well-managed to generate returns above the high cost of capital.

Managers are forced to make strategic decisions under tighter financial constraints, fostering innovation and prudent resource allocation.

The market naturally weeds out weaker businesses, leaving a landscape of more robust and competitive firms.

This environment has prevented the "zombification" of markets seen in some developed economies, where ultra-low interest rates have allowed less productive firms to survive artificially. As a result, Brazilian companies that succeed in this high-stakes environment often demonstrate superior financial discipline and adaptability, potentially offering more sustainable long-term value for investors.

Conclusion

The analysis of Brazilian equity market valuation reveals a compelling investment opportunity.

Current valuation metrics, including the Price to Sales ratio and various median value ratios, indicate that Brazilian stocks are trading at a discount relative to their historical averages. This suggests significant upside potential for investors willing to enter the market.

Brazil's unique high-interest rate environment has fostered a landscape of resilient, efficient, and well-managed companies. This natural selection process has created a market of survivors – businesses that have proven their ability to generate returns above the high cost of capital and adapt to challenging economic conditions.

While risks remain, including political uncertainty and global economic headwinds, the current valuation levels appear to offer a favorable risk-reward profile. The combination of attractive valuations and battle-tested companies positions Brazilian equities as an intriguing option for investors seeking exposure to emerging markets with potential for substantial returns.

As with any investment decision, thorough due diligence and careful consideration of individual risk tolerance are essential. However, for those willing to navigate the complexities of the Brazilian market, the current equity valuations suggest that now may be an opportune time to consider increasing exposure to this dynamic South American economy.

P.S:Reassuring to see that Research Affiliates arrive at the same conclusion

Disclaimer

The views and opinions expressed in this post are solely those of the author. This content does not reflect the views or positions of any entities where the author works or is contracted from. This stock report is provided for informational purposes only and represents the author's personal opinions based on research and analysis conducted at the time of writing. The information contained herein should not be construed as financial, legal, or investment advice.

Not a Recommendation: This report does not constitute a recommendation to buy, sell, or hold any security or financial instrument. Any action taken based on the information presented is at the reader's own risk and discretion.

Do Your Own Research: Readers are strongly encouraged to conduct their own due diligence and consult with qualified financial advisors before making any investment decisions. The author is not responsible for any actions taken based on the information provided in this report.

No Guarantee of Accuracy: While efforts have been made to ensure the accuracy and reliability of the information presented, the author makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained in this report.

Past Performance: Any references to past performance of securities or markets are not indicative of future results. Investments can go up or down in value, and there is always the potential for loss as well as profit.

Forward-Looking Statements: This report may contain forward-looking statements that are based on current expectations, forecasts, and assumptions. These statements involve risks and uncertainties, and actual results may differ materially from those expressed or implied.

Conflicts of Interest: The author may hold positions in the securities discussed in this report. Readers should be aware that the author may have a conflict of interest that could affect the objectivity of this analysis.

Not Tailored Advice: This report does not take into account the specific investment objectives, financial situation, or particular needs of any individual person or entity. It is not personalized advice or a solicitation for any specific investment product or service.

Subject to Change: The opinions and information presented in this report are subject to change without notice. The author is under no obligation to update or amend this report based on new information, future events, or for any other reason.

Jurisdiction: This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation.

By accessing and reading this stock report, you acknowledge that you have read, understood, and agree to be bound by the terms of this disclaimer.